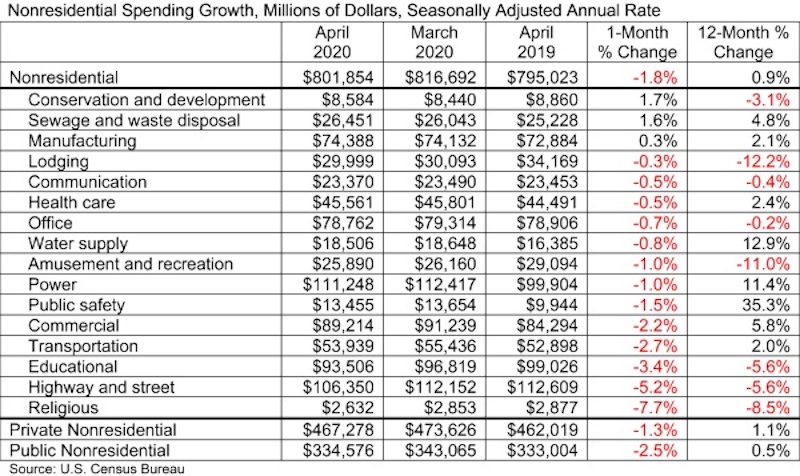

National nonresidential construction spending decreased by 1.8% in April, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, spending totaled $801.8 billion for the month, a 0.9% increase from April 2019.

Of the 16 subcategories, 13 were down on a monthly basis. Private nonresidential spending declined 1.3% in April, while public nonresidential construction spending was down 2.5% for the month.

“Nonresidential construction has fared far better than most economic segments during the COVID-19 crisis, but the industry’s headline spending numbers fail to fully capture the damage inflicted on many key segments by the pandemic,” said ABC Chief Economist Anirban Basu. “For instance, spending in the lodging category was down more than 12% in April relative to a year ago and down 11% in the amusement and recreation category. Spending is also down meaningfully in a number of categories that are public-sector intensive, including education and highway/street.

“In much of the nation, construction was deemed an essential industry, which helped to mitigate spending decreases,” said Basu. “But in many places, including in New York, New Jersey, Boston, Pennsylvania and California, construction was deemed nonessential. That has rendered ongoing work and backlog—which stood at 7.8 months in April, according to ABC’s Construction Backlog Indicator—less of an effective shield against the early stages of the broader economic downturn than it is normally. The nonresidential construction spending data would have been far worse but for a massive increase in spending in the public safety category, which is up 35% year over year due to investments made to shore up capacity to deal with COVID-19.

“As the nation slowly reopens, nonresidential contractors will face many challenges,” said Basu. “State and local government finances have been compromised, jeopardizing infrastructure spending going forward. Many office suites and storefronts have been vacated, which will suppress demand for new construction going forward. Capital will also be scarcer, resulting in greater difficulty securing financing for projects. Moreover, if the past is prologue, many dislocated construction workers will find jobs in other industries, given construction’s tendency to be among the last economic segments to fully recover.”

Related Stories

Market Data | Oct 16, 2020

5 must reads for the AEC industry today: October 16, 2020

Princeton's new museum and Miami's yacht-inspired luxury condos.

Market Data | Oct 15, 2020

6 must reads for the AEC industry today: October 15, 2020

Chicago's Bank of America Tower opens and altering facilities for a post-COVID-19 world.

Market Data | Oct 14, 2020

6 must reads for the AEC industry today: October 14, 2020

Thailand's new Elephant Museum and the Art Gallery of New South Wales receives an expansion.

Market Data | Oct 13, 2020

5 must reads for the AEC industry today: October 13, 2020

Miami Beach Convention Center renovation completes and guidance offered for K-12 schools to support students with asthma.

Market Data | Oct 12, 2020

Majority of contractors fear long-term business implications of COVID-19, according to Construction Executive survey

While many contractors have not yet seen drastic impacts to their business, as construction was in many areas considered an “essential” service, the long-term implications are concerning.

Market Data | Oct 12, 2020

6 must reads for the AEC industry today: October 12, 2020

4 challenges of realizing BIM's value for an owner and Florida office property is designed for a post-Covid world.

Market Data | Oct 8, 2020

6 must reads for the AEC industry today: October 8, 2020

The first rendering of the National Medal of Honor Museum is unveiled and seven urgent changes needed to fix senior living.

Market Data | Oct 7, 2020

6 must reads for the AEC industry today: October 7, 2020

Water-filled windows' effect on energy and construction begins on PGA of America HQ.

Market Data | Oct 6, 2020

Construction sector adds 26,000 workers in September but nonresidential jobs stall

Many commercial firms experience project cancellations.

Market Data | Oct 6, 2020

6 must reads for the AEC industry today: October 6, 2020

Construction rises 1.4% in August while nonresidential construction spending falls slightly.