After another year when the growth in multifamily housing exceeded expectations, apartment demand and property values could keep rolling through 2017.

“The forces that have produced the best multifamily market in recent memory remain largely in place,” says John Affleck, apartment research strategist for CoStar Group.

In a recent report from Real Capital Markets, 49% of investors polled said that multifamily remains an ideal investment in commercial real estate, and that the market doesn’t look like it will be slowing down any time soon.

The National Association of Home Builders expects multifamily starts to rise to 384,000 units, or 1,000 above last year’s number. Robert Dietz, NAHB’s chief economist, believes this pace is being driven by demographics and the balance between supply and demand.

CoStar actually forecasts that sales volumes, units per sale, and price growth of multifamily properties will finally level off this year from record highs. However, CoStar also acknowledges the sector’s momentum, where—through the third quarter of 2016—multifamily had the lowest vacancy rate (5.2%) of all major property types, and had seen rents rise by 3.9%.

Aggressive pricing aside, the sector’s record of steady rent growth and high occupancy with low volatility continue to make apartment properties an ideal defensive asset as the economic cycle extends into a seventh year, Affleck says.

CoStar predicts that the national vacancy rate for multifamily properties will increase to 5.6% this year and to 5.7% in 2018. Rental rate growth should moderate to 2.3% this year and 2.1% next.

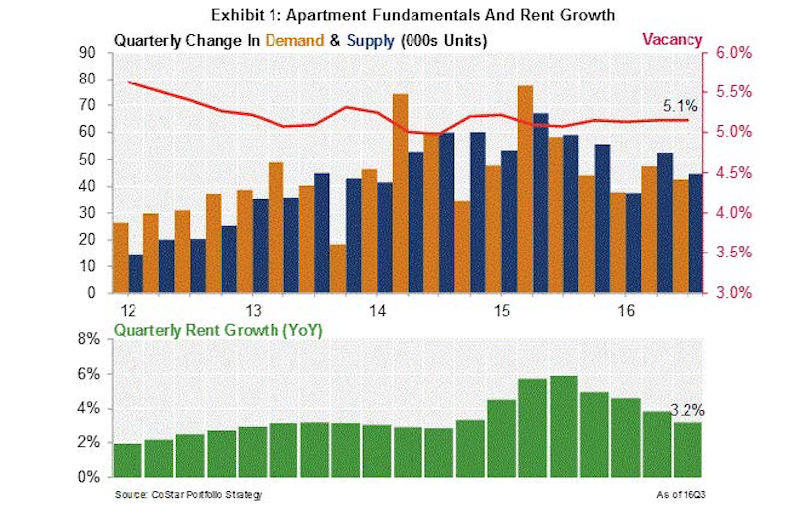

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

David Brickman, Executive Vice President and head of Freddic Mac’s multifamily business, foresees a spike in renter households, spurred on by positive job growth and a stable economy. In addition, home prices are on the rise, which might cause renters to further postpone any residential purchases. And aging baby boomers continue to downsize into rental units.

Fannie Mae is a bit more conservative in its estimates about multifamily growth over the next two years. But Kim Betancourt, Fannie’s Director of Economics, doesn’t expect any moderation to be long lasting.

“Considering that rent concessions have declined steadily for nearly seven straight years, and that their current level is now below 1%, it is probably only a question of ‘when’ and not ‘if’ concessions begin to rise again,” Betancourt says.

CoStar’s Affleck sees the “unprecedented propensity to rent, even among the most affluent” as “the chief risk to this cycle,” because higher rents will inevitably coax more renters to consider homeownership, especially if interest rates stay relatively low.

Related Stories

Student Housing | Jun 20, 2024

How student housing developments are evolving to meet new expectations

The days of uninspired dorm rooms with little more than a bed and a communal bathroom down the hall are long gone. Students increasingly seek inclusive design, communities to enhance learning and living, and a focus on wellness that encompasses everything from meditation spaces to mental health resources.

MFPRO+ News | Jun 20, 2024

National multifamily outlook: Summer 2024

The multifamily sector continues to be strong in 2024, even when a handful of challenges are present. That is according to the Matrix Multifamily National Report for Summer 2024.

Multifamily Housing | Jun 17, 2024

Elevating multifamily properties through quiet luxury

As the demands of urban living continue to evolve, the need for a tranquil and refined home environment has never been more pronounced.

Multifamily Housing | Jun 14, 2024

AEC inspections are the key to financially viable office to residential adaptive reuse projects

About a year ago our industry was abuzz with an idea that seemed like a one-shot miracle cure for both the shockingly high rate of office vacancies and the worsening housing shortage. The seemingly simple idea of converting empty office buildings to multifamily residential seemed like an easy and elegant solution. However, in the intervening months we’ve seen only a handful of these conversions, despite near universal enthusiasm for the concept.

Adaptive Reuse | Jun 13, 2024

4 ways to transform old buildings into modern assets

As cities grow, their office inventories remain largely stagnant. Yet despite changes to the market—including the impact of hybrid work—opportunities still exist. Enter: “Midlife Metamorphosis.”

Affordable Housing | Jun 12, 2024

Studio Libeskind designs 190 affordable housing apartments for seniors

In Brooklyn, New York, the recently opened Atrium at Sumner offers 132,418 sf of affordable housing for seniors. The $132 million project includes 190 apartments—132 of them available to senior households earning below or at 50% of the area median income and 57 units available to formerly homeless seniors.

MFPRO+ News | Jun 11, 2024

Rents rise in multifamily housing for May 2024

Multifamily rents rose for the fourth month in a row, according to the May 2024 National Multifamily Report. Up 0.6% year-over-year, the average U.S. asking rent increased by $6 in May, up to $1,733.

Apartments | Jun 4, 2024

Apartment sizes on the rise after decade-long shrinking trend

The average size of new apartments in the U.S. saw substantial growth in 2023, bouncing back to 916 sf after a steep decline the previous year. That is according to a recent RentCafe market insight report released this month.

Multifamily Housing | Jun 3, 2024

Grassroots groups becoming a force in housing advocacy

A growing movement of grassroots organizing to support new housing construction is having an impact in city halls across the country. Fed up with high housing costs and the commonly hostile reception to new housing proposals, advocacy groups have sprung up in many communities to attend public meetings to speak in support of developments.

MFPRO+ News | Jun 3, 2024

New York’s office to residential conversion program draws interest from 64 owners

New York City’s Office Conversion Accelerator Program has been contacted by the owners of 64 commercial buildings interested in converting their properties to residential use.