Having weathered the coronavirus pandemic somewhat better than the single-family home construction sector, new supply of multifamily housing delivered in 2021 is expected to increase by around 17% to 334,000 units, according to Yardi Matrix’s latest U.S. Outlook.

“Some 174,000 units were absorbed nationally through May, which puts 2021 on track to be among the hottest years since the 2008 recession,” states the report.

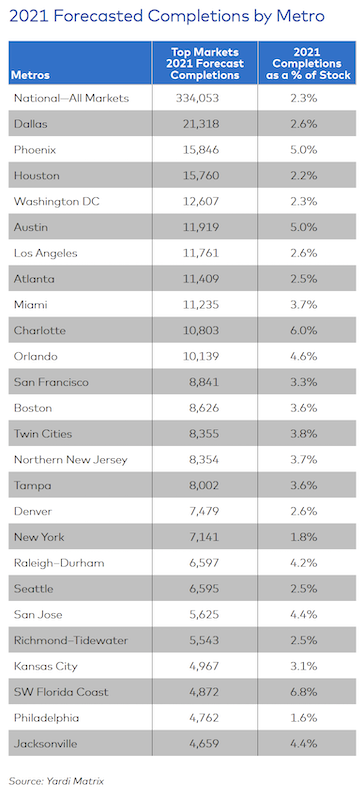

As of mid-year, some 863,500 multifamily units were under construction, representing 6% of the existing U.S. stock. That’s good and bad news, suggests Yardi Matrix, because such a large number of projects could impede the overall rent recovery in so-called “gateway” markets like Miami, whose forecasted deliveries are projected to equal 3.7% of its existing stock; Boston (3.6% of existing stock), San Francisco (3.3%), Los Angeles (2.6%), Washington D.C. (2.3%), New York (1.8%) and Chicago (1.3%).

“These new projects might have a difficult time leasing up, as there is already much supply in these metros with limited new demand, especially in the Lifestyle segment,” states the report.

The leaders in multifamily completions over the past 12 months include Austin (4.4% of total stock), Charlotte (4.3%), Minneapolis-St. Paul (3.7%) and Raleigh (3.6%). Yardi Matrix points out that among these four metros, Charlotte has been the only one able to sustain strong rent growth and deliveries simultaneously. Still, rents in all four metros have picked up in recent months, driven by a surge in migration and demand for apartments.

Yardi Matrix foresees Dallas leading the country in multifamily completions this year. Image: Yardi Matrix

SMALLER MARKETS, BIGGER DEMAND

Yardi Matrix looked at 136 markets, and found robust growth in tertiary metros like Northwest Arkansas (home to Walmart’s headquarters city of Bentonville) that led the list with 8.8% of its stock expected to be delivered this year from new construction. Next were Wilmington, N.C. (with 7% of its stock expected to be delivered), and the Southwest Florida Coast (6.8%). These metros had limited existing multifamily housing stock to begin with.

Measured by sheer units, Dallas is forecast to have the highest number of completions in 2021 (21,318 units), followed by Phoenix, Houston, Washington DC, Austin, L.A., Atlanta, and Miami. Yardi Matrix believes that while Dallas, Phoenix, and Houston should have little trouble absorbing new deliveries, “Washington DC might struggle,” because demand is lagging in part due to remote work requirements or preferences, and out-migration.

Material price hikes are the “wild card” in prognostications about apartment development, says Yardi Matrix. The extreme volatility of lumber prices over the past several months, coupled with increases in the cost of other building materials, could slow new starts and force developers “to choose between raising rents and reducing profit margins.”

RENTS RISING AT UNSUSTAINABLE RATES

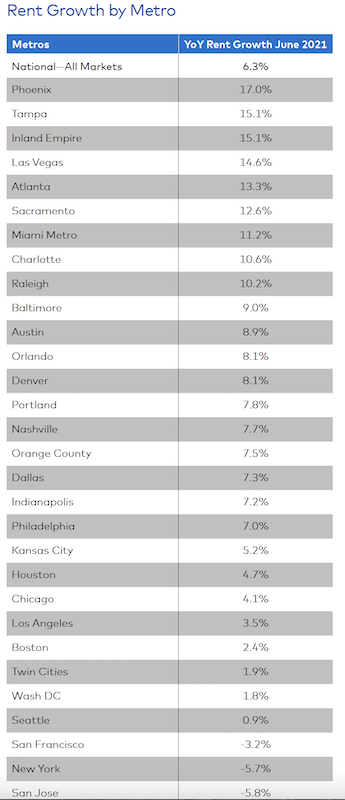

Through the first six months of 2021, national asking rents rose 5.8%. Yardi Matrix estimates that year-over-year asking rent growth, as of June, stood at 6.3%, “well above the [country’s] pre-pandemic performance.” Rent inflation is even more pronounced in tech hubs and tertiary metros, and asking rent growth in the Southwest and Southeast has been at levels “not seen in decades.”

While this escalation for multifamily units probably isn’t sustainable, Yardi Matrix expects conditions for above-average rent growth to persist in many metros “for months.” The report points out that rents are driven by “buoyant” demand. In the 12 months through May, 378,000 multifamily units were absorbed nationwide. The top markets for absorption as a percentage of total inventories were Miami (8,500 units, or 2.7% of stock), Charlotte (4,500, 2.4%) and Orlando (4,900, 2.1%).

Through June of this year, rent growth in Phoenix was nearly three times the national average. And despite its year-to-year rent decline, New York bounced back in the first half of 2021. Image: Yardi Matrix

By units, Chicago topped the list with almost 7,800 multifamily units absorbed, or 2.2 % of the Windy City’s stock. And for all the talk about New Yorkers evacuating in droves during the pandemic, rents actually rose by 6% during the first half of this year, and more companies are now requiring employees to return to office work. Rent recoveries through the first half of 2021 were also in “full swing” in Chicago (up 6.5%), Miami (6.4%), Boston (5%), Los Angeles (4%) and D.C. (3.3%).

Yardi Matrix’s report offers an economic outlook that foresees a flat labor participation market, and questions about rising inflation. Economic volatility “is likely to continue” globally until markets get a handle on controlling their virus outbreaks. “However, that does not mean there won’t be strong economic growth in certain sectors and geographies in the short term,” the report states.

Related Stories

Multifamily Housing | Oct 22, 2020

The Weekly show: Universal design in multifamily housing, reimagining urban spaces, back to campus trends

BD+C editors speak with experts from KTGY Architecture + Planning, LS3P, and Omgivning on the October 22 episode of "The Weekly." The episode is available for viewing on demand.

Multifamily Housing | Oct 20, 2020

New multifamily complex completes in Austin

Charlan Brock Associates and Britt Design Group designed the project.

Multifamily Housing | Oct 15, 2020

Miami’s yacht-inspired UNA Residences begins construction

AS+GG designed the tower.

Multifamily Housing | Oct 15, 2020

L.A., all the way

KFA Architecture has hitched its wagon to Los Angeles’s star for more than 40 years.

Multifamily Housing | Oct 2, 2020

Everyone's getting a fire pit!

Skeleton fire pit in Chicago, October 2020

Coronavirus | Oct 2, 2020

With revenues drying up, colleges reexamine their student housing projects

Shifts to online learning raise questions about the value of campus residence life.

Multifamily Housing | Oct 1, 2020

Glass railings installed at 300-unit rental complex in Columbus, Ohio

Vision Communities chose Viewrail railings for the main entrance of The Ave, a 300-unit rental enterprise in Columbus, Ohio.

Multifamily Housing | Sep 29, 2020

Washington, D.C.’s first modular apartment building breaks ground

Eric Colbert & Associates designed the building.

Multifamily Housing | Sep 22, 2020

AIA/HUD Secretary's Awards celebrate affordable, accessible, and well-designed housing

Each year, the AIA and HUD partner to celebrate projects that demonstrate affordable, accessible and well-designed housing, proving that good design is not exclusive.

Multifamily Housing | Sep 16, 2020

8 (more) noteworthy multifamily projects to debut in 2020

An office-to-apartment conversion in Clearwater, Fla., and a modular affordable housing community in Portland, Ore., highlight the latest multifamily developments to open this year.