Nonresidential construction spending in April declined for the fifth-straight month to a two-year low as demand waned for numerous public and private project categories in the face of lengthening production and delivery times for materials, along with fast-rising prices for many items, according to an analysis of new federal construction spending data by the Associated General Contractors of America. Officials with the association urged the President and Congress to boost infrastructure investments, remove tariffs on key materials and take steps to address production and deliver backups for key construction supplies.

“Both public and private nonresidential spending overall continued to shrink in April, despite a pickup in a few spending categories from March,” said Ken Simonson, the association’s chief economist. “Ever-growing delays and uncertainty regarding backlogs and delivery times for key materials, as well as shortages and record prices, are likely to make even more project owners hesitant to commit to new work.”

Construction spending in April totaled $1.52 trillion at a seasonally adjusted annual rate, an increase of 0.2% from the pace in March and 9.8% higher than the pandemic-depressed rate in April 2020. As has been true for the past several months, the year-over-year gain was limited to residential construction, Simonson noted. That segment climbed 1.0% for the month and 29.5% year-over-year. Meanwhile, combined private and public nonresidential spending declined 0.5% from March—the fifth consecutive monthly decrease—and 3.9% over 12 months, to the lowest annual rate since December 2018.

Private nonresidential construction spending fell 0.5% from March to April and 4.8% since April 2020, with year-over-year decreases in 10 out of 11 subsegments. The largest private nonresidential category, power construction, plunged 7.1% year-over-year and 1.8% from March to April. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—retreated 1.3% year-over-year despite a gain of 0.4% for the month. Manufacturing construction rose 0.6% from a year earlier and 0.4% from March. Office construction decreased 1.6 percent year-over-year but edged up 0.2 percent in April.

Public construction spending slipped 2.2% year-over-year and 0.6% for the month. Among the largest segments, highway and street construction declined 2.7% from a year earlier, although spending rose 0.6% for the month. Public educational construction decreased 4.0% year-over-year and 0.5% in April. Spending on transportation facilities fell1.9% over 12 months and 1.2% in April.

Association officials cautioned that a recent Commerce Department announcement that it intends to double the current tariff levels on Canadian lumber would further undermine nonresidential construction activity. They said the Biden administration should instead remove tariffs on lumber, steel and aluminum and work to ease production and shipping delays. Boosting infrastructure funding, which leaders of both parties have proposed, will also help, the construction officials added.

“The last thing construction workers need is for the Biden administration to double tariffs on lumber,” said Stephen E. Sandherr, the association’s chief executive officer. “Instead of making it even harder to build, the administration needs to ease supply backups, remove tariffs and pass a bipartisan infrastructure bill.”

Related Stories

Market Data | Mar 29, 2017

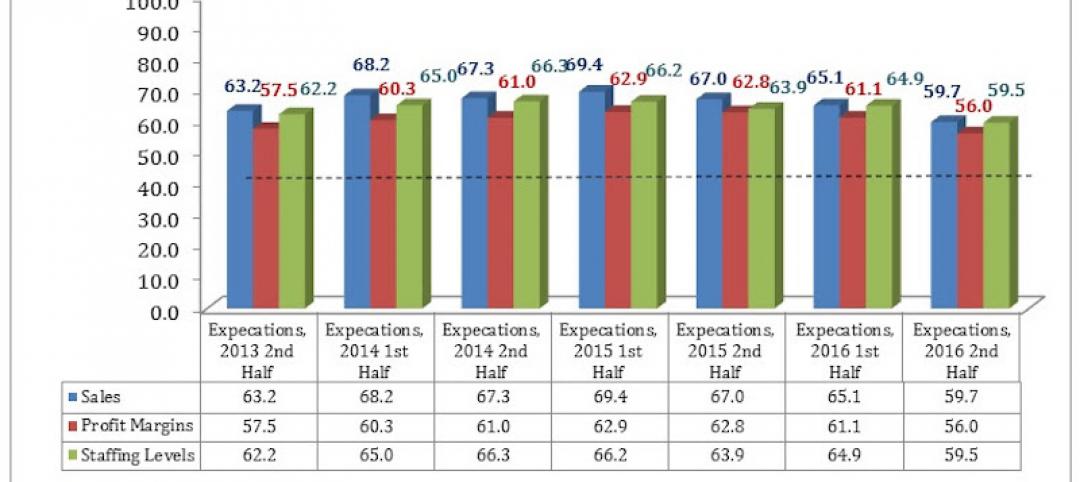

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.

Market Data | Mar 22, 2017

After a strong year, construction industry anxious about Washington’s proposed policy shifts

Impacts on labor and materials costs at issue, according to latest JLL report.

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.

Market Data | Feb 28, 2017

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.

Market Data | Feb 23, 2017

Entering 2017, architecture billings slip modestly

Despite minor slowdown in overall billings, commercial/ industrial and institutional sectors post strongest gains in over 12 months.

Market Data | Feb 16, 2017

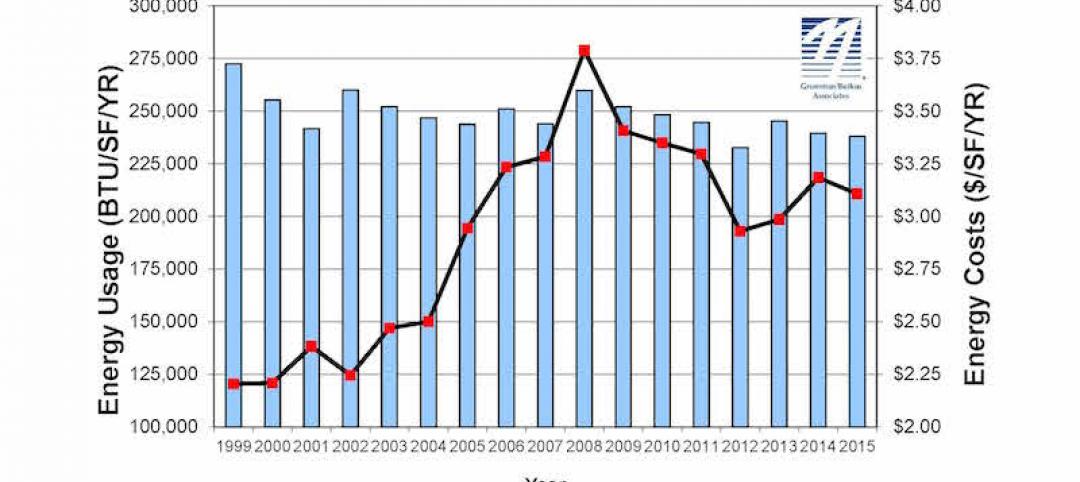

How does your hospital stack up? Grumman/Butkus Associates 2016 Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Feb 1, 2017

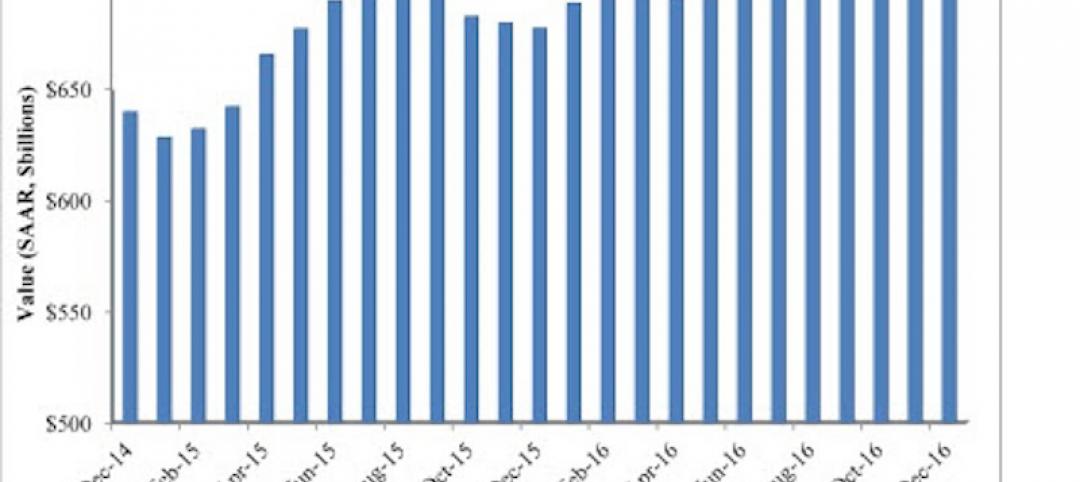

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.

Market Data | Jan 31, 2017

AIA foresees nonres building spending increasing, but at a slower pace than in 2016

Expects another double-digit growth year for office construction, but a more modest uptick for health-related building.