As the nation’s economy continues to improve, the number of Americans forming households in the U.S. has recovered to a more normal pace. Ironically, the multifamily engine that helped sustain the housing market under bleaker economic conditions has been sputtering a bit as things have gotten better.

That assessment comes from The State of the Nation’s Housing 2019, the annual tracking of the nation’s housing pulse conducted by the Harvard Joint Center for Housing Studies. As has been the case in past reports, this year’s survey found persistent disparities in supply and demand, especially in affordable housing stock. Home values varied widely, too: they were more than five times greater than incomes in roughly one in seven metro areas (primarily on the West Coast), compared with less than three times in about one in three metros (primarily in the Midwest and South).

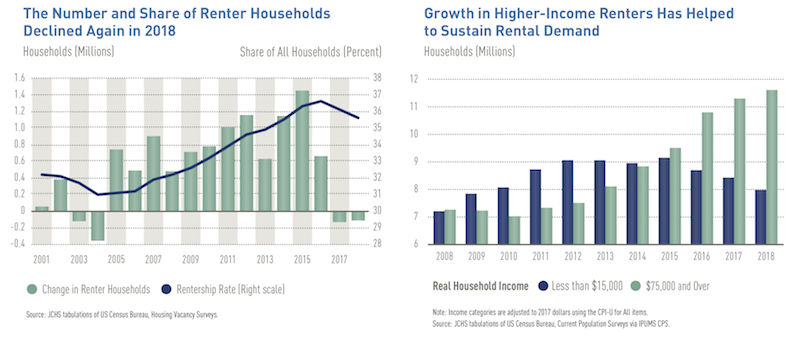

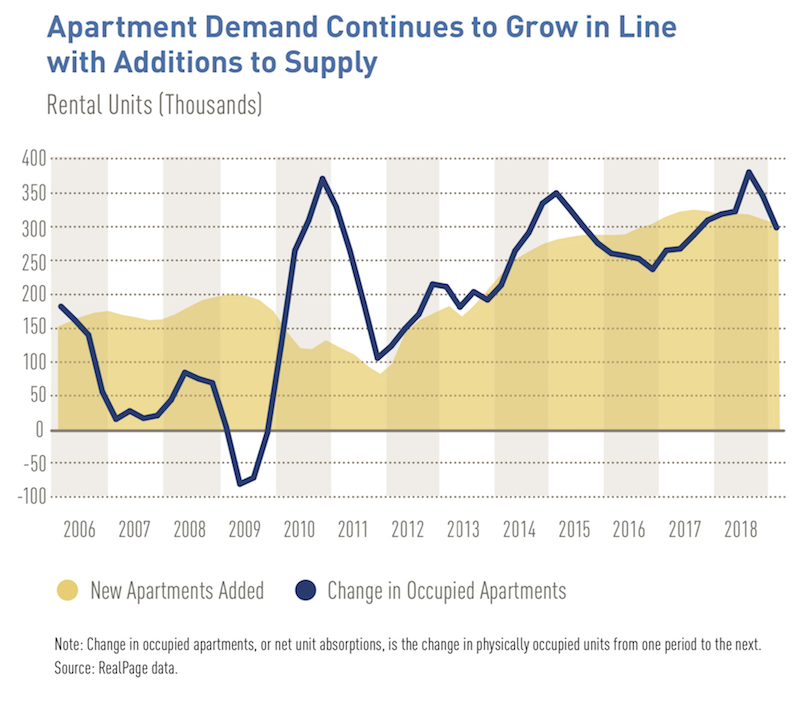

On the renter side (which is predominantly multifamily), households fell for the second consecutive year in 2018, a stark contrast to the increases of the 12 preceding years. Despite that decline, rents are rising at twice the rate of overall inflation.

“The growing presence of higher-income renters has helped keep rental markets stable,” says Daniel McCue, a senior research associate at the Joint Center. “This has maintained demand for new apartments, even as overall rental demand has waned.” At the lower end of the market, the number of units renting for under $800 per month fell by one million in 2017, bringing the total loss from 2011–2017 to four million.

Looking forward, the report authors expect rental growth to be solid, with 400,000 additional renter households per year expected between 2018 and 2028. Whether these projections come to pass depends on a number of factors, including economic conditions, housing affordability, and the pace of foreign immigration.

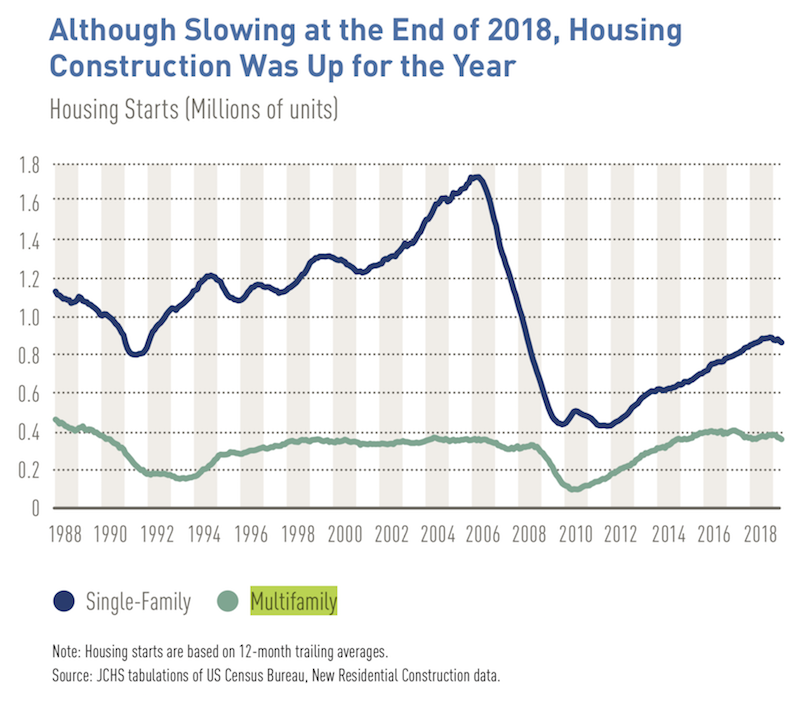

Construction rebounds

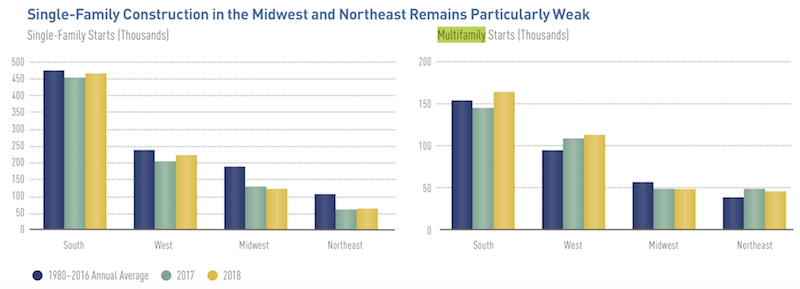

Multifamily construction starts last year picked up after two years of decline, rising 5.6% to 374,100 units. With the exceptions of 2015 and 2016, multifamily construction was higher in 2018 than in any other year since 1988. However, given the previous two-year dip in starts and the lengthy construction process for larger apartment buildings, the number of multifamily completions fell 3.6% last year, to 344,700 units, the first annual decline since 2012.

Image: Harvard Joint Center for Housing Studies

Construction of multifamily condominiums and co-ops held at near post-recession lows last year, with completions of just 27,000 units. Moreover, many condos are even more expensive than single-family homes because of their locations, with a median asking price of $521,200 for units completed in 2017. At the same time, construction of townhomes (attached single-family units) rose significantly over the past year, up 8% to 108,000 units—nearly double the level in 2011. Again, though, the number of new townhomes was still well below levels in the early 2000s.

Nearly three-quarters of multifamily rental units completed in 2018 were in the South (43 percent) and West (29 percent), where median asking rents topped $1,500 per month.

Rents nationwide continued to climb in 2018, up 3.6% for the year, according to the Consumer Price Index. While this was a slight deceleration from 3.8% in 2017, rent growth picked up pace again in the first months of 2019. Year-over-year rent growth hit 3.8% in April, more than double the rate of inflation for other items.

RealPage data for multifamily apartments in 150 metros also show an acceleration, with nominal rent growth increasing from 2.6% in the first quarter of 2018 to 3.3% in the first quarter of 2019. Meanwhile, CoreLogic data indicate that rent growth for single-family leased units increased to 3.2% in January 2019, from 2.7% in January 2018.

Property values rise

With steady rent gains and low vacancy rates, net operating incomes for multifamily properties remained strong in 2018. The National Council of Real Estate Investment Fiduciaries reports that annualized growth of net operating income jumped from 3.4% in the first quarter of 2018 to 7.5% in the first quarter of 2019.

At the same time, National Apartment Association data show a 2.1% nominal rise in operating expenses and an 11.3% increase in capital expenditures. As a result, annualized returns on investment held steady at 5.9% in early 2019— well below the 10.4% average in 2013–2016 but still far outstripping overall inflation.

Image: Harvard Joint Center for Housing Studies

The ongoing rise in property prices has increased the cost of investing. The Freddie Mac Apartment Investment Market Index, measuring the relative value of multifamily investments, dropped 7.5% year-over-year at the end of 2018, indicating that growth in net operating incomes did not offset the rise in prices. Declines in all 13 metros covered by that index suggest that conditions are becoming less favorable for new multifamily investors.

Multifamily financing activity should remain stable this year, although credit conditions may tighten. A moderate net share of banks responding to the Federal Reserve’s Senior Loan Officer Opinion Survey reported tightening lending standards. At the same time, a small net share of respondents also noted weakening demand for multifamily lending.

Affordable rentals scarcer

The supply of low-rent housing continues to decline in metro markets across the country. In 2016–2017 alone, the stock of units renting for less than $800 fell by one million, or 4.9 percent. The number of units in this rent range has decreased every year since 2011, bringing the total net decline to four million. Just over three-quarters of all 383 metros with populations of at least 50,000 lost nearly 20% of their low-cost stocks on average in 2011–2017.

New construction has not made up for these declines. According to the Survey of Market Absorption, only 9% of apartments in unsubsidized multifamily buildings completed in the first quarter of 2018 had asking rents below $1,050, and only 4% rented for less than $850.

The National Multifamily Housing Council also notes that new construction has not even served the middle of the market, with the share of new apartments affordable to median-income renter households dropping to less than 3 percent annually over the last decade. The focus of new construction on higher-cost units has thus shifted the overall distribution of rents upward.

Image: Harvard Joint Center for Housing Studies

Demographics will drive demand

The Joint Center’s outlook is that the modest decline in the number of renter households over the last two years might deliver some short-term relief from rising rents. Thus far, however, any positive impact of the decline has been offset by the ongoing increase in higher-income renters, who drive a growing share of market activity, and by low vacancy rates, which are keeping overall conditions tight.

That being said, going forward demographic trends should support strong rental demand. The Joint Center estimates that renter household growth will total 4.2 million by 2028 if homeownership rates remain near their current levels.

And even if the homeownership rate rises by 1.6 percentage points over the decade, the high-end projection indicates that renter household growth will still total at least 2.1 million, given expected increases in the adult population. On the supply side, however, conditions at the lower end of the market will remain challenging, as millions of low-income households compete for an already insufficient number of affordable rental units.

Related Stories

| May 27, 2014

America's oldest federal public housing development gets a facelift

First opened in 1940, South Boston's Old Colony housing project had become a symbol of poor housing conditions. Now the revamped neighborhood serves as a national model for sustainable, affordable multifamily design.

| May 23, 2014

Big design, small package: AIA Chicago names 2014 Small Project Awards winners

Winning projects include an events center for Mies van der Rohe's landmark Farnsworth House and a new boathouse along the Chicago river.

| May 22, 2014

No time for a trip to Dubai? Team BlackSheep's drone flyover gives a bird's eye view [video]

Team BlackSheep—devotees of filmmaking with drones—has posted a fun video that takes viewers high over the city for spectacular vistas of a modern architectural showcase.

| May 22, 2014

NYC's High Line connects string of high-profile condo projects

The High Line, New York City's elevated park created from a conversion of rail lines, is the organizing principle for a series of luxury condo buildings designed by big names in architecture.

| May 20, 2014

Kinetic Architecture: New book explores innovations in active façades

The book, co-authored by Arup's Russell Fortmeyer, illustrates the various ways architects, consultants, and engineers approach energy and comfort by manipulating air, water, and light through the layers of passive and active building envelope systems.

| May 20, 2014

World's best new skyscrapers: Renzo Piano's The Shard, China's 'doughnut hotel' voted to Emporis list

Eight other high-rise projects were named Emporis Skyscraper Award winners, including DC Tower 1 by Dominique Perrault Architecture and Tour Carpe Diem by Robert A.M. Stern.

| May 16, 2014

BoA, USGBC to offer $25,000 grants for green affordable housing projects

The Affordable Green Neighborhoods Grant Program will offer 14 grants to developers of affordable housing in North America who are committed to building sustainable communities through the LEED for Neighborhood Development program.

| May 13, 2014

19 industry groups team to promote resilient planning and building materials

The industry associations, with more than 700,000 members generating almost $1 trillion in GDP, have issued a joint statement on resilience, pushing design and building solutions for disaster mitigation.

| May 12, 2014

The best of affordable housing: 4 projects honored with 2014 AIA/HUD Secretary Awards [slideshow]

The winners include two dramatic conversions of historic YMCA buildings into modern, affordable multifamily complexes.

| May 11, 2014

Final call for entries: 2014 Giants 300 survey

BD+C's 2014 Giants 300 survey forms are due Wednesday, May 21. Survey results will be published in our July 2014 issue. The annual Giants 300 Report ranks the top AEC firms in commercial construction, by revenue.