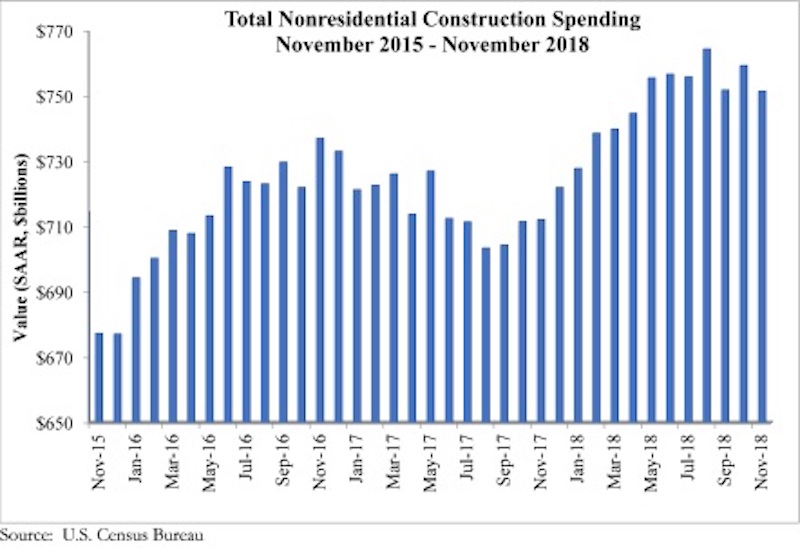

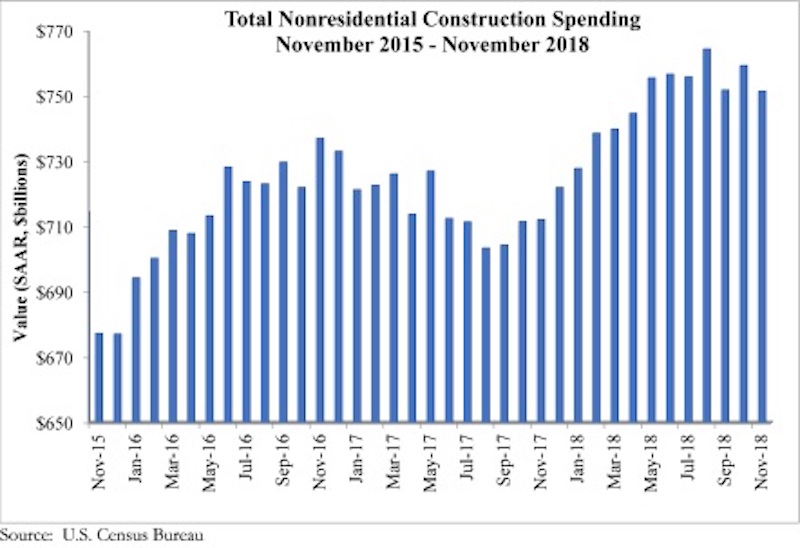

National nonresidential construction spending declined 1% in November, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data recently released. The release of November data, originally scheduled for Jan. 3, was delayed by the partial government shutdown.

Total nonresidential spending stood at $751.5 billion on a seasonally adjusted annualized rate, which represents a 5.5% increase over November 2017. However, 12 of the 16 nonresidential subsectors experienced monthly declines.

“One of the most interesting and surprising aspect of today’s release was evident of a dip in infrastructure spending, at least in certain categories,” said ABC Chief Economist Anirban Basu. “Spending on infrastructure was one of the key sources of nonresidential construction spending growth for much of last year, but declines in monthly construction spending were observed in the public safety, water supply and educational categories. This pattern is likely to prove temporary, given the healthier conditions of state and local government finances in much of the nation.

“The dip in November spending should not be viewed as a leading indicator of coming decline,” said Basu. “The government’s employment numbers indicate that contractors have continued to take on more staff, presumably because there is a growing amount of work to be done. While weather-related impacts are more severe at this time of year, rendering employment and other data more difficult to interpret, the U.S. economy still growing, and with more people working, that should ultimately translate into expanding nonresidential construction spending.

“However, there was a meaningful decline in spending in the commercial category,” said Basu. “Many brick and mortar retailers continue to struggle with the imposing presence of Amazon and other large-scale online sellers. This is translating into more store closings and probably fewer new stores being built. Still, the consumer segment of the economy remains strong, suggesting that other elements of the commercial segment, including fulfillment center and warehouse construction, will perform decently in 2019.”

Related Stories

Market Data | May 11, 2020

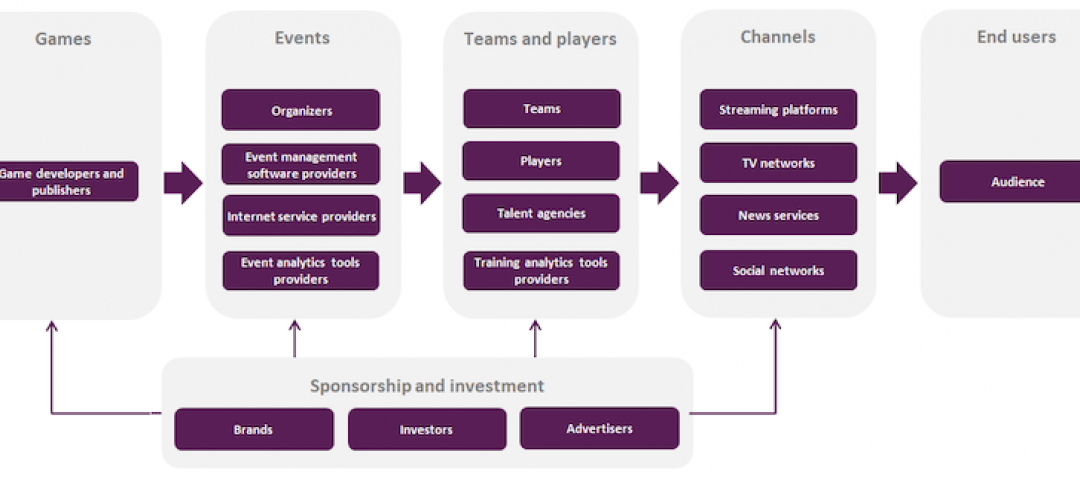

Interest in eSports is booming amid COVID-19

The industry has proved largely immune to the COVID-19 pandemic due to its prompt transition into online formats and sudden spike in interest from traditional sports organizations.

Market Data | May 11, 2020

6 must reads for the AEC industry today: May 11, 2020

Nashville residential tower will rise 416 feet and the construction industry loses 975,000 jobs.

Market Data | May 8, 2020

Construction industry loses 975,000 jobs in April as new association survey shows deteriorating demand for construction projects

Association partner Procore also releases near real-time construction data measuring impacts of coronavirus as association calls for new measures.

Market Data | May 8, 2020

7 must reads for the AEC industry today: May 8, 2020

The death of the office and Colorado's first multifamily project to receive WELL Precertification.

Market Data | May 7, 2020

5 must reads for the AEC industry today: May 7, 2020

5 memory care communities with a strong sense of mission and making jobsites safer in the COVID-19 world.

Market Data | May 6, 2020

6 must reads for the AEC industry today: May 6, 2020

5 questions engineers will ask after COVID-19 and coronavirus threatens push for denser housing.

Market Data | May 5, 2020

5 must reads for the AEC industry today: May 5, 2020

A new temporary hospital pops up in N.J., and apartment firms' reactivation plans begin to take shape.

Market Data | May 4, 2020

6 must reads for the AEC industry today: May 4, 2020

How working from home is influencing design and is this the end of the open office?

Market Data | May 4, 2020

The Los Angeles market continue to lead the U.S. hotel construction pipeline at the close of the first quarter of 2020

Nationally, under construction project counts hit a new all-time high with 1,819 projects with 243,100 rooms.

Market Data | May 1, 2020

Nonresidential construction spending declines in March as pandemic halts projects

Group warns loan threats are hurting relief program.