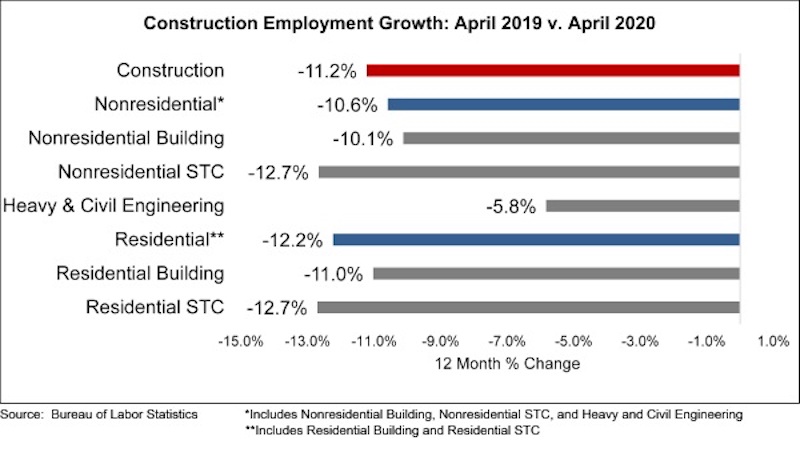

The construction industry lost 975,000 jobs on net in April, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. This was the largest recorded decrease in construction jobs since the government began tracking employment in 1939, despite construction remaining an essential industry in much of the nation through April.

Nonresidential construction employment lost 560,500 jobs on net in April. There were job losses in all three nonresidential segments, with the largest decline registered among nonresidential specialty trade contractors, which lost 393,100 jobs. Nonresidential building lost 88,500 jobs, while heavy and civil engineering lost 78,900 jobs.

The construction unemployment rate was 16.6% in April, up 11.9 percentage points from the same time last year. Unemployment across all industries rose from 4.4% in March to 14.7% last month. This was the highest rate since the BLS started tracking unemployment in 1948. Because of technical reasons related to the BLS survey and a classification error in several responses, the unemployment rate is probably closer to 20%.

“The hope had been that construction activity would hold up well given the industry’s classification as an essential industry in much of the nation and the presence of substantial backlog coming into the crisis, which stood at 8.2 months in February, according to ABC’s Construction Backlog Indicator,” said ABC Chief Economist Anirban Basu. “But alas, in large measure, those hopes were not realized. The level of construction industry job loss in April easily surpassed that of the worst month sustained during the Great Recession, when 155,000 jobs were lost in March 2009. Between April 2006 and January 2011, construction industry employment declined by 2.3 million. The construction industry lost nearly a million jobs last month alone.

“Based on a combination of business confidence indicators, initial unemployment claims and other emerging data, May will represent another month of crushing construction employment loss,” said Basu. “Project postponements and cancellations are now commonplace, with construction backlog failing to be the protective shield that it normally is during the early stages of economywide recession.”

Related Stories

Market Data | Feb 20, 2019

Strong start to 2019 for architecture billings

“The government shutdown affected architecture firms, but doesn’t appear to have created a slowdown in the profession,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD, in the latest ABI report.

Market Data | Feb 19, 2019

ABC Construction Backlog Indicator steady in Q4 2018

CBI reached a record high of 9.9 months in the second quarter of 2018 and averaged about 9.1 months throughout all four quarters of last year.

Market Data | Feb 14, 2019

U.S. Green Building Council announces top 10 countries and regions for LEED green building

The list ranks countries and regions in terms of cumulative LEED-certified gross square meters as of December 31, 2018.

Market Data | Feb 13, 2019

Increasingly tech-enabled construction industry powers forward despite volatility

Construction industry momentum to carry through first half of 2019.

Market Data | Feb 4, 2019

U.S. Green Building Council announces annual Top 10 States for LEED Green Building in 2018

Illinois takes the top spot as USGBC defines the next generation of green building with LEED v4.1.

Market Data | Feb 4, 2019

Nonresidential construction spending dips in November

Total nonresidential spending stood at $751.5 billion on a seasonally adjusted annualized rate.

Market Data | Feb 1, 2019

The year-end U.S. hotel construction pipeline continues steady growth trend

Project counts in the early planning stage continue to rise reaching an all-time high of 1,723 projects/199,326 rooms.

Market Data | Feb 1, 2019

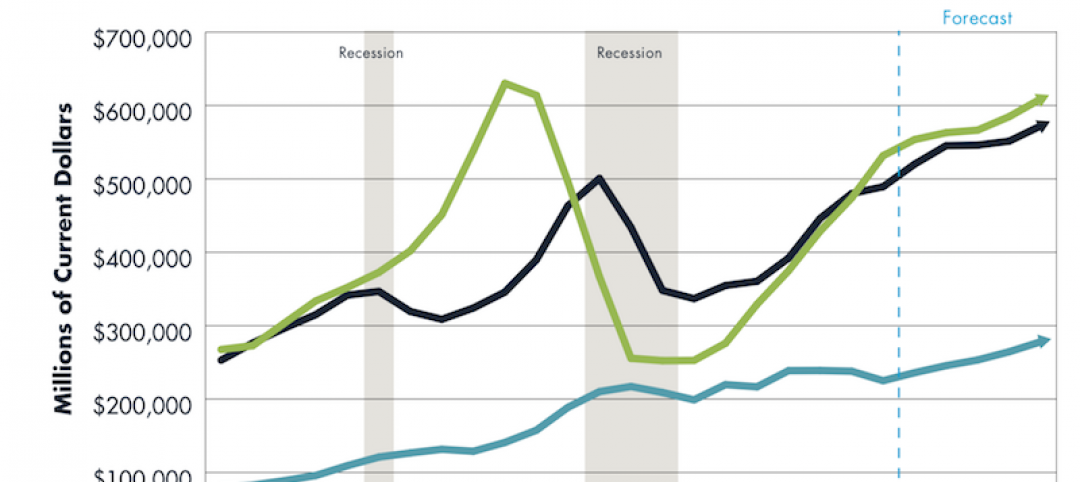

Construction spending is projected to increase by more than 11% through 2022

FMI’s annual outlook also expects the industry’s frantic M&A activity to be leavened by caution going forward.

Market Data | Jan 23, 2019

Architecture billings slow, but close 2018 with growing demand

AIA’s Architecture Billings Index (ABI) score for December was 50.4 compared to 54.7 in November.

Market Data | Jan 16, 2019

AIA 2019 Consensus Forecast: Nonresidential construction spending to rise 4.4%

The education, public safety, and office sectors will lead the growth areas this year, but AIA's Kermit Baker offers a cautious outlook for 2020.