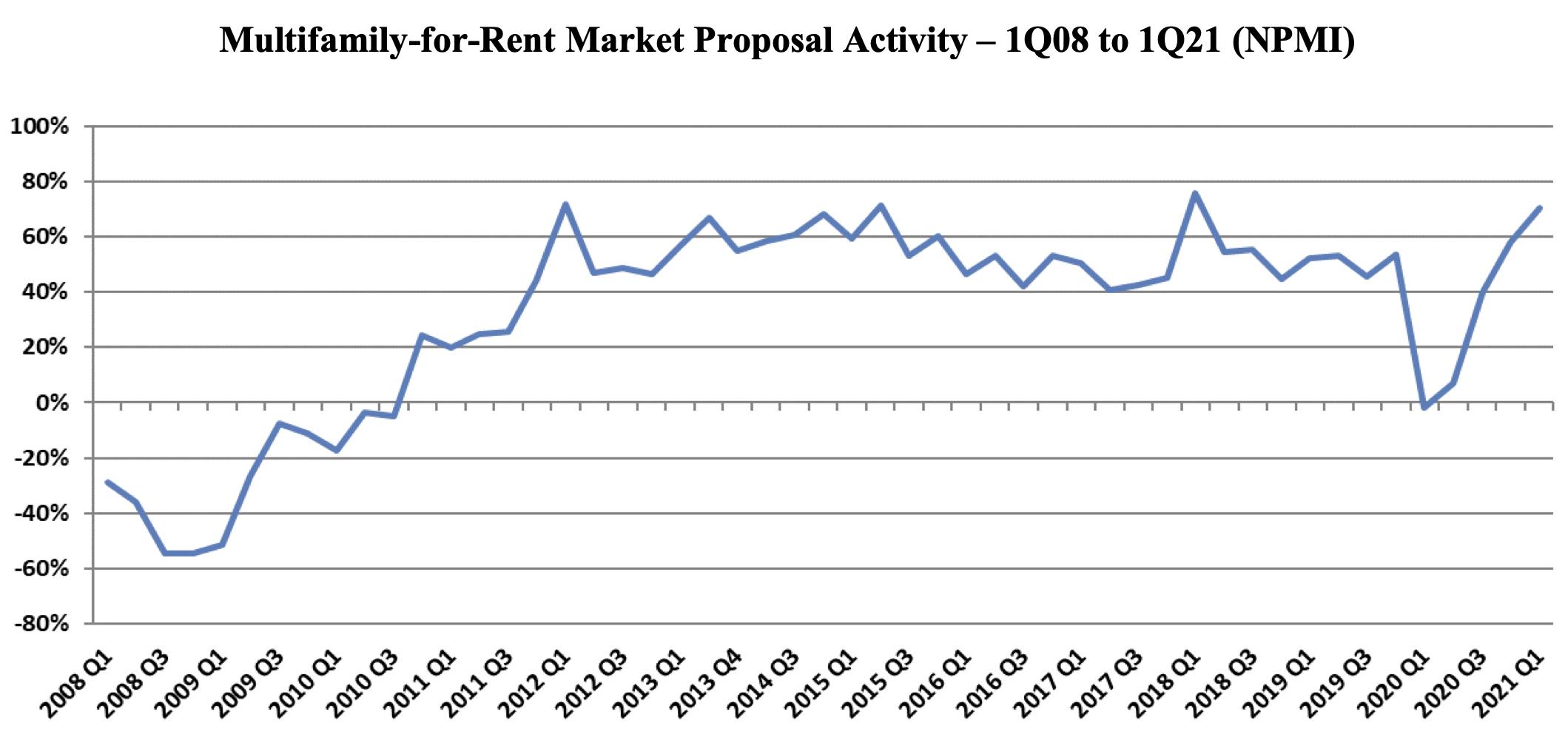

First-quarter proposal activity for multifamily housing added to prior quarter gains, reaching a near-record Net Plus/Minus Index (NPMI) of 71%. Multifamily topped the four other housing submarkets, though all performed well.

The first three months of the year saw housing lead all 12 major markets in the PSMJ Resources Quarterly Market Forecast survey of architecture, engineering, and construction (AEC) firms.

PSMJ’s NPMI expresses the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease. The QMF has proven to be a solid predictor of market health for the industry since its inception in 2003. A consistent group of over 300 AEC firm leaders participate regularly, with 183 contributing to the most recent survey.

Up 13 percentage points from the final quarter of 2020, multifamily’s NPMI of 71% tied its third-highest score since PSMJ added submarkets to its QMF survey in 2006. In addition to the record-high 76% in the 1st Quarter of 2018 and 72% in the 1st Quarter of 2012, Multifamily hit 71% in the 1st Quarter of 2015.

The 2021 performance marked a remarkable rebound for Multifamily, which dipped to -2% in the 1st Quarter of 2020, its first time in negative figures since 2010. In fact, before the COVID-driven drop a year ago, Multifamily’s NPMI had not fallen below 40% since the 3rd Quarter of 2011.

PSMJ Senior Principal David Burstein, PE, AECPM, noted that the strong performance of Multifamily and the entire Housing sector illustrates the industry’s overall economic health, as Housing growth often leads to activity in commercial, institutional and industrial markets as well. Should Congress pass an infrastructure stimulus bill, adds Burstein, the market could see even more historic growth.

Among respondents that work in the Multifamily sector, only 1% said that they saw a decrease in proposal opportunities in the 1st Quarter, compared with 72% that saw a noticeable increase. The remainder said that activity was about the same as the prior quarter.

The Assisted/Independent Senior Living submarket was another highflyer in the 1st Quarter, climbing 32 NPMI percentage points to 59%, tied for 12th -best among all submarkets. Condominiums bounced another 15 NPMI points to 30%, its best showing in three years.

The two other Housing markets measured in the PSMJ survey remain in rarefied air. The Housing Subdivision market recorded an NPMI of 68%, eclipsing its record-tying 4th -Quarter 2020 performance by 17 percentage points. Single-Family Homes dipped 8 NPMI percentage points to 51% – one of only 3 submarkets to see a decline – but that was still good enough for its second-best NPMI performance in the history of the QMF survey.

Related Stories

Multifamily Housing | Dec 16, 2020

What the Biden Administration means for multifamily construction

What can the multifamily real estate sector expect from Biden and Company? At the risk of having egg, if not a whole omelet, on my face, let me take a shot.

Giants 400 | Dec 16, 2020

Download a PDF of all 2020 Giants 400 Rankings

This 70-page PDF features AEC firm rankings across 51 building sectors, disciplines, and specialty services.

Multifamily Housing | Dec 4, 2020

The Weekly show: Designing multifamily housing for COVID-19, and trends in historic preservation and adaptive reuse

This week on The Weekly show, BD+C editors spoke with leaders from Page & Turnbull and Grimm + Parker Architects about designing multifamily housing for COVID-19, and trends in historic preservation and adaptive reuse

Giants 400 | Dec 2, 2020

2020 Multifamily Sector Giants: Top architecture, engineering, and construction firms in the U.S. multifamily building sector

Clark Group, Humphreys & Partners Architects, and Kimley-Horn head BD+C's rankings of the nation's largest multifamily building sector architecture, engineering, and construction firms, as reported in the 2020 Giants 400 Report.

Smart Buildings | Nov 20, 2020

The Weekly show: SPIRE smart building rating system, and pickleball court design tips

The November 19 episode of BD+C's The Weekly is available for viewing on demand.

AEC Tech | Nov 12, 2020

The Weekly show: Nvidia's Omniverse, AI for construction scheduling, COVID-19 signage

BD+C editors speak with experts from ALICE Technologies, Build Group, Hastings Architecture, Nvidia, and Woods Bagot on the November 12 episode of "The Weekly." The episode is available for viewing on demand.

Multifamily Housing | Nov 11, 2020

San Jose affordable housing project will feature a mass timber frame

SERA Architects and Lendlease will design and build the project.

Multifamily Housing | Oct 30, 2020

The Weekly show: Multifamily security tips, the state of construction industry research, and AGC's market update

BD+C editors speak with experts from AGC, Charles Pankow Foundation, and Silva Consultants on the October 29 episode of "The Weekly." The episode is available for viewing on demand.

Multifamily Housing | Oct 29, 2020

Uncertainty shades a once-soaring multifamily construction market

Demand varies by region, and by perceptions about the economy, COVID-19, and the election.