According to Lodging Econometrics’ (LE) most recent construction pipeline trend report, at the close of the second quarter, the top five markets with the largest hotel construction pipelines are New York City, with 146 projects/25,232 rooms; Los Angeles with 135 projects/22,586 rooms; Dallas with 132 projects/16,183 rooms; Atlanta with 129 projects/17,845 rooms; and Nashville with 91 projects/12,703 rooms.

The five top markets with the most projects currently under construction are New York City with 111 projects/19,582 rooms, Atlanta with 39 projects/5,795 rooms, Los Angeles with 34 projects/5,771 rooms, Dallas with 30 projects/4,173 rooms, and Austin with 29 projects/3,768 rooms. These five markets collectively account for nearly 25% of the total number of rooms currently under construction in the U.S.

According to LE’s research, many hotel owners, developers, and management groups have used the operational downtime, caused by COVID-19’s impact on operating performance, as an opportunity to upgrade and renovate their hotels and/or redefine their hotels with a brand conversion. In the second quarter of 2021, LE recorded a combined renovation and conversion total of 1,135 active projects with 176,445 rooms for the U.S. The markets with the largest combined number of renovations and conversions are New York with 25 projects/7,957 rooms, Houston with 24 projects/3,549 rooms, Los Angeles with 24 projects/3,423 rooms, Chicago with 20 projects/2,803 rooms, and Miami with 19 projects/2,305 rooms.

Despite previous, and in some cases, ongoing delays in the pipeline, and with the recent changes to travel restrictions and the summer travel season upon us, many developers are feeling more optimistic about the future of the lodging industry as new hotel announcements continue. In the second quarter of 2021, Memphis recorded the highest count of new projects announced into the pipeline with 8 projects/927 rooms. Austin followed with 7 projects/1,084 rooms, then Atlanta with 6 projects/658 rooms, Washington DC with 5 projects/1,554 rooms, and Miami with 5 projects/499 rooms.

Hotels forecast to open in 2021 are led by New York City with 59 projects/8,583 rooms for a 7.2% supply increase, followed by Orlando with 22 projects/ 3,555 rooms for a 2.6% supply increase, Nashville with 22 projects/2,938 rooms for a 5.7% supply increase, Atlanta with 22 projects/2,930 rooms for a 2.7% supply increase, and then Houston with 22 projects/2,470 rooms for a 2.7% supply increase.

In 2022, New York is forecast to, again, top the list of new hotel openings with 46 projects/7,934 rooms while at this time, Dallas is anticipated to lead in 2023 with 35 projects/4,013 rooms expected to open.

Related Stories

Market Data | Feb 20, 2019

Strong start to 2019 for architecture billings

“The government shutdown affected architecture firms, but doesn’t appear to have created a slowdown in the profession,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD, in the latest ABI report.

Market Data | Feb 19, 2019

ABC Construction Backlog Indicator steady in Q4 2018

CBI reached a record high of 9.9 months in the second quarter of 2018 and averaged about 9.1 months throughout all four quarters of last year.

Market Data | Feb 14, 2019

U.S. Green Building Council announces top 10 countries and regions for LEED green building

The list ranks countries and regions in terms of cumulative LEED-certified gross square meters as of December 31, 2018.

Market Data | Feb 13, 2019

Increasingly tech-enabled construction industry powers forward despite volatility

Construction industry momentum to carry through first half of 2019.

Market Data | Feb 4, 2019

U.S. Green Building Council announces annual Top 10 States for LEED Green Building in 2018

Illinois takes the top spot as USGBC defines the next generation of green building with LEED v4.1.

Market Data | Feb 4, 2019

Nonresidential construction spending dips in November

Total nonresidential spending stood at $751.5 billion on a seasonally adjusted annualized rate.

Market Data | Feb 1, 2019

The year-end U.S. hotel construction pipeline continues steady growth trend

Project counts in the early planning stage continue to rise reaching an all-time high of 1,723 projects/199,326 rooms.

Market Data | Feb 1, 2019

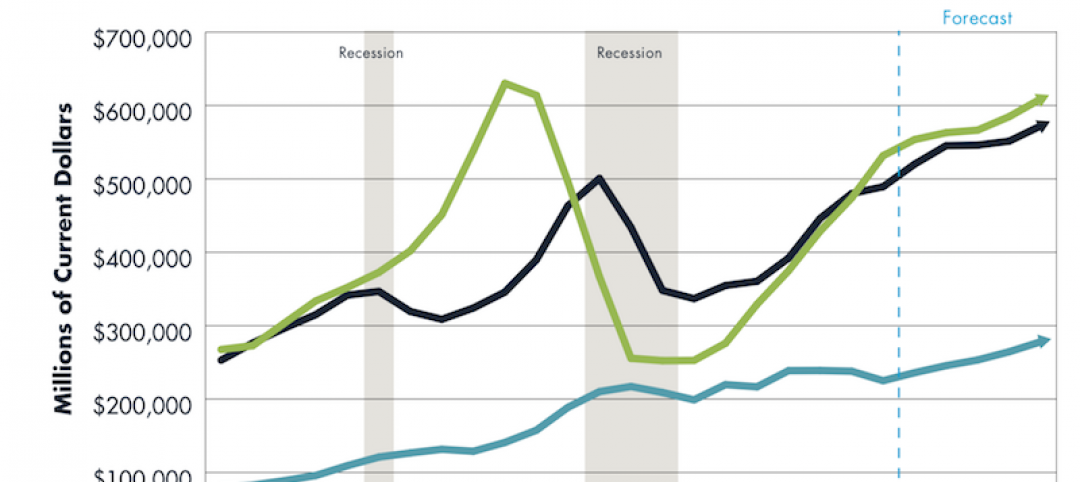

Construction spending is projected to increase by more than 11% through 2022

FMI’s annual outlook also expects the industry’s frantic M&A activity to be leavened by caution going forward.

Market Data | Jan 23, 2019

Architecture billings slow, but close 2018 with growing demand

AIA’s Architecture Billings Index (ABI) score for December was 50.4 compared to 54.7 in November.

Market Data | Jan 16, 2019

AIA 2019 Consensus Forecast: Nonresidential construction spending to rise 4.4%

The education, public safety, and office sectors will lead the growth areas this year, but AIA's Kermit Baker offers a cautious outlook for 2020.