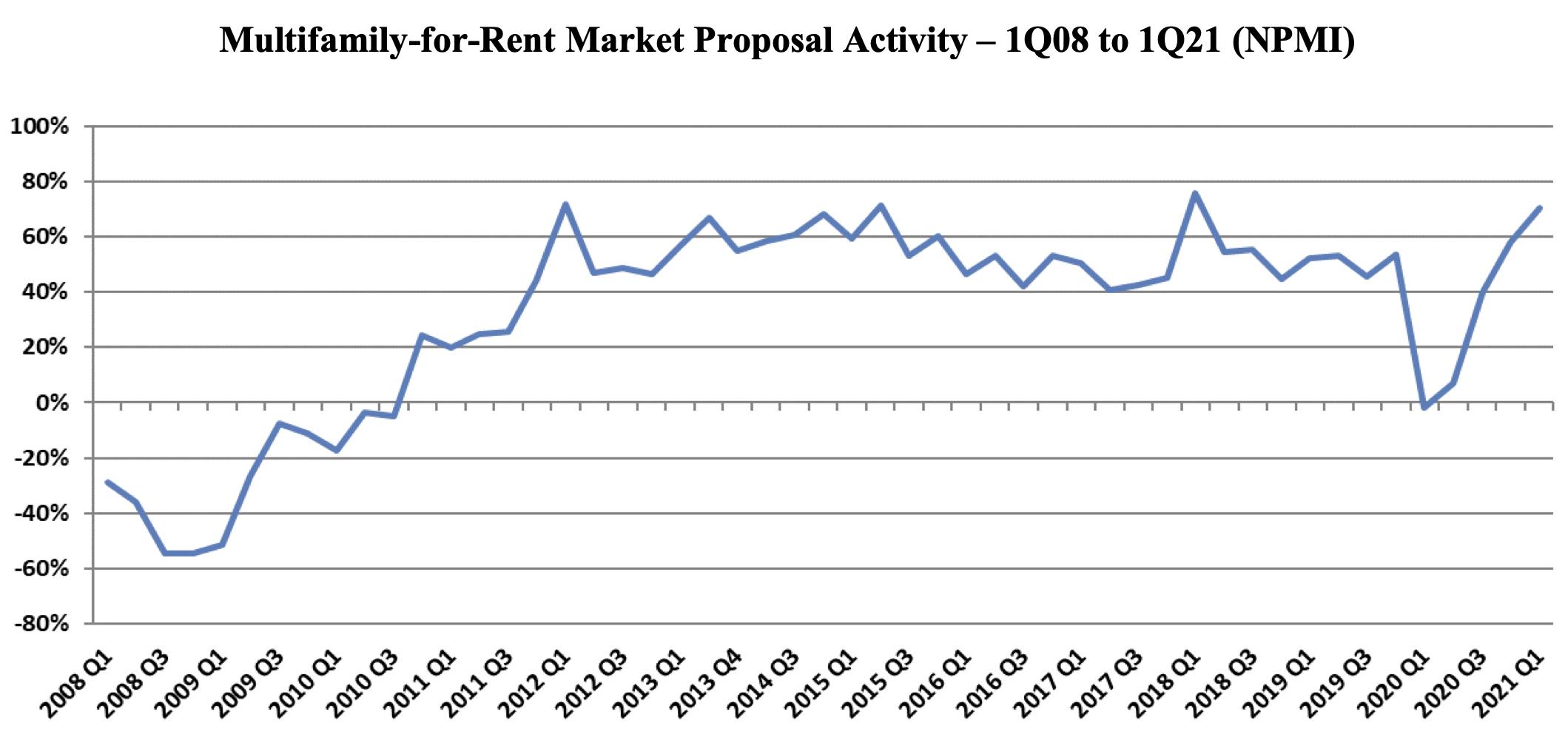

First-quarter proposal activity for multifamily housing added to prior quarter gains, reaching a near-record Net Plus/Minus Index (NPMI) of 71%. Multifamily topped the four other housing submarkets, though all performed well.

The first three months of the year saw housing lead all 12 major markets in the PSMJ Resources Quarterly Market Forecast survey of architecture, engineering, and construction (AEC) firms.

PSMJ’s NPMI expresses the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease. The QMF has proven to be a solid predictor of market health for the industry since its inception in 2003. A consistent group of over 300 AEC firm leaders participate regularly, with 183 contributing to the most recent survey.

Up 13 percentage points from the final quarter of 2020, multifamily’s NPMI of 71% tied its third-highest score since PSMJ added submarkets to its QMF survey in 2006. In addition to the record-high 76% in the 1st Quarter of 2018 and 72% in the 1st Quarter of 2012, Multifamily hit 71% in the 1st Quarter of 2015.

The 2021 performance marked a remarkable rebound for Multifamily, which dipped to -2% in the 1st Quarter of 2020, its first time in negative figures since 2010. In fact, before the COVID-driven drop a year ago, Multifamily’s NPMI had not fallen below 40% since the 3rd Quarter of 2011.

PSMJ Senior Principal David Burstein, PE, AECPM, noted that the strong performance of Multifamily and the entire Housing sector illustrates the industry’s overall economic health, as Housing growth often leads to activity in commercial, institutional and industrial markets as well. Should Congress pass an infrastructure stimulus bill, adds Burstein, the market could see even more historic growth.

Among respondents that work in the Multifamily sector, only 1% said that they saw a decrease in proposal opportunities in the 1st Quarter, compared with 72% that saw a noticeable increase. The remainder said that activity was about the same as the prior quarter.

The Assisted/Independent Senior Living submarket was another highflyer in the 1st Quarter, climbing 32 NPMI percentage points to 59%, tied for 12th -best among all submarkets. Condominiums bounced another 15 NPMI points to 30%, its best showing in three years.

The two other Housing markets measured in the PSMJ survey remain in rarefied air. The Housing Subdivision market recorded an NPMI of 68%, eclipsing its record-tying 4th -Quarter 2020 performance by 17 percentage points. Single-Family Homes dipped 8 NPMI percentage points to 51% – one of only 3 submarkets to see a decline – but that was still good enough for its second-best NPMI performance in the history of the QMF survey.

Related Stories

| Jul 28, 2014

Reconstruction Sector Construction Firms [2014 Giants 300 Report]

Structure Tone, Turner, and Gilbane top Building Design+Construction's 2014 ranking of the largest reconstruction contractor and construction management firms in the U.S.

| Jul 28, 2014

Reconstruction Sector Engineering Firms [2014 Giants 300 Report]

Jacobs, URS, and Wiss, Janney, Elstner top Building Design+Construction's 2014 ranking of the largest reconstruction engineering and engineering/architecture firms in the U.S.

| Jul 28, 2014

Reconstruction Sector Architecture Firms [2014 Giants 300 Report]

Stantec, HDR, and HOK top Building Design+Construction's 2014 ranking of the largest reconstruction architecture and architecture/engineering firms in the U.S.

| Jul 23, 2014

Architecture Billings Index up nearly a point in June

AIA reported the June ABI score was 53.5, up from a mark of 52.6 in May.

| Jul 22, 2014

Herzog & de Meuron unveil curvy concrete condo in Manhattan

Herzog & de Meuron have released renderings of their new $250 million New York building, a 12-story condominium with 88 luxury apartments.

| Jul 21, 2014

Economists ponder uneven recovery, weigh benefits of big infrastructure [2014 Giants 300 Report]

According to expert forecasters, multifamily projects, the Panama Canal expansion, and the petroleum industry’s “shale gale” could be saving graces for commercial AEC firms seeking growth opportunities in an economy that’s provided its share of recent disappointments.

| Jul 18, 2014

Contractors warm up to new technologies, invent new management schemes [2014 Giants 300 Report]

“UAV.” “LATISTA.” “CMST.” If BD+C Giants 300 contractors have anything to say about it, these new terms may someday be as well known as “BIM” or “LEED.” Here’s a sampling of what Giant GCs and CMs are doing by way of technological and managerial innovation.

| Jul 18, 2014

Top Construction Management Firms [2014 Giants 300 Report]

Jacobs, Barton Malow, Hill International top Building Design+Construction's 2014 ranking of the largest construction management and project management firms in the United States.

| Jul 18, 2014

Top Contractors [2014 Giants 300 Report]

Turner, Whiting-Turner, Skanska top Building Design+Construction's 2014 ranking of the largest contractors in the United States.

| Jul 18, 2014

Engineering firms look to bolster growth through new services, technology [2014 Giants 300 Report]

Following solid revenue growth in 2013, the majority of U.S.-based engineering and engineering/architecture firms expect more of the same this year, according to BD+C’s 2014 Giants 300 report.