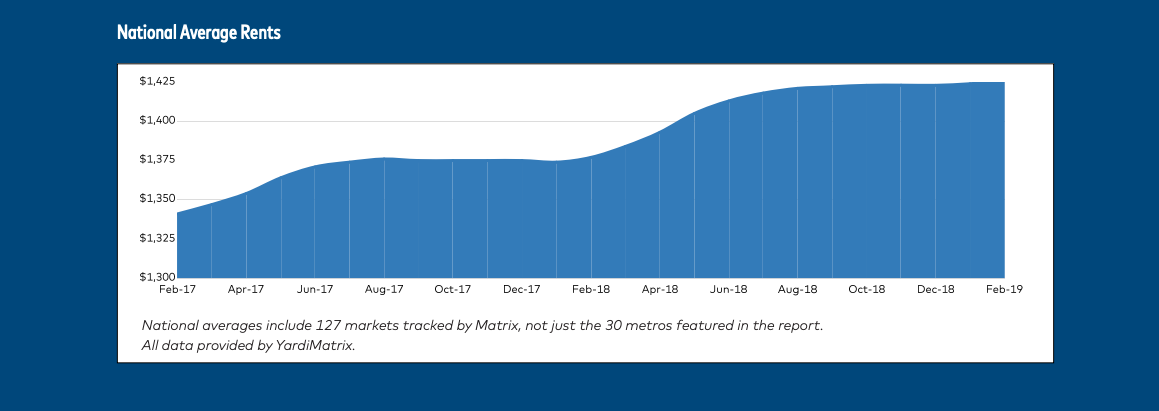

A $2 rise in average U.S. rents in February 2019 and year-over-year growth of 3.6%, the highest since late 2016, point to the multifamily industry’s continuing strength, according to a report from Yardi Matrix.

A February survey of 127 major U.S. real estate markets shows that demand, bolstered by a job market with low unemployment and accelerating wage growth, shows no signs of slowing.

Demand is most pronounced in metros with strong population gains and healthy job growth. Rents averaged $1,426 for the month.

The latest numbers “are evidence that the market has strength to perform well for a while, even if the economy or other commercial real estate segments slow down,” the report says. “Occupancy rates have ticked down slightly, but absorption has been no problem.”

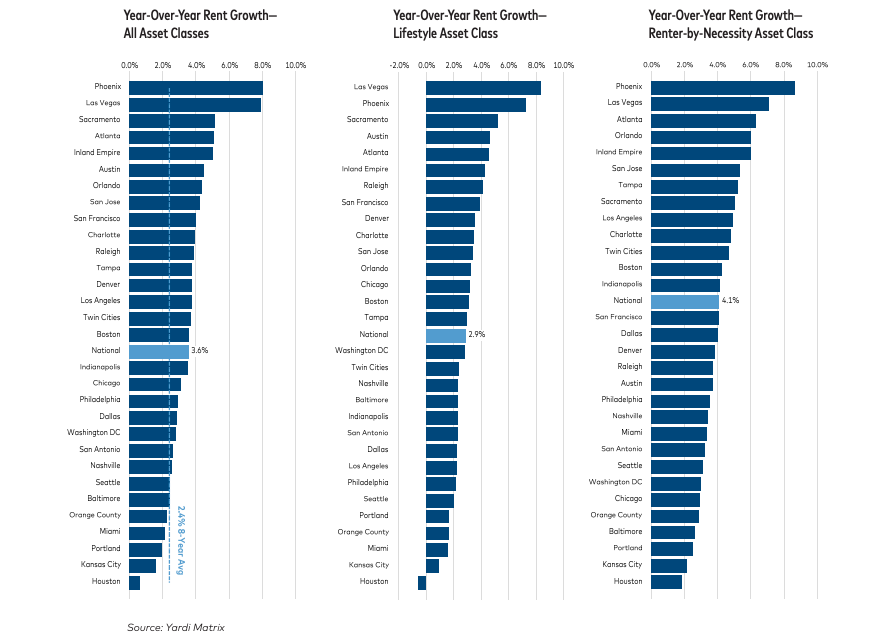

February’s year-over-year rent growth leaders were Phoenix, Las Vegas, Sacramento, Calif., Atlanta, and California’s Inland Empire. View the full report.

U.S. multifamily rents rose $2 in February to $1,426 and year-over-year growth remained at 3.6%, as January was revised upward from 3.3% to 3.6%. Annual growth is the highest it has been since late 2016. Rent growth has steadily increased since bottoming at 2.2% in the fall of 2017. The consistent growth is a sign of the strength of the sector’s fundamentals and an indication that the cycle has a ways to run.

U.S. multifamily rents rose $2 in February to $1,426 and year-over-year growth remained at 3.6%, as January was revised upward from 3.3% to 3.6%. Annual growth is the highest it has been since late 2016. Rent growth has steadily increased since bottoming at 2.2% in the fall of 2017. The consistent growth is a sign of the strength of the sector’s fundamentals and an indication that the cycle has a ways to run.

The desert Southwest continues to lead our rankings of top markets, as Phoenix (8.0%) and Las Vegas (7.9%) charge ahead. The gap between the top two markets and the rest of the nation is expanding, as well. Sacramento (5.1%) ranks third, with growth nearly 300 basis points less.

The desert Southwest continues to lead our rankings of top markets, as Phoenix (8.0%) and Las Vegas (7.9%) charge ahead. The gap between the top two markets and the rest of the nation is expanding, as well. Sacramento (5.1%) ranks third, with growth nearly 300 basis points less.

Related Stories

| Jan 27, 2011

Perkins Eastman's report on senior housing signals a changing market

Top international design and architecture firm Perkins Eastman is pleased to announce that the Perkins Eastman Research Collaborative recently completed the “Design for Aging Review 10 Insights and Innovations: The State of Senior Housing” study for the American Institute of Architects (AIA). The results of the comprehensive study reflect the changing demands and emerging concepts that are re-shaping today’s senior living industry.

| Jan 21, 2011

Harlem facility combines social services with retail, office space

Harlem is one of the first neighborhoods in New York City to combine retail with assisted living. The six-story, 50,000-sf building provides assisted living for residents with disabilities and a nonprofit group offering services to minority groups, plus retail and office space.

| Jan 21, 2011

Nothing dinky about these residences for Golden Gophers

The Sydney Hall Student Apartments combines 125 student residences with 15,000 sf of retail space in the University of Minnesota’s historic Dinkytown neighborhood, in Minneapolis.

| Jan 21, 2011

Revamped hotel-turned-condominium building holds on to historic style

The historic 89,000-sf Hotel Stowell in Los Angeles was reincarnated as the El Dorado, a 65-unit loft condominium building with retail and restaurant space. Rockefeller Partners Architects, El Segundo, Calif., aimed to preserve the building’s Gothic-Art Nouveau combination style while updating it for modern living.

| Jan 21, 2011

Upscale apartments offer residents a twist on modern history

The Goodwynn at Town: Brookhaven, a 433,300-sf residential and retail building in DeKalb County, Ga., combines a historic look with modern amenities. Atlanta-based project architect Niles Bolton Associates used contemporary materials in historic patterns and colors on the exterior, while concealing a six-level parking structure on the interior.

| Jan 20, 2011

Worship center design offers warm and welcoming atmosphere

The Worship Place Studio of local firm Ziegler Cooper Architects designed a new 46,000-sf church complex for the Pare de Sufrir parish in Houston.

| Jan 19, 2011

Baltimore mixed-use development combines working, living, and shopping

The Shoppes at McHenry Row, a $117 million mixed-use complex developed by 28 Walker Associates for downtown Baltimore, will include 65,000 sf of office space, 250 apartments, and two parking garages. The 48,000 sf of main street retail space currently is 65% occupied, with space for small shops and a restaurant remaining.

| Jan 7, 2011

Mixed-Use on Steroids

Mixed-use development has been one of the few bright spots in real estate in the last few years. Successful mixed-use projects are almost always located in dense urban or suburban areas, usually close to public transportation. It’s a sign of the times that the residential component tends to be rental rather than for-sale.

| Jan 4, 2011

An official bargain, White House loses $79 million in property value

One of the most famous office buildings in the world—and the official the residence of the President of the United States—is now worth only $251.6 million. At the top of the housing boom, the 132-room complex was valued at $331.5 million (still sounds like a bargain), according to Zillow, the online real estate marketplace. That reflects a decline in property value of about 24%.