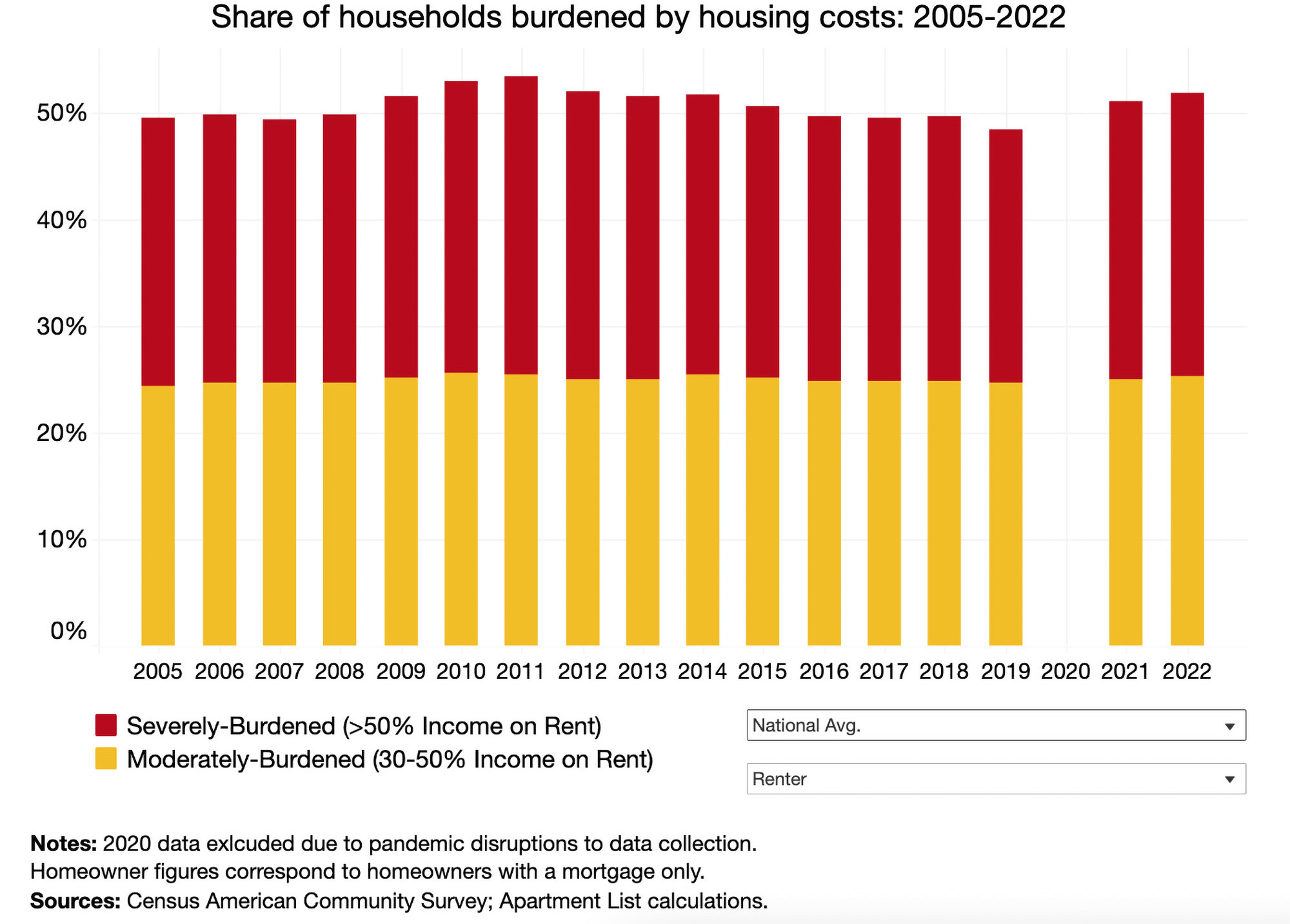

According to the common measure of housing affordability, a household is considered "cost-burdened" when housing expenses consume over 30% of occupant's total gross income. Those that spend more than 50% of their income on monthly housing costs are classified as "severely" cost-burdened.

The most recent data derived from the 2022 Census American Community Survey reveals that the proportion of American renters facing housing cost burdens has reached its highest point since 2012, undoing the progress made in the ten years leading up to the pandemic. The majority of this increase can be attributed to a surge in severely burdened households—those expending more than half of their earnings on rent.

The latest report by Apartment List explores the cost burden rate and what it says about the state of housing affordability in the U.S. Here are some of their takeaways:

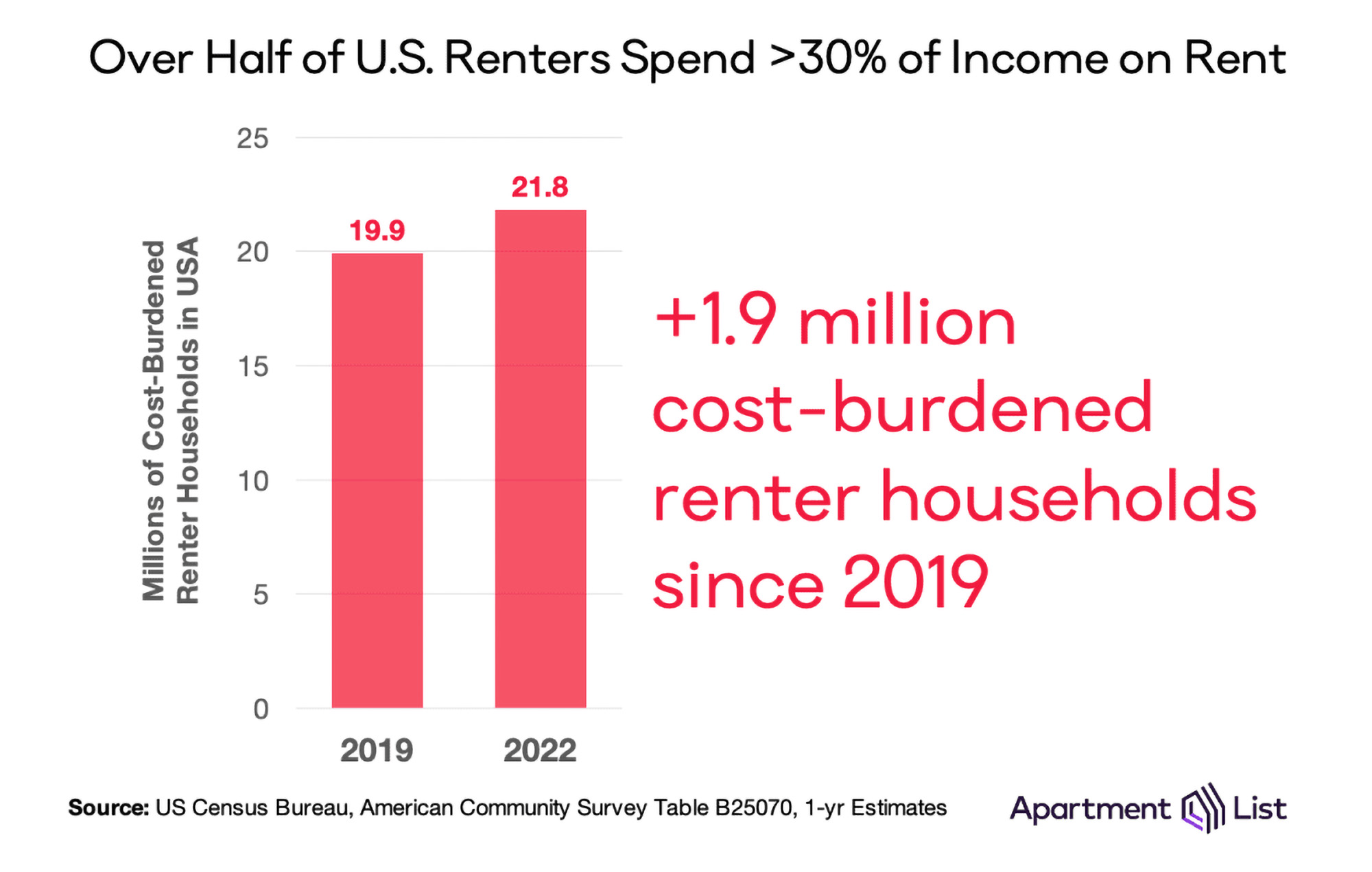

1. The pandemic burdened nearly 2 million renters in the last three years

The number of cost-burdened renter households have been decreasing steadily since 2011. In a five-year span alone, the number of homes fell by 826,000 between 2014 and 2019. By 2019, just under 20 million renter households were considered cost-burdened.

In 2022, however, the number of cost-burdened renter households has increased by 1.9 million—making the total 21.8 million—and the number of non-burdened households fell by 957,000.

2. Severely-burdened households make up 27% of those affected

Renter households that spend more that 50% of their income on housing costs are considered severely-burdened. In the past three years, the share of these households among the total of those burdened increased by 3% to 26.7 percent.

Though the cost burden rate is much lower for those who own homes, it has also been rising in recent years. In 2022, the percentage of homeowners that are cost-burdened jumped to 27.9 percent, up from 26.6% in 2019.

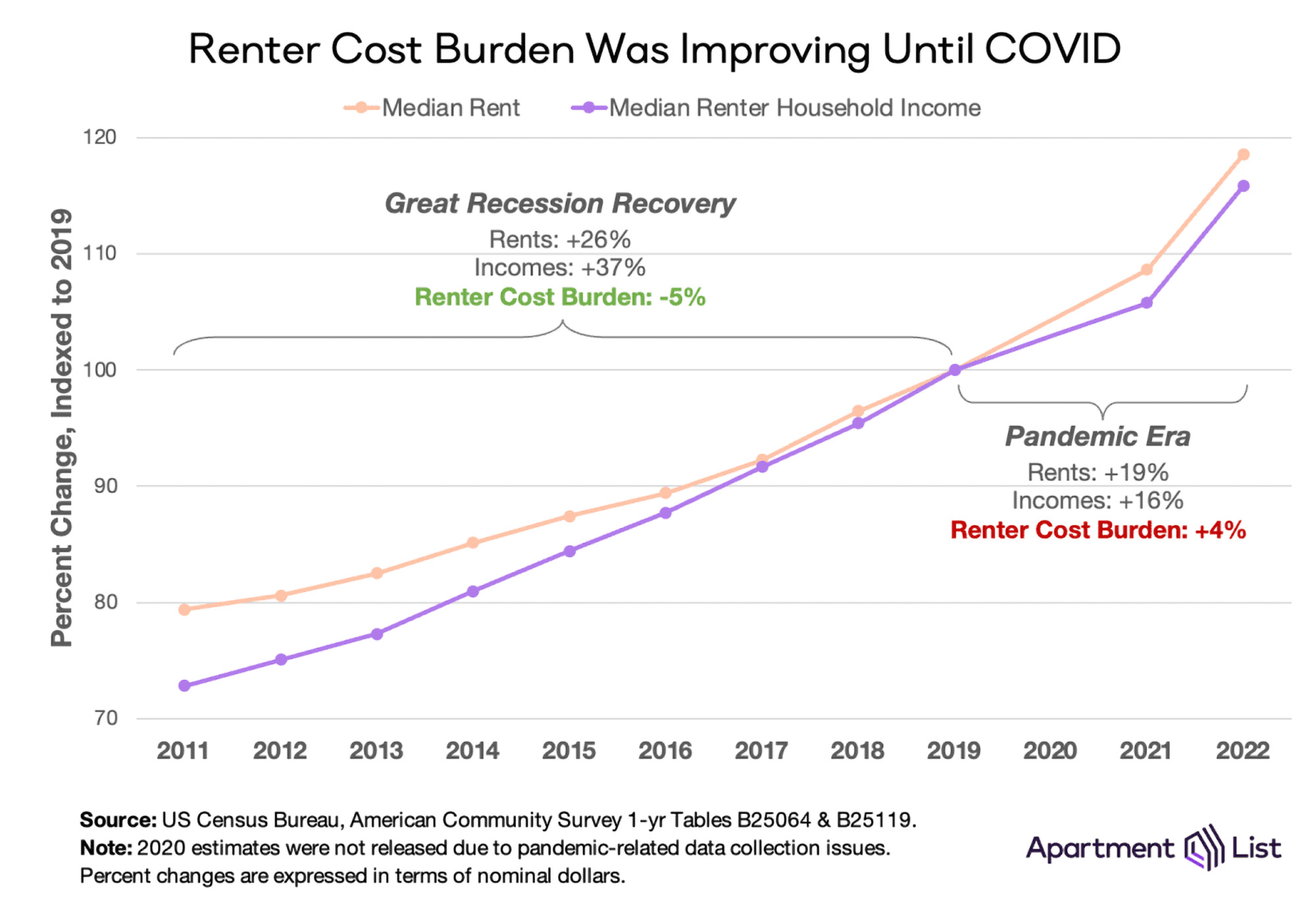

3. The cost burden is driven by rent prices rising faster than household incomes

After the Great Recession, renter cost burden improved gradually for several years. While the median rent rose 26 percent, the median renter household income increased 37 percent in the same eight years.

Since 2019, renter cost burden has increased 4% and median rent jumped up 19 percent, while renter income rose only 16 percent. According to the Apartment List analysis, 74 of the 100 largest U.S. metros have experienced rent prices growing faster than renter income. Since 2019, the cost burden has worsened in nearly all (94%) of the top metros.

Future outlook from Apartment List

"Preliminary data from the Bureau of Labor Statistics shows that incomes in the second quarter of 2023 are up 5.7% year-over-year (1.7% after adjusting for inflation). And while these statistics are not available for renters specifically, other breakdowns show that recent wage growth is higher for lower-earners and non-white workers, who are both more likely to rent.

However, rent growth may also continue on an upward trajectory. For more than half of all renter households, monthly rent payments are eating up a large enough share of their income to put financial stability at risk. And more than one-in-four renter households spend more than half of their income on rent—a level which can often necessitate extreme measures such as overcrowding and cutting back on spending on other basic needs. Thankfully, policymakers have demonstrated an increased focus on this issue in recent years, but solutions are still urgently needed."

To read the full report, visit Apartment List

Related Stories

Market Data | Jul 20, 2020

Construction employment rises from May to June in 31 states, slips in 18

Recent data from Procore on jobsite workers’ hours indicates employment may have leveled off.

Market Data | Jul 20, 2020

6 must reads for the AEC industry today: July 20, 2020

Never waste a crisis and robotic parking systems help developers optimize parking amenities.

Market Data | Jul 17, 2020

7 must reads for the AEC industry today: July 17, 2020

Kennedy Middle School's new Administration/Family Center and Tips to make optimal use of salvaged materials.

Market Data | Jul 16, 2020

Final NEPA rule will make it easier to rebuild infrastructure, reinvigorate the economy, and continue protecting the environment

Administration’s final reforms to the federal environmental review process fix problems with prior process, maintain environmental rigor, and accelerate needed infrastructure improvements.

Market Data | Jul 16, 2020

5 must reads for the AEC industry today: July 16, 2020

1928 hotel reimagined as a new resiential and cultural hub and Walgreens plans hundreds of doctor's offices at its stores.

Market Data | Jul 10, 2020

5 must reads for the AEC industry today: July 10, 2020

The world's tallest hybrid timber tower and the Florida Gators have a new $65 million ballpark.

Market Data | Jul 9, 2020

6 must reads for the AEC industry today: July 9, 2020

The world's most sustainable furniture factory and what will construction look like when COVID-19 ends?

Market Data | Jul 8, 2020

North America’s construction output to fall by 6.5% in 2020, says GlobalData

Even though all construction activities have been allowed to continue in most parts of the US and Canada since the start of the COVID-19 pandemic, many projects in the bidding or final planning stages have been delayed or canceled.

Market Data | Jul 8, 2020

5 must reads for the AEC industry today: July 8, 2020

AEMSEN develops concept for sustainable urban living and nonresidential construction has recovered 56% of jobs lost since March.

Market Data | Jul 7, 2020

Nonresidential construction has recovered 56% of jobs lost since March employment report

Nonresidential construction employment added 74,700 jobs on net in June.