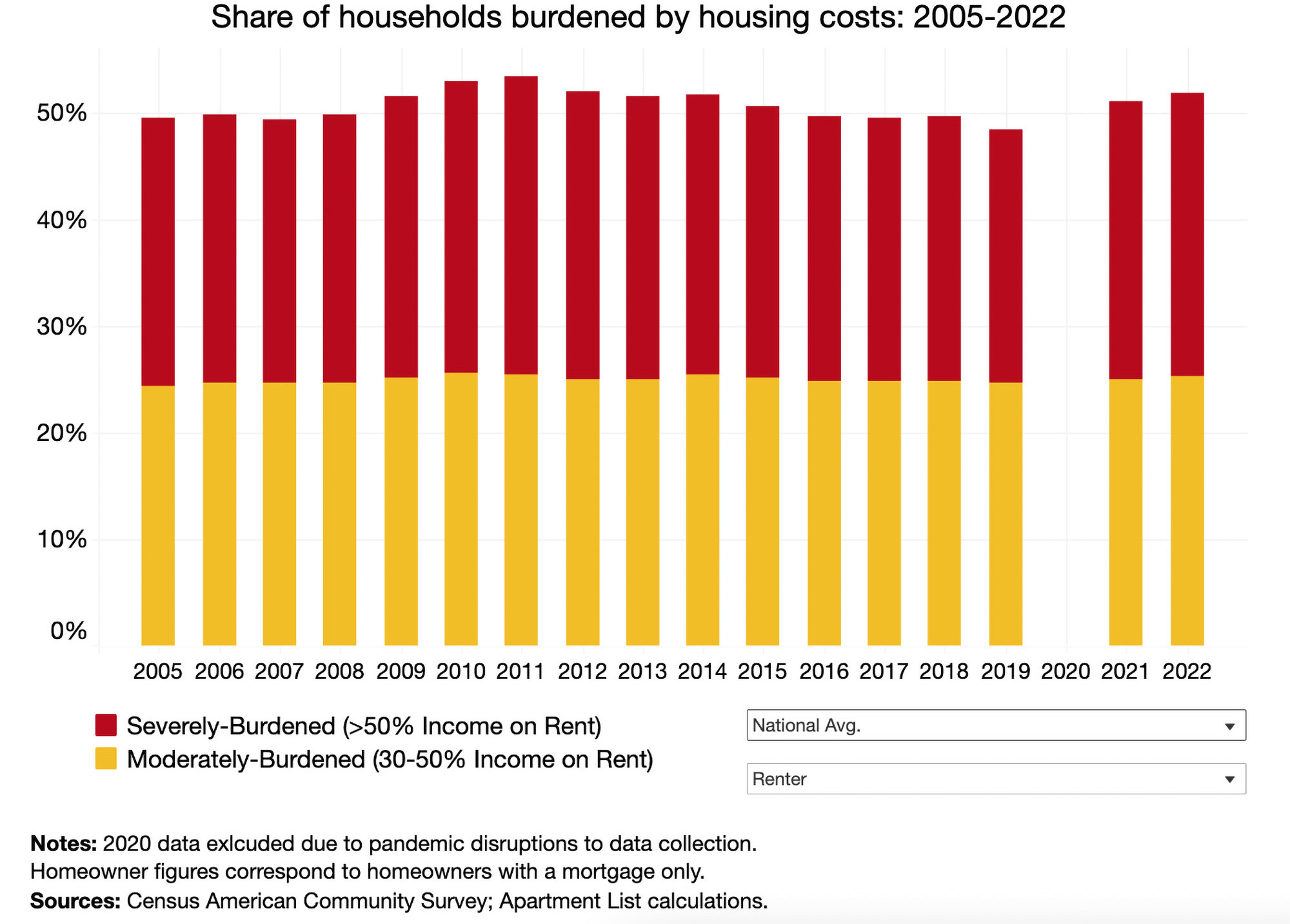

According to the common measure of housing affordability, a household is considered "cost-burdened" when housing expenses consume over 30% of occupant's total gross income. Those that spend more than 50% of their income on monthly housing costs are classified as "severely" cost-burdened.

The most recent data derived from the 2022 Census American Community Survey reveals that the proportion of American renters facing housing cost burdens has reached its highest point since 2012, undoing the progress made in the ten years leading up to the pandemic. The majority of this increase can be attributed to a surge in severely burdened households—those expending more than half of their earnings on rent.

The latest report by Apartment List explores the cost burden rate and what it says about the state of housing affordability in the U.S. Here are some of their takeaways:

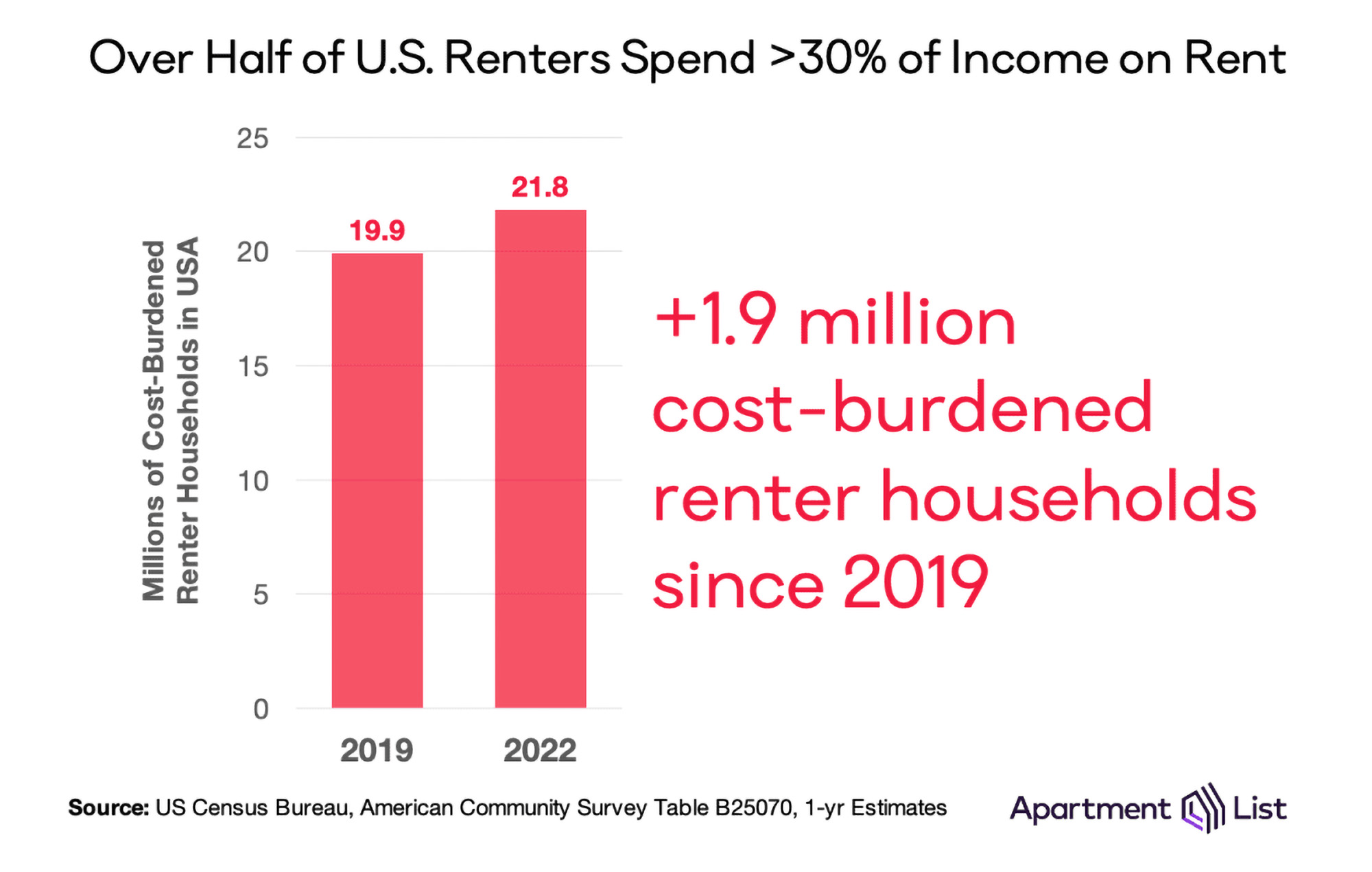

1. The pandemic burdened nearly 2 million renters in the last three years

The number of cost-burdened renter households have been decreasing steadily since 2011. In a five-year span alone, the number of homes fell by 826,000 between 2014 and 2019. By 2019, just under 20 million renter households were considered cost-burdened.

In 2022, however, the number of cost-burdened renter households has increased by 1.9 million—making the total 21.8 million—and the number of non-burdened households fell by 957,000.

2. Severely-burdened households make up 27% of those affected

Renter households that spend more that 50% of their income on housing costs are considered severely-burdened. In the past three years, the share of these households among the total of those burdened increased by 3% to 26.7 percent.

Though the cost burden rate is much lower for those who own homes, it has also been rising in recent years. In 2022, the percentage of homeowners that are cost-burdened jumped to 27.9 percent, up from 26.6% in 2019.

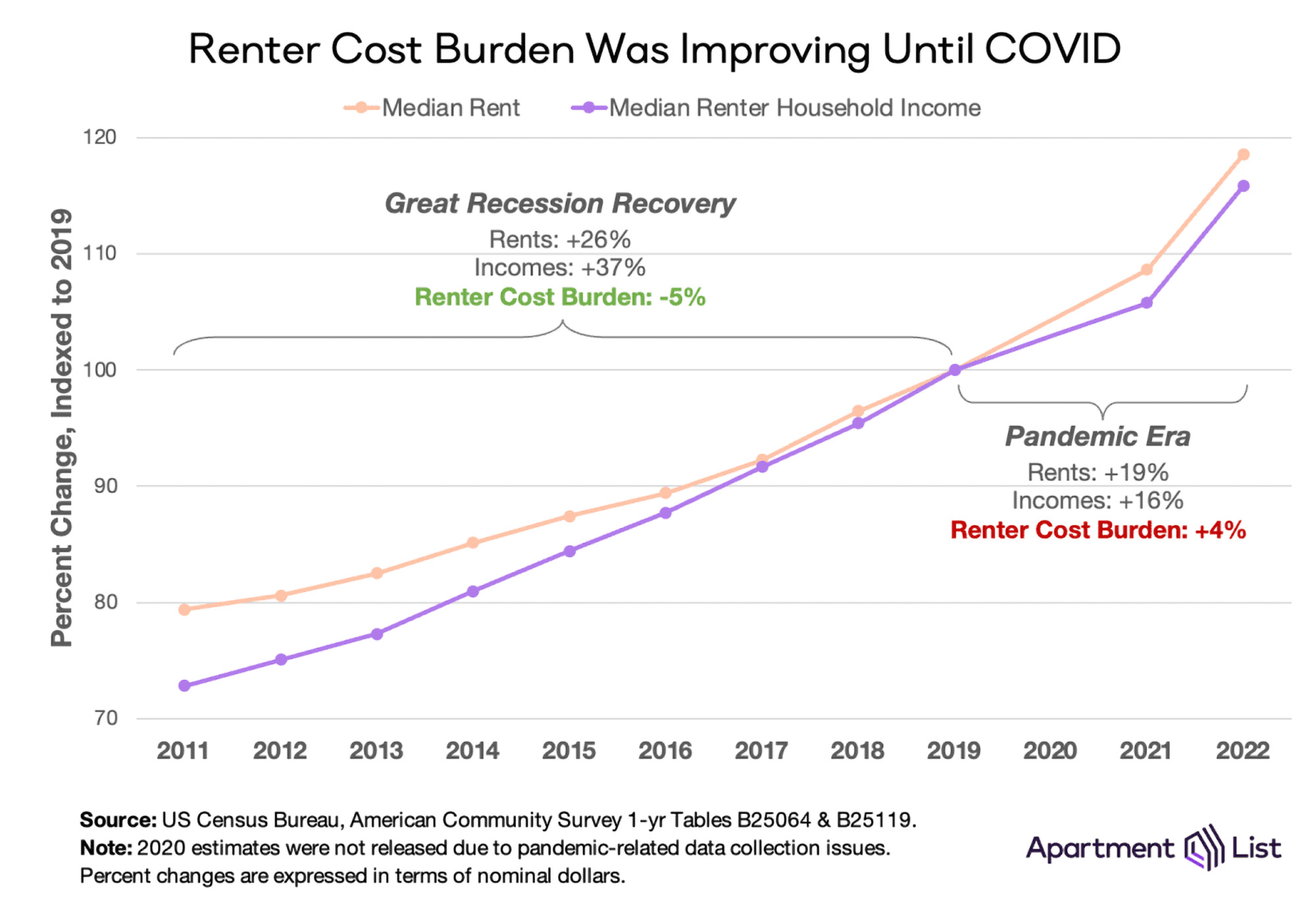

3. The cost burden is driven by rent prices rising faster than household incomes

After the Great Recession, renter cost burden improved gradually for several years. While the median rent rose 26 percent, the median renter household income increased 37 percent in the same eight years.

Since 2019, renter cost burden has increased 4% and median rent jumped up 19 percent, while renter income rose only 16 percent. According to the Apartment List analysis, 74 of the 100 largest U.S. metros have experienced rent prices growing faster than renter income. Since 2019, the cost burden has worsened in nearly all (94%) of the top metros.

Future outlook from Apartment List

"Preliminary data from the Bureau of Labor Statistics shows that incomes in the second quarter of 2023 are up 5.7% year-over-year (1.7% after adjusting for inflation). And while these statistics are not available for renters specifically, other breakdowns show that recent wage growth is higher for lower-earners and non-white workers, who are both more likely to rent.

However, rent growth may also continue on an upward trajectory. For more than half of all renter households, monthly rent payments are eating up a large enough share of their income to put financial stability at risk. And more than one-in-four renter households spend more than half of their income on rent—a level which can often necessitate extreme measures such as overcrowding and cutting back on spending on other basic needs. Thankfully, policymakers have demonstrated an increased focus on this issue in recent years, but solutions are still urgently needed."

To read the full report, visit Apartment List

Related Stories

Market Data | Jul 28, 2020

6 must reads for the AEC industry today: July 28, 2020

St. Petersburg Pier reconstruction completes and post-pandemic workplace design will not be the same for all.

Market Data | Jul 28, 2020

Senate Republicans' coronavirus relief measure includes provisions that will help hard-hit construction firms recover

The HEALS Act includes essential liability, workforce, financial & unemployment reforms, but association will work to get needed infrastructure investments included in final relief measure.

Market Data | Jul 27, 2020

6 must reads for the AEC industry today: July 27, 2020

Customized labs give universities a recruiting edge and the U.S. construction pipeline remains robust through the first half of 2020.

Market Data | Jul 27, 2020

The U.S. construction pipeline remains robust through the first half of 2020, despite pandemic

Projects currently under construction stand at 1,771 projects/235,467 rooms, up 3% and 1% respectively, YOY.

Market Data | Jul 24, 2020

5 must reads for the AEC industry today: July 24, 2020

North Carolina will stop relying on FEMA flood mapping and Cal Poly Pomona's newest project.

Market Data | Jul 23, 2020

New LEED guidance from USGBC helps cities and communities expand resilience efforts in response to the COVID-19 pandemic

Credits integrate public health and social equity with sustainability planning.

Market Data | Jul 23, 2020

6 must reads for the AEC industry today: July 23, 2020

Skanska selects Pickard Chilton to design new ofice tower and days grow long at nursing homes as virus lockdowns drag on.

Market Data | Jul 22, 2020

6 must reads for the AEC industry today: July 22, 2020

Phase one of Toronto's The Orbit detailed and architecture billings remains in negative territory.

Market Data | Jul 21, 2020

Nonresidential building spending to decline through 2021

The commercial building sector is expected to be the hardest hit.

Market Data | Jul 21, 2020

7 must reads for the AEC industry today: July 21, 2020

Abandoned high-rise becomes mixed-use luxury apartments and researchers are developing anti-coronavirus tech for buildings.