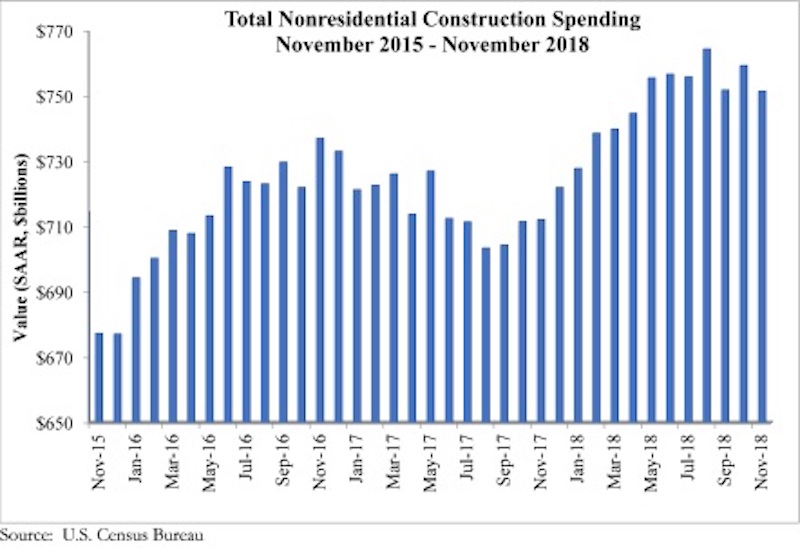

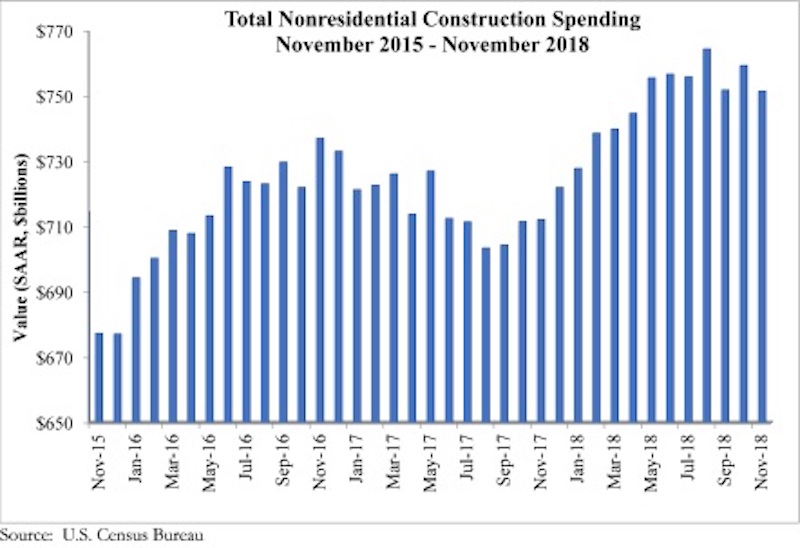

National nonresidential construction spending declined 1% in November, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data recently released. The release of November data, originally scheduled for Jan. 3, was delayed by the partial government shutdown.

Total nonresidential spending stood at $751.5 billion on a seasonally adjusted annualized rate, which represents a 5.5% increase over November 2017. However, 12 of the 16 nonresidential subsectors experienced monthly declines.

“One of the most interesting and surprising aspect of today’s release was evident of a dip in infrastructure spending, at least in certain categories,” said ABC Chief Economist Anirban Basu. “Spending on infrastructure was one of the key sources of nonresidential construction spending growth for much of last year, but declines in monthly construction spending were observed in the public safety, water supply and educational categories. This pattern is likely to prove temporary, given the healthier conditions of state and local government finances in much of the nation.

“The dip in November spending should not be viewed as a leading indicator of coming decline,” said Basu. “The government’s employment numbers indicate that contractors have continued to take on more staff, presumably because there is a growing amount of work to be done. While weather-related impacts are more severe at this time of year, rendering employment and other data more difficult to interpret, the U.S. economy still growing, and with more people working, that should ultimately translate into expanding nonresidential construction spending.

“However, there was a meaningful decline in spending in the commercial category,” said Basu. “Many brick and mortar retailers continue to struggle with the imposing presence of Amazon and other large-scale online sellers. This is translating into more store closings and probably fewer new stores being built. Still, the consumer segment of the economy remains strong, suggesting that other elements of the commercial segment, including fulfillment center and warehouse construction, will perform decently in 2019.”

Related Stories

Market Data | Feb 19, 2020

Architecture billings continue growth into 2020

Demand for design services increases across all building sectors.

Market Data | Feb 5, 2020

Construction employment increases in 211 out of 358 metro areas from December 2018 to 2019

Dallas-Plano-Irving, Texas and Kansas City have largest gains; New York City and Fairbanks, Alaska lag the most as labor shortages likely kept firms in many areas from adding even more workers.

Market Data | Feb 4, 2020

Construction spending dips in December as nonresidential losses offset housing pickup

Homebuilding strengthens but infrastructure and other nonresidential spending fades in recent months, reversing pattern in early 2019.

Market Data | Feb 4, 2020

IMEG Corp. acquires Clark Engineering

Founded in 1938 in Minneapolis, Clark Engineering has an extensive history of public and private project experience.

Market Data | Jan 30, 2020

U.S. economy expands 2.1% in 4th quarter

Investment in structures contracts.

Market Data | Jan 30, 2020

US construction & real estate industry sees a drop of 30.4% in deal activity in December 2019

A total of 48 deals worth $505.11m were announced in December 2019.

Market Data | Jan 29, 2020

Navigant research report finds global wind capacity value is expected to increase tenfold over the next decade

Wind power is being developed in more countries as well as offshore and onshore.

Market Data | Jan 28, 2020

What eight leading economists predict for nonresidential construction in 2020 and 2021

Public safety, education, and healthcare highlight a market that is entering growth-slowdown mode, but no downturn is projected, according to AIA's latest Consensus Construction Forecast panel.

Market Data | Jan 28, 2020

Los Angeles has the largest hotel construction pipeline in the United States

Los Angeles will have a growth rate of 2.5% with 19 new hotels/2,589 rooms opening.

Market Data | Jan 27, 2020

U.S. hotel construction pipeline finishes 2019 trending upward

Projects under construction continue to rise reaching an all-time high of 1,768 projects.