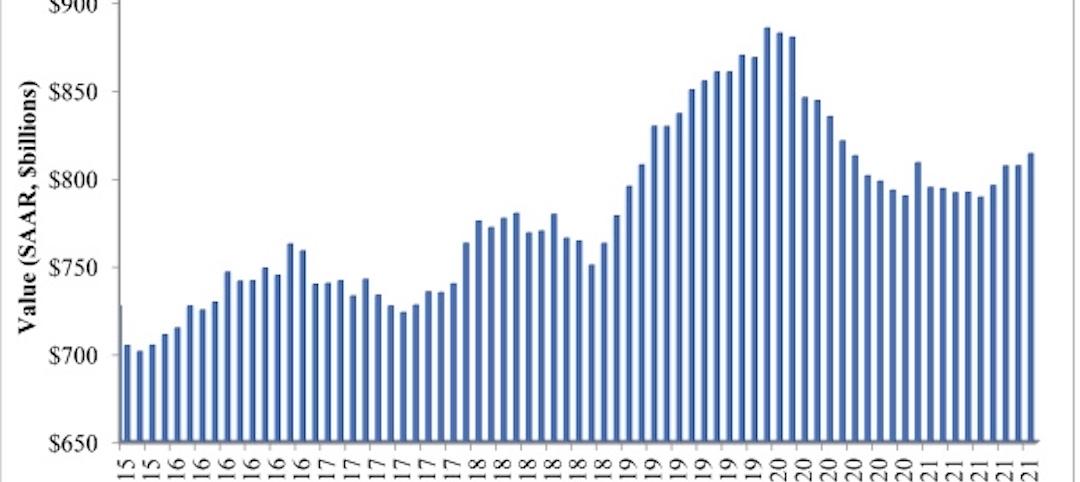

As a result of the partially shutdown economy, businesses and organizations will continue to be hesitant to invest in modernized or new facilities, according to a mid-year update to the American Institute of Architects’ (AIA) Consensus Construction Forecast. The trend ends an almost decade-long expansion in construction spending.

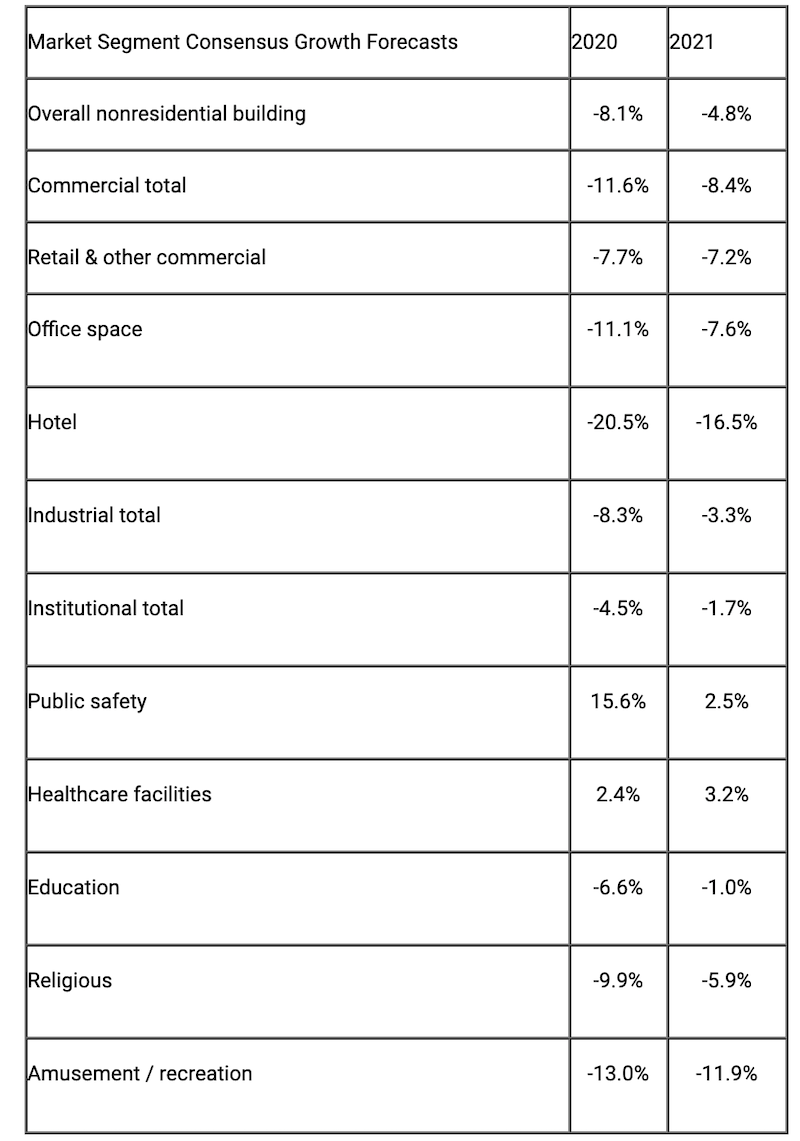

The AIA Consensus Construction Forecast Panel—consisting of leading economic forecasters—projects spending on nonresidential facilities will decline just over eight percent this year, and another five percent in 2021. The commercial building sector is expected to be the hardest hit, with spending projected to decline almost 12% this year and another eight percent in 2021. The industrial sector is slated to see declines of five percent this year and three percent next year. While institutional buildings will fare the best on the nonresidential side, spending on these facilities is projected to drop almost five percent this year, and another two percent next.

“As much of the economy was shut down in mid-March to help limit the spread of the pandemic, there was hope that after the initial steep decline in economic activity there could be an almost equally quick recovery,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “However, since mid-June economic growth has stalled. The timing coincides with a spike in new Covid-19 cases across the country, and the resulting pause or roll-back of reopening plans in many states.”

Complete details on the latest Consensus Construction Forecast can be found on AIA’s website.

Related Stories

Market Data | Jan 6, 2022

A new survey offers a snapshot of New York’s construction market

Anchin’s poll of 20 AEC clients finds a “growing optimism,” but also multiple pressure points.

Market Data | Jan 3, 2022

Construction spending in November increases from October and year ago

Construction spending in November totaled $1.63 trillion at a seasonally adjusted annual rate.

Market Data | Dec 22, 2021

Two out of three metro areas add construction jobs from November 2020 to November 2021

Construction employment increased in 237 or 66% of 358 metro areas over the last 12 months.

Market Data | Dec 17, 2021

Construction jobs exceed pre-pandemic level in 18 states and D.C.

Firms struggle to find qualified workers to keep up with demand.

Market Data | Dec 15, 2021

Widespread steep increases in materials costs in November outrun prices for construction projects

Construction officials say efforts to address supply chain challenges have been insufficient.

Market Data | Dec 15, 2021

Demand for design services continues to grow

Changing conditions could be on the horizon.

Market Data | Dec 5, 2021

Construction adds 31,000 jobs in November

Gains were in all segments, but the industry will need even more workers as demand accelerates.

Market Data | Dec 5, 2021

Construction spending rebounds in October

Growth in most public and private nonresidential types is offsetting the decline in residential work.

Market Data | Dec 5, 2021

Nonresidential construction spending increases nearly 1% in October

Spending was up on a monthly basis in 13 of the 16 nonresidential subcategories.

Market Data | Nov 30, 2021

Two-thirds of metro areas add construction jobs from October 2020 to October 2021

The pandemic and supply chain woes may limit gains.