After another year when the growth in multifamily housing exceeded expectations, apartment demand and property values could keep rolling through 2017.

“The forces that have produced the best multifamily market in recent memory remain largely in place,” says John Affleck, apartment research strategist for CoStar Group.

In a recent report from Real Capital Markets, 49% of investors polled said that multifamily remains an ideal investment in commercial real estate, and that the market doesn’t look like it will be slowing down any time soon.

The National Association of Home Builders expects multifamily starts to rise to 384,000 units, or 1,000 above last year’s number. Robert Dietz, NAHB’s chief economist, believes this pace is being driven by demographics and the balance between supply and demand.

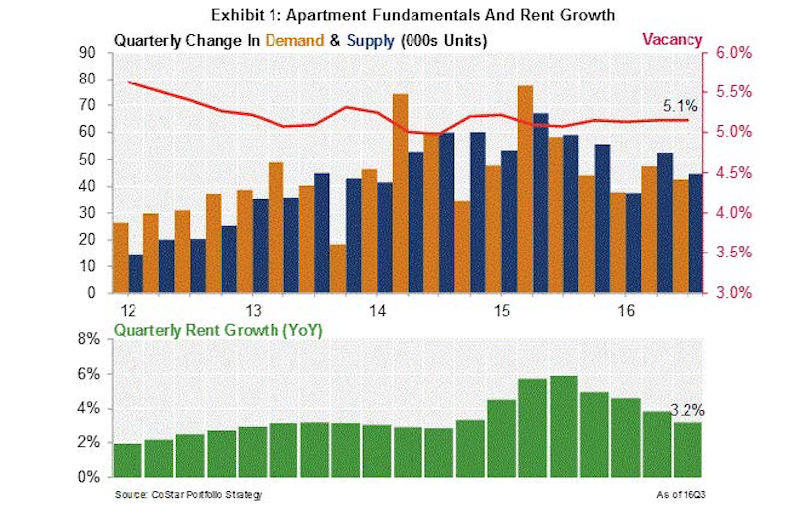

CoStar actually forecasts that sales volumes, units per sale, and price growth of multifamily properties will finally level off this year from record highs. However, CoStar also acknowledges the sector’s momentum, where—through the third quarter of 2016—multifamily had the lowest vacancy rate (5.2%) of all major property types, and had seen rents rise by 3.9%.

Aggressive pricing aside, the sector’s record of steady rent growth and high occupancy with low volatility continue to make apartment properties an ideal defensive asset as the economic cycle extends into a seventh year, Affleck says.

CoStar predicts that the national vacancy rate for multifamily properties will increase to 5.6% this year and to 5.7% in 2018. Rental rate growth should moderate to 2.3% this year and 2.1% next.

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

David Brickman, Executive Vice President and head of Freddic Mac’s multifamily business, foresees a spike in renter households, spurred on by positive job growth and a stable economy. In addition, home prices are on the rise, which might cause renters to further postpone any residential purchases. And aging baby boomers continue to downsize into rental units.

Fannie Mae is a bit more conservative in its estimates about multifamily growth over the next two years. But Kim Betancourt, Fannie’s Director of Economics, doesn’t expect any moderation to be long lasting.

“Considering that rent concessions have declined steadily for nearly seven straight years, and that their current level is now below 1%, it is probably only a question of ‘when’ and not ‘if’ concessions begin to rise again,” Betancourt says.

CoStar’s Affleck sees the “unprecedented propensity to rent, even among the most affluent” as “the chief risk to this cycle,” because higher rents will inevitably coax more renters to consider homeownership, especially if interest rates stay relatively low.

Related Stories

| Oct 15, 2014

Final touches make 432 Park Avenue tower second tallest in New York City

Concrete has been poured for the final floors of the residential high-rise at 432 Park Avenue in New York City, making it the city’s second-tallest building and the tallest residential tower in the Western Hemisphere.

| Oct 14, 2014

Richard Meier unveils design for his first tower in Taiwan

Taiwan will soon have its first Richard Meier building, a 535-foot apartment tower in Taichung City, the country’s third-largest city.

| Oct 12, 2014

AIA 2030 commitment: Five years on, are we any closer to net-zero?

This year marks the fifth anniversary of the American Institute of Architects’ effort to have architecture firms voluntarily pledge net-zero energy design for all their buildings by 2030.

| Oct 7, 2014

Analysis: Student loans will cost housing industry $83 billion in 2014

More than 410,000 single- and multifamily home sales will be lost in 2014 due to student loan debt, according to analysis by John Burns Real Estate Consulting.

| Oct 7, 2014

Economic gains are rallying rents in Raleigh, N.C.

The greater Raleigh, N.C., market appears to be getting back on its feet again, which is good news for rental property owners.

| Oct 3, 2014

Herzog & de Meuron unveil design for Manhattan hotel-condo tower [slideshow]

Herzog & de Meuron will partner with interior designer John Pawson to design a 28-story tower for Manhattan's Bowery district. The majority of the building will house a 370-room hotel, with 11 luxury residences on its top.

| Sep 25, 2014

Look to history warily when gauging where the construction industry may be headed

Precedents and patterns may not tell you all that much about future spending or demand.

| Sep 24, 2014

Architecture billings see continued strength, led by institutional sector

On the heels of recording its strongest pace of growth since 2007, there continues to be an increasing level of demand for design services signaled in the latest Architecture Billings Index.

| Sep 22, 2014

4 keys to effective post-occupancy evaluations

Perkins+Will's Janice Barnes covers the four steps that designers should take to create POEs that provide design direction and measure design effectiveness.

| Sep 22, 2014

Sound selections: 12 great choices for ceilings and acoustical walls

From metal mesh panels to concealed-suspension ceilings, here's our roundup of the latest acoustical ceiling and wall products.