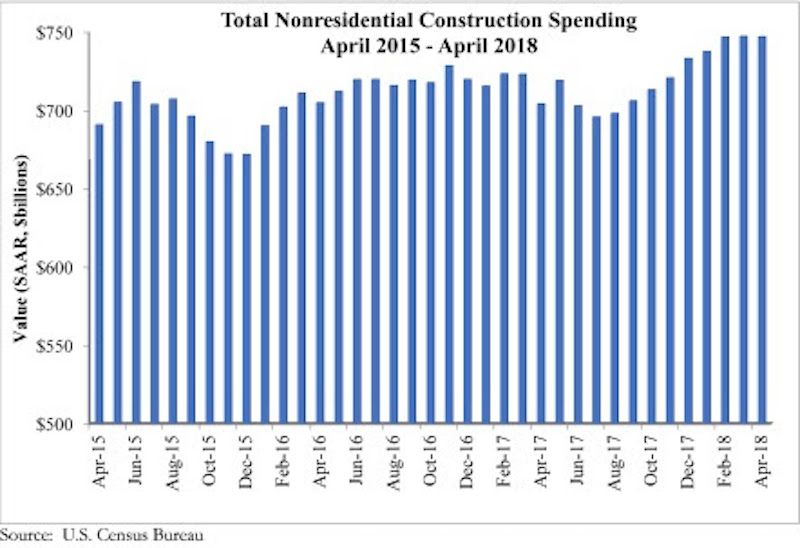

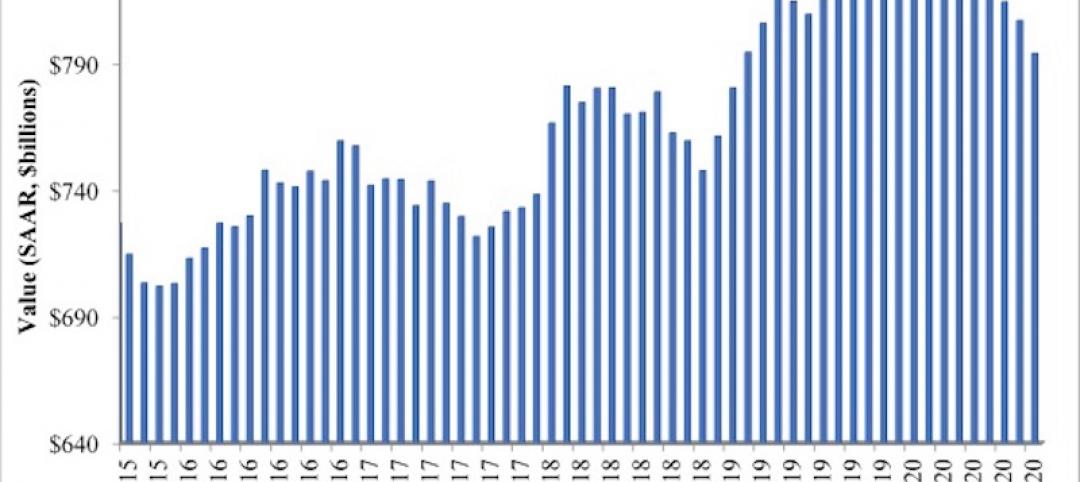

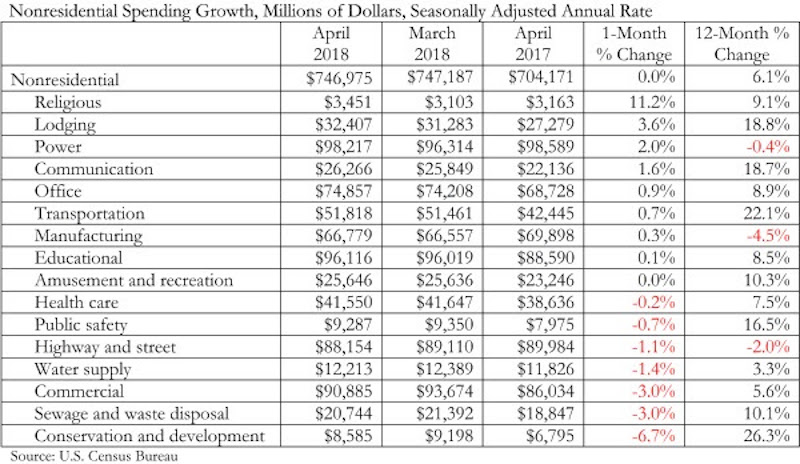

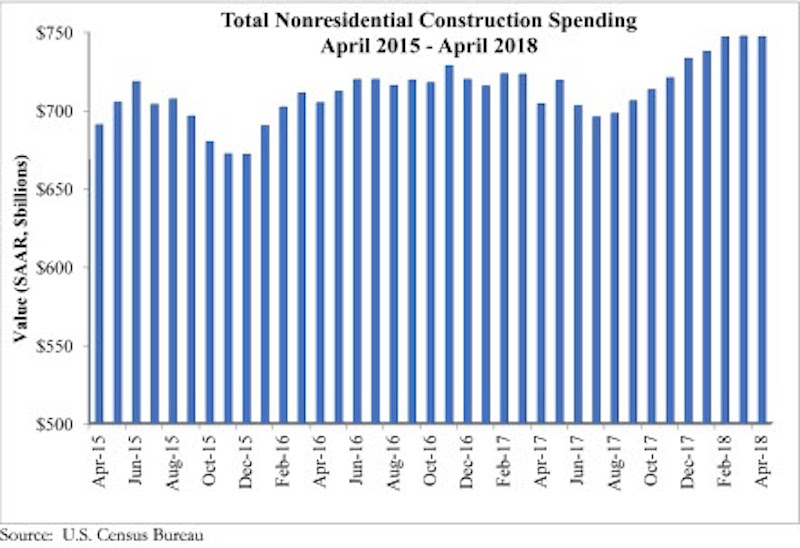

Nonresidential construction spending remained unchanged in April on a monthly basis, according to an Associated Builders and Contractors (ABC) analysis of U.S. Census Bureau data released today. However, year-over-year spending was up a sturdy 6.1%.

Private sector spending increased 0.8% on a monthly basis and is up 5.3% from a year ago. Public sector spending fell 1.4% in April, but is up 7.3% year over year.

“Between today’s employment and construction spending reports, it is clear that the economy continues to exhibit strong momentum and abundant confidence,” said ABC Chief Economist Anirban Basu. “It’s important to remember that the construction spending data generally have failed to display as much economic strength as many other indicators. Even the most recent monthly readings on construction spending were unspectacular, but the year-over-year numbers are consistent with ongoing economic and industry progress.

“Perhaps most encouraging is the growing strength of the public categories,” said Basu. “For many years, public construction spending languished even as private categories demonstrated growing vigor. With the dramatic improvement in state and local government finances in many communities in recent years, there is greater capacity to invest in infrastructure. Not coincidentally, construction spending in the transportation category rose 22% during the past year. Spending in the public safety category, which includes spending on police and fire stations, is up by nearly 17%.

“As always, there is a need to pay attention to any clouds forming on the horizon,” said Basu. “Inflationary pressures continue to build, with tariffs on steel and aluminum likely to accelerate construction materials price appreciation during the next several months. Interest rates are expected to head higher, though perhaps only in fits and starts. Wage pressures also continue to build. The implication is that the cost of financing construction projects is on the rise. Should those costs rise too quickly, the momentum presently observable in nonresidential construction spending and employment data could quickly dissipate.”

Related Stories

Market Data | Dec 2, 2020

Nonresidential construction spending remains flat in October

Residential construction expands as many commercial projects languish.

Market Data | Nov 30, 2020

New FEMA study projects implementing I-Codes could save $600 billion by 2060

International Code Council and FLASH celebrate the most comprehensive study conducted around hazard-resilient building codes to-date.

Market Data | Nov 23, 2020

Construction employment is down in three-fourths of states since February

This news comes even after 36 states added construction jobs in October.

Market Data | Nov 18, 2020

Architecture billings remained stalled in October

The pace of decline during October remained at about the same level as in September.

Market Data | Nov 17, 2020

Architects face data, culture gaps in fighting climate change

New study outlines how building product manufacturers can best support architects in climate action.

Market Data | Nov 10, 2020

Construction association ready to work with president-elect Biden to prepare significant new infrastructure and recovery measures

Incoming president and congress should focus on enacting measures to rebuild infrastructure and revive the economy.

Market Data | Nov 9, 2020

Construction sector adds 84,000 workers in October

A growing number of project cancellations risks undermining future industry job gains.

Market Data | Nov 4, 2020

Drop in nonresidential construction offsets most residential spending gains as growing number of contractors report cancelled projects

Association officials warn that demand for nonresidential construction will slide further without new federal relief measures.

Market Data | Nov 2, 2020

Nonresidential construction spending declines further in September

Among the sixteen nonresidential subcategories, thirteen were down on a monthly basis.

Market Data | Nov 2, 2020

A white paper assesses seniors’ access to livable communities

The Joint Center for Housing Studies and AARP’s Public Policy Institute connect livability with income, race, and housing costs.