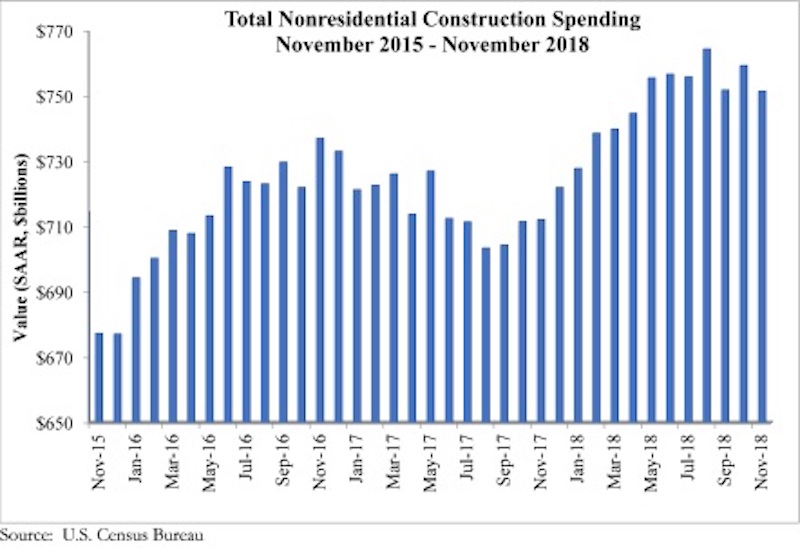

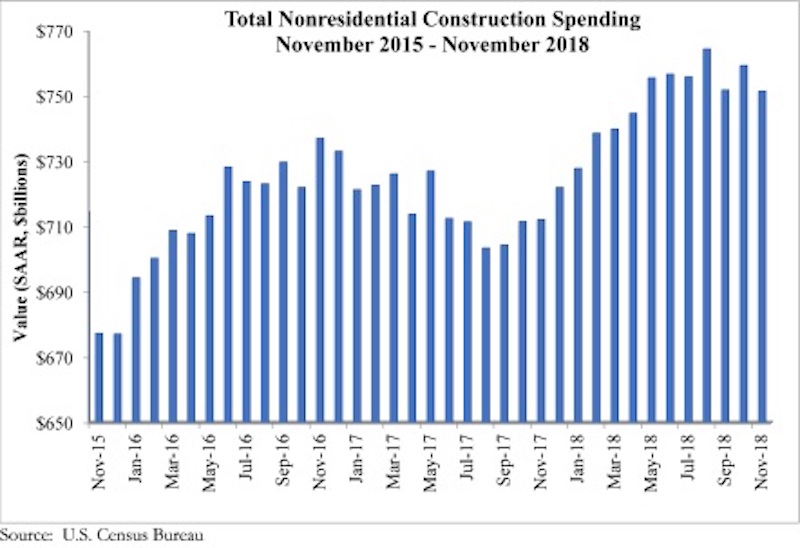

National nonresidential construction spending declined 1% in November, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data recently released. The release of November data, originally scheduled for Jan. 3, was delayed by the partial government shutdown.

Total nonresidential spending stood at $751.5 billion on a seasonally adjusted annualized rate, which represents a 5.5% increase over November 2017. However, 12 of the 16 nonresidential subsectors experienced monthly declines.

“One of the most interesting and surprising aspect of today’s release was evident of a dip in infrastructure spending, at least in certain categories,” said ABC Chief Economist Anirban Basu. “Spending on infrastructure was one of the key sources of nonresidential construction spending growth for much of last year, but declines in monthly construction spending were observed in the public safety, water supply and educational categories. This pattern is likely to prove temporary, given the healthier conditions of state and local government finances in much of the nation.

“The dip in November spending should not be viewed as a leading indicator of coming decline,” said Basu. “The government’s employment numbers indicate that contractors have continued to take on more staff, presumably because there is a growing amount of work to be done. While weather-related impacts are more severe at this time of year, rendering employment and other data more difficult to interpret, the U.S. economy still growing, and with more people working, that should ultimately translate into expanding nonresidential construction spending.

“However, there was a meaningful decline in spending in the commercial category,” said Basu. “Many brick and mortar retailers continue to struggle with the imposing presence of Amazon and other large-scale online sellers. This is translating into more store closings and probably fewer new stores being built. Still, the consumer segment of the economy remains strong, suggesting that other elements of the commercial segment, including fulfillment center and warehouse construction, will perform decently in 2019.”

Related Stories

Market Data | Nov 22, 2021

Only 16 states and D.C. added construction jobs since the pandemic began

Texas, Wyoming have worst job losses since February 2020, while Utah, South Dakota add the most.

Market Data | Nov 10, 2021

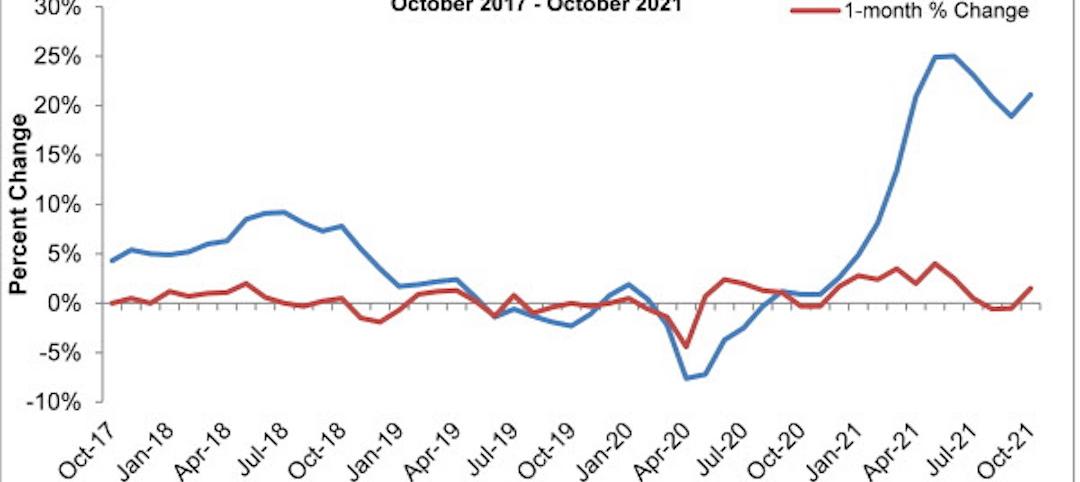

Construction input prices see largest monthly increase since June

Construction input prices are 21.1% higher than in October 2020.

Market Data | Nov 9, 2021

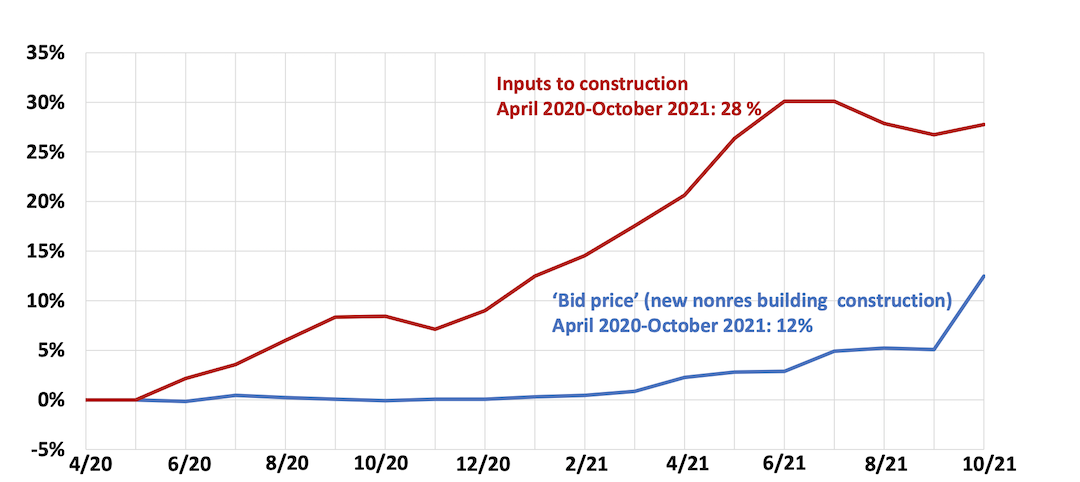

Continued increases in construction materials prices starting to drive up price of construction projects

Supply chain and labor woes continue.

Market Data | Nov 5, 2021

Construction firms add 44,000 jobs in October

Gain occurs even as firms struggle with supply chain challenges.

Market Data | Nov 3, 2021

One-fifth of metro areas lost construction jobs between September 2020 and 2021

Beaumont-Port Arthur, Texas and Sacramento--Roseville--Arden-Arcade Calif. top lists of gainers.

Market Data | Nov 2, 2021

Construction spending slumps in September

A drop in residential work projects adds to ongoing downturn in private and public nonresidential.

Hotel Facilities | Oct 28, 2021

Marriott leads with the largest U.S. hotel construction pipeline at Q3 2021 close

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S.

Hotel Facilities | Oct 28, 2021

At the end of Q3 2021, Dallas tops the U.S. hotel construction pipeline

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline.

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.