Having weathered the coronavirus pandemic somewhat better than the single-family home construction sector, new supply of multifamily housing delivered in 2021 is expected to increase by around 17% to 334,000 units, according to Yardi Matrix’s latest U.S. Outlook.

“Some 174,000 units were absorbed nationally through May, which puts 2021 on track to be among the hottest years since the 2008 recession,” states the report.

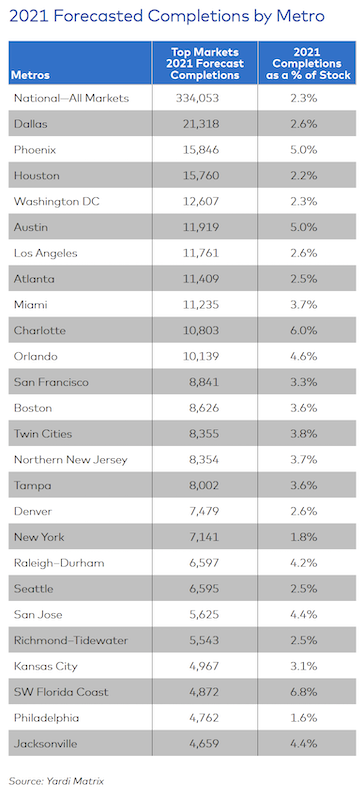

As of mid-year, some 863,500 multifamily units were under construction, representing 6% of the existing U.S. stock. That’s good and bad news, suggests Yardi Matrix, because such a large number of projects could impede the overall rent recovery in so-called “gateway” markets like Miami, whose forecasted deliveries are projected to equal 3.7% of its existing stock; Boston (3.6% of existing stock), San Francisco (3.3%), Los Angeles (2.6%), Washington D.C. (2.3%), New York (1.8%) and Chicago (1.3%).

“These new projects might have a difficult time leasing up, as there is already much supply in these metros with limited new demand, especially in the Lifestyle segment,” states the report.

The leaders in multifamily completions over the past 12 months include Austin (4.4% of total stock), Charlotte (4.3%), Minneapolis-St. Paul (3.7%) and Raleigh (3.6%). Yardi Matrix points out that among these four metros, Charlotte has been the only one able to sustain strong rent growth and deliveries simultaneously. Still, rents in all four metros have picked up in recent months, driven by a surge in migration and demand for apartments.

Yardi Matrix foresees Dallas leading the country in multifamily completions this year. Image: Yardi Matrix

SMALLER MARKETS, BIGGER DEMAND

Yardi Matrix looked at 136 markets, and found robust growth in tertiary metros like Northwest Arkansas (home to Walmart’s headquarters city of Bentonville) that led the list with 8.8% of its stock expected to be delivered this year from new construction. Next were Wilmington, N.C. (with 7% of its stock expected to be delivered), and the Southwest Florida Coast (6.8%). These metros had limited existing multifamily housing stock to begin with.

Measured by sheer units, Dallas is forecast to have the highest number of completions in 2021 (21,318 units), followed by Phoenix, Houston, Washington DC, Austin, L.A., Atlanta, and Miami. Yardi Matrix believes that while Dallas, Phoenix, and Houston should have little trouble absorbing new deliveries, “Washington DC might struggle,” because demand is lagging in part due to remote work requirements or preferences, and out-migration.

Material price hikes are the “wild card” in prognostications about apartment development, says Yardi Matrix. The extreme volatility of lumber prices over the past several months, coupled with increases in the cost of other building materials, could slow new starts and force developers “to choose between raising rents and reducing profit margins.”

RENTS RISING AT UNSUSTAINABLE RATES

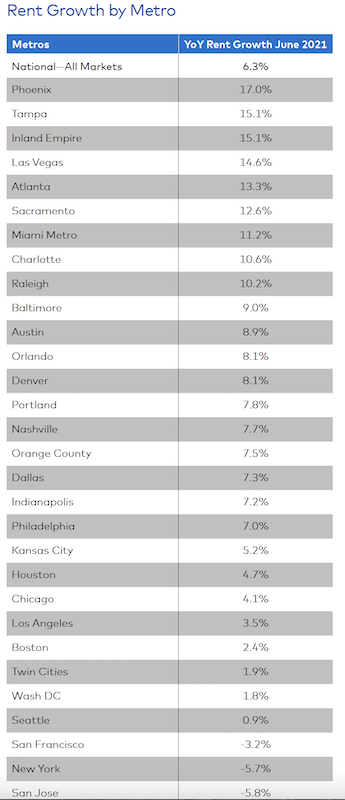

Through the first six months of 2021, national asking rents rose 5.8%. Yardi Matrix estimates that year-over-year asking rent growth, as of June, stood at 6.3%, “well above the [country’s] pre-pandemic performance.” Rent inflation is even more pronounced in tech hubs and tertiary metros, and asking rent growth in the Southwest and Southeast has been at levels “not seen in decades.”

While this escalation for multifamily units probably isn’t sustainable, Yardi Matrix expects conditions for above-average rent growth to persist in many metros “for months.” The report points out that rents are driven by “buoyant” demand. In the 12 months through May, 378,000 multifamily units were absorbed nationwide. The top markets for absorption as a percentage of total inventories were Miami (8,500 units, or 2.7% of stock), Charlotte (4,500, 2.4%) and Orlando (4,900, 2.1%).

Through June of this year, rent growth in Phoenix was nearly three times the national average. And despite its year-to-year rent decline, New York bounced back in the first half of 2021. Image: Yardi Matrix

By units, Chicago topped the list with almost 7,800 multifamily units absorbed, or 2.2 % of the Windy City’s stock. And for all the talk about New Yorkers evacuating in droves during the pandemic, rents actually rose by 6% during the first half of this year, and more companies are now requiring employees to return to office work. Rent recoveries through the first half of 2021 were also in “full swing” in Chicago (up 6.5%), Miami (6.4%), Boston (5%), Los Angeles (4%) and D.C. (3.3%).

Yardi Matrix’s report offers an economic outlook that foresees a flat labor participation market, and questions about rising inflation. Economic volatility “is likely to continue” globally until markets get a handle on controlling their virus outbreaks. “However, that does not mean there won’t be strong economic growth in certain sectors and geographies in the short term,” the report states.

Related Stories

Adaptive Reuse | Jul 10, 2023

California updates building code for adaptive reuse of office, retail structures for housing

The California Building Standards Commission recently voted to make it easier to convert commercial properties to residential use. The commission adopted provisions of the International Existing Building Code (IEBC) that allow developers more flexibility for adaptive reuse of retail and office structures.

Mixed-Use | Jun 29, 2023

Massive work-live-play development opens in LA's new Cumulus District

VOX at Cumulus, a 14-acre work-live-play development in Los Angeles, offers 910 housing units and 100,000 sf of retail space anchored by a Whole Foods outlet. VOX, one of the largest mixed-use communities to open in the Los Angeles area, features apartments and townhomes with more than one dozen floorplans.

Multifamily Housing | Jun 29, 2023

5 ways to rethink the future of multifamily development and design

The Gensler Research Institute’s investigation into the residential experience indicates a need for fresh perspectives on residential design and development, challenging norms, and raising the bar.

Office Buildings | Jun 28, 2023

When office-to-residential conversion works

The cost and design challenges involved with office-to-residential conversions can be daunting; designers need to devise creative uses to fully utilize the space.

Multifamily Housing | Jun 28, 2023

Sutton Tower, an 80-story multifamily development, completes construction in Manhattan’s Midtown East

In Manhattan’s Midtown East, the construction of Sutton Tower, an 80-story residential building, has been completed. Located in the Sutton Place neighborhood, the tower offers 120 for-sale residences, with the first move-ins scheduled for this summer. The project was designed by Thomas Juul-Hansen and developed by Gamma Real Estate and JVP Management. Lendlease, the general contractor, started construction in 2018.

Affordable Housing | Jun 27, 2023

Racial bias concerns prompt lawmakers to ask HUD to ban biometric surveillance, including facial recognition

Two members of the U.S. House of Representative have asked the Department of Housing and Urban Development to end the use of biometric technology, including facial recognition, for surveillance purposes in public housing.

Apartments | Jun 27, 2023

Average U.S. apartment rent reached all-time high in May, at $1,716

Multifamily rents continued to increase through the first half of 2023, despite challenges for the sector and continuing economic uncertainty. But job growth has remained robust and new households keep forming, creating apartment demand and ongoing rent growth. The average U.S. apartment rent reached an all-time high of $1,716 in May.

Apartments | Jun 27, 2023

Dallas high-rise multifamily tower is first in state to receive WELL Gold certification

HALL Arts Residences, 28-story luxury residential high-rise in the Dallas Arts District, recently became the first high-rise multifamily tower in Texas to receive WELL Gold Certification, a designation issued by the International WELL Building Institute. The HKS-designed condominium tower was designed with numerous wellness details.

Multifamily Housing | Jun 19, 2023

Adaptive reuse: 5 benefits of office-to-residential conversions

FitzGerald completed renovations on Millennium on LaSalle, a 14-story building in the heart of Chicago’s Loop. Originally built in 1902, the former office building now comprises 211 apartment units and marks LaSalle Street’s first complete office-to-residential conversion.