After another year when the growth in multifamily housing exceeded expectations, apartment demand and property values could keep rolling through 2017.

“The forces that have produced the best multifamily market in recent memory remain largely in place,” says John Affleck, apartment research strategist for CoStar Group.

In a recent report from Real Capital Markets, 49% of investors polled said that multifamily remains an ideal investment in commercial real estate, and that the market doesn’t look like it will be slowing down any time soon.

The National Association of Home Builders expects multifamily starts to rise to 384,000 units, or 1,000 above last year’s number. Robert Dietz, NAHB’s chief economist, believes this pace is being driven by demographics and the balance between supply and demand.

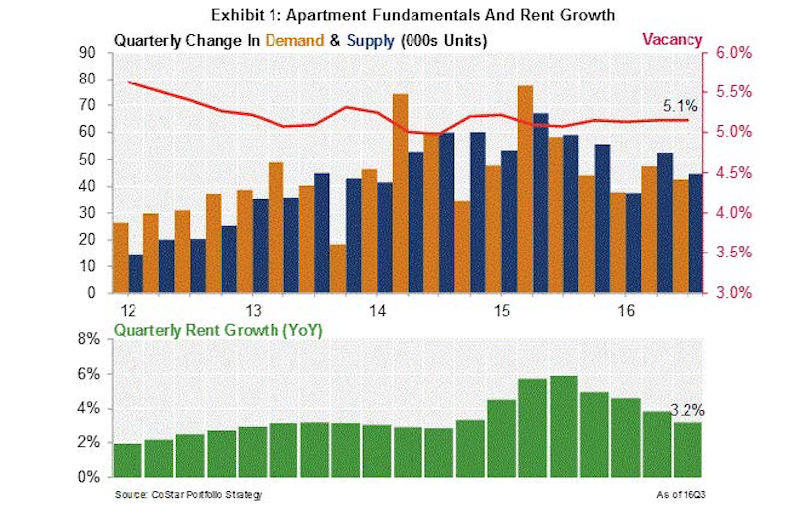

CoStar actually forecasts that sales volumes, units per sale, and price growth of multifamily properties will finally level off this year from record highs. However, CoStar also acknowledges the sector’s momentum, where—through the third quarter of 2016—multifamily had the lowest vacancy rate (5.2%) of all major property types, and had seen rents rise by 3.9%.

Aggressive pricing aside, the sector’s record of steady rent growth and high occupancy with low volatility continue to make apartment properties an ideal defensive asset as the economic cycle extends into a seventh year, Affleck says.

CoStar predicts that the national vacancy rate for multifamily properties will increase to 5.6% this year and to 5.7% in 2018. Rental rate growth should moderate to 2.3% this year and 2.1% next.

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

David Brickman, Executive Vice President and head of Freddic Mac’s multifamily business, foresees a spike in renter households, spurred on by positive job growth and a stable economy. In addition, home prices are on the rise, which might cause renters to further postpone any residential purchases. And aging baby boomers continue to downsize into rental units.

Fannie Mae is a bit more conservative in its estimates about multifamily growth over the next two years. But Kim Betancourt, Fannie’s Director of Economics, doesn’t expect any moderation to be long lasting.

“Considering that rent concessions have declined steadily for nearly seven straight years, and that their current level is now below 1%, it is probably only a question of ‘when’ and not ‘if’ concessions begin to rise again,” Betancourt says.

CoStar’s Affleck sees the “unprecedented propensity to rent, even among the most affluent” as “the chief risk to this cycle,” because higher rents will inevitably coax more renters to consider homeownership, especially if interest rates stay relatively low.

Related Stories

| Feb 5, 2013

8 eye-popping wood building projects

From 100-foot roof spans to novel reclaimed wood installations, the winners of the 2013 National Wood Design Awards push the envelope in wood design.

| Jan 31, 2013

Map of U.S. illustrates planning times for commercial construction

Stephen Oliner, a UCLA professor doing research for the Federal Reserve Board, has made the first-ever estimate of planning times for commercial construction across the United States.

| Jan 31, 2013

More severe wind storms should prompt nationwide reexamination of building codes, says insurance expert

The increased number and severity of storms with high winds nationally should prompt a reexamination of building codes in every community, says Mory Katz, vice president, Verisk Insurance Solutions Commercial Property, Jersey City, N.J.

| Jan 29, 2013

Trinitas and Harrison Street Break Ground Near University of Kentucky

The 699-bed Collegiate on Angliana, with an anticipated opening date of August 2013, will serve students attending the University of Kentucky (UK).

| Jan 23, 2013

Music-Inspired Apartment Complex Completed in Tampa's Tempo District

Named in honor of jazz artist Ella Fitzgerald, Ella at Encore is the first building to rise from plans to develop a mixed-use, mixed-income urban village in the community.

| Dec 6, 2012

Suffolk Construction awarded Phase Two of Boston’s Old Colony redevelopment project

Project team breaks ground on South Boston public housing project designed for energy efficiency.

| Nov 13, 2012

2012 LEED for Homes Award recipients announced

USGBC recognizes excellence in the green residential building community at its Greenbuild Conference & Expo in San Francisco

| Nov 11, 2012

Greenbuild 2012 Report: Multifamily

Sustainably designed apartments are apples of developers’ eyes

| Oct 5, 2012

2012 Reconstruction Award Silver Winner: 220 Water Street, Brooklyn, N.Y.

The recent rehabilitation of 220 Water Street transforms it from a vacant manufacturing facility to a 134-unit luxury apartment building in Brooklyn’s DUMBO neighborhood.

| Aug 1, 2012

C.W. Driver forms Driver URBAN

Driver URBAN specializes in the construction of multi-family apartments, mixed-use developments, affordable housing, student and senior housing, and hospitality projects.