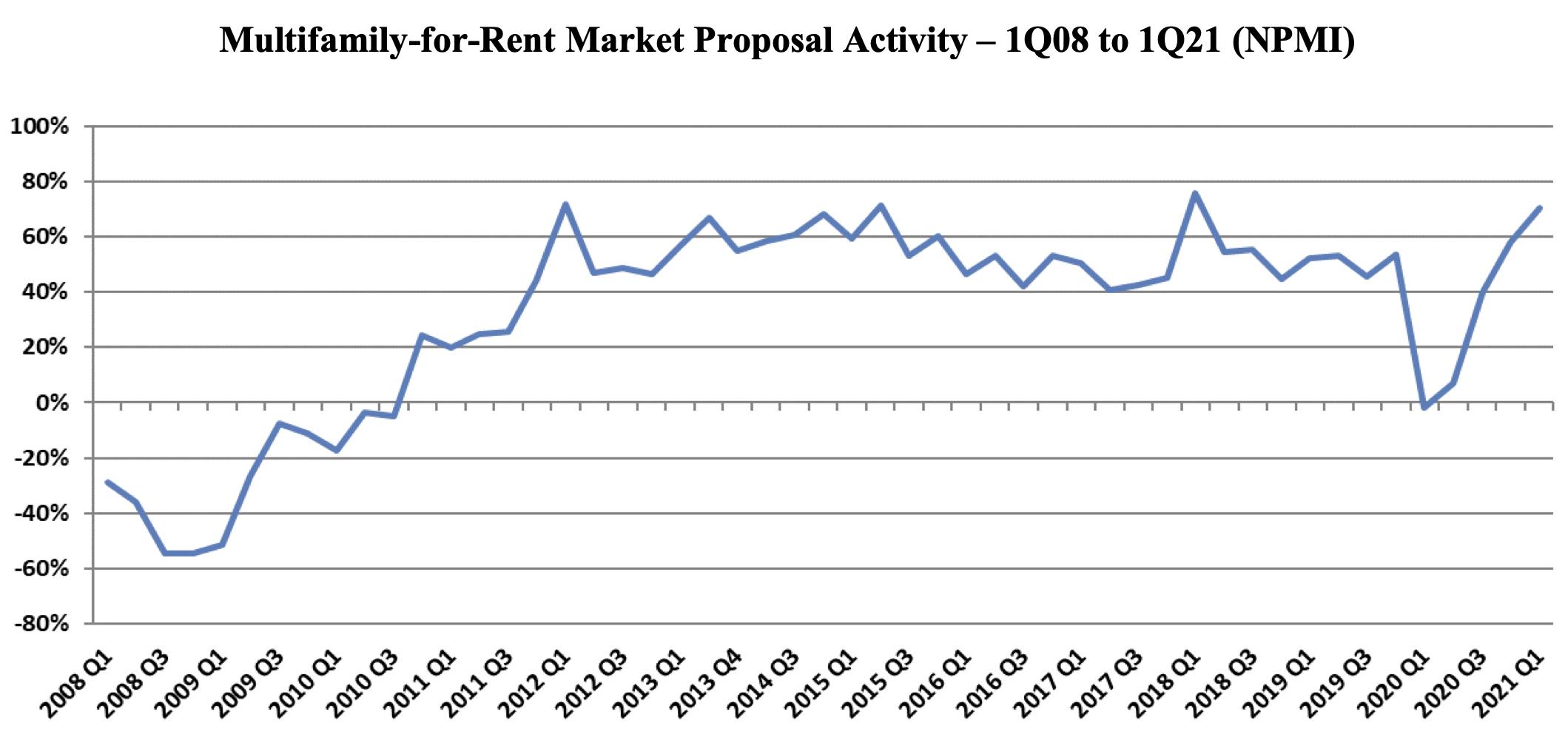

First-quarter proposal activity for multifamily housing added to prior quarter gains, reaching a near-record Net Plus/Minus Index (NPMI) of 71%. Multifamily topped the four other housing submarkets, though all performed well.

The first three months of the year saw housing lead all 12 major markets in the PSMJ Resources Quarterly Market Forecast survey of architecture, engineering, and construction (AEC) firms.

PSMJ’s NPMI expresses the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease. The QMF has proven to be a solid predictor of market health for the industry since its inception in 2003. A consistent group of over 300 AEC firm leaders participate regularly, with 183 contributing to the most recent survey.

Up 13 percentage points from the final quarter of 2020, multifamily’s NPMI of 71% tied its third-highest score since PSMJ added submarkets to its QMF survey in 2006. In addition to the record-high 76% in the 1st Quarter of 2018 and 72% in the 1st Quarter of 2012, Multifamily hit 71% in the 1st Quarter of 2015.

The 2021 performance marked a remarkable rebound for Multifamily, which dipped to -2% in the 1st Quarter of 2020, its first time in negative figures since 2010. In fact, before the COVID-driven drop a year ago, Multifamily’s NPMI had not fallen below 40% since the 3rd Quarter of 2011.

PSMJ Senior Principal David Burstein, PE, AECPM, noted that the strong performance of Multifamily and the entire Housing sector illustrates the industry’s overall economic health, as Housing growth often leads to activity in commercial, institutional and industrial markets as well. Should Congress pass an infrastructure stimulus bill, adds Burstein, the market could see even more historic growth.

Among respondents that work in the Multifamily sector, only 1% said that they saw a decrease in proposal opportunities in the 1st Quarter, compared with 72% that saw a noticeable increase. The remainder said that activity was about the same as the prior quarter.

The Assisted/Independent Senior Living submarket was another highflyer in the 1st Quarter, climbing 32 NPMI percentage points to 59%, tied for 12th -best among all submarkets. Condominiums bounced another 15 NPMI points to 30%, its best showing in three years.

The two other Housing markets measured in the PSMJ survey remain in rarefied air. The Housing Subdivision market recorded an NPMI of 68%, eclipsing its record-tying 4th -Quarter 2020 performance by 17 percentage points. Single-Family Homes dipped 8 NPMI percentage points to 51% – one of only 3 submarkets to see a decline – but that was still good enough for its second-best NPMI performance in the history of the QMF survey.

Related Stories

Multifamily Housing | Mar 10, 2015

KTGY homes in on seniors with new studio

Its director, Doug Ahlstrom, says designs will emphasize socialization and community.

Multifamily Housing | Mar 10, 2015

Multifamily renovation now drives growth for national restoration business

Response Team 1 has established a national footprint through acquisitions.

Retail Centers | Mar 10, 2015

Retrofit projects give dying malls new purpose

Approximately one-third of the country’s 1,200 enclosed malls are dead or dying. The good news is that a sizable portion of that building stock is being repurposed.

Architects | Mar 9, 2015

Study explores why high ceilings are popular

High ceilings give us a sense of freedom, new research finds

Transit Facilities | Mar 4, 2015

5+design looks to mountains for Chinese transport hub design

The complex, Diamond Hill, will feature sloping rooflines and a mountain-like silhouette inspired by traditional Chinese landscape paintings.

Multifamily Housing | Mar 3, 2015

10 kitchen and bath design trends for 2015

From kitchens made for pet lovers to floating vanities, the nation's top kitchen and bath designers identify what's hot for 2015.

Sponsored | Modular Building | Mar 3, 2015

Modular construction brings affordable housing to many New Yorkers

After city officials waived certain zoning and density regulations, modular microunits smaller than 400 square feet are springing up in New York.

Modular Building | Feb 23, 2015

Edge construction: The future of modular

Can innovative project delivery methods, namely modular construction, bring down costs and offer a solution for housing in urban markets? FXFOWLE’s David Wallance discusses the possibilities for modular.

Multifamily Housing | Feb 23, 2015

Millennials to outgrow Baby Boomers in 2015

The Baby Boomer generation, once the nation's largest living generation, will be outpaced by the Millennials this year, according to the Pew Research Center.

Multifamily Housing | Feb 19, 2015

Is multifamily construction getting too frothy for demand?

Contractors are pushing full speed ahead, but CoStar Group thinks a slowdown might be in order this year.