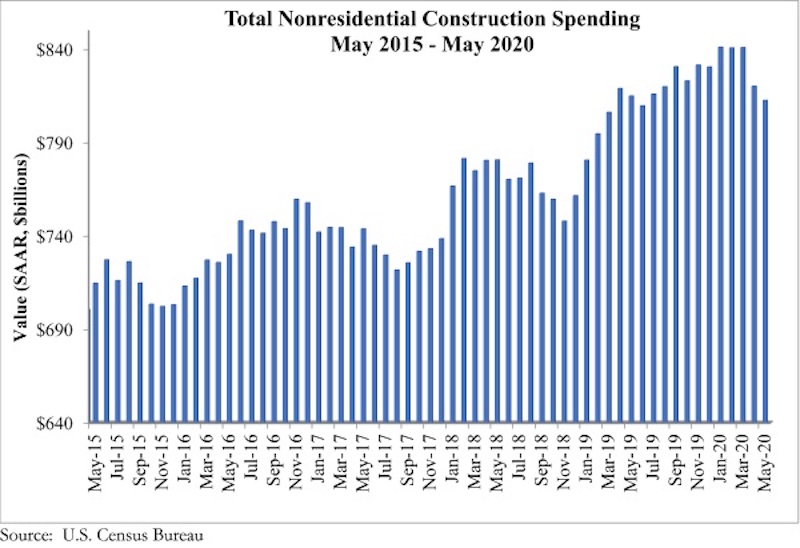

National nonresidential construction spending declined 0.9% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, spending totaled $812.5 billion for the month. Private nonresidential spending declined 2.4% in May and public nonresidential construction spending increased 1.2%.

“Certain aspects of today’s data release are precisely what was anticipated, while other elements are rather surprising,” said ABC Chief Economist Anirban Basu. “For instance, the precipitous 5.3% decline in health care-related construction spending is hardly shocking, as many elective surgeries, dental appointments and wellness checkups were postponed, resulting in billions of dollars of losses among medical systems. In addition, many medical systems have experienced large-scale layoffs in an effort to preserve cash balances.

“Other segments negatively affected include lodging, manufacturing and power, which was expected,” said Basu. “A general lack of travel and occupancy has slowed hotel construction. A shrunken global economy and disrupted worldwide supply chains have pummeled industrial construction. And the energy sector has taken a hit from commodity prices that remain significantly lower than pre-crisis levels, truncating demand for new construction.

“What is surprising is the overall stability of construction spending,” said Basu. “In May, nonresidential construction spending declined by less than 1%, which represents a level of stability not enjoyed by much of the balance of the economy. Spending in a number of categories, mostly public, was higher for the month, including highway/street, public safety, transportation and water supply. Moreover, certain construction segments may experience rapid recovery going forward, including health care, manufacturing and power. For now, construction spending data and ABC’s Construction Backlog Indicator, which stood at 7.9 months in May, show that the industry has managed to remain a bulwark of relative stability in the face of ongoing pandemic-induced economic dislocations.”

Related Stories

Hotel Facilities | Jan 13, 2016

Hotel construction should remain strong through 2017

More than 100,000 rooms could be delivered this year alone.

Market Data | Jan 6, 2016

Census Bureau revises 10 years’ worth of construction spending figures

The largest revisions came in the last two years and were largely upward.

Market Data | Jan 5, 2016

Majority of AEC firms saw growth in 2015, remain optimistic for 2016: BD+C survey

By all indications, 2015 was another solid year for U.S. architecture, engineering, and construction firms.

Market Data | Jan 5, 2016

Nonresidential construction spending falters in November

Only 4 of 16 subsectors showed gains

Market Data | Dec 15, 2015

AIA: Architecture Billings Index hits another bump

Business conditions show continued strength in South and West regions.

Market Data | Dec 7, 2015

2016 forecast: Continued growth expected for the construction industry

ABC forecasts growth in nonresidential construction spending of 7.4% in 2016 along with growth in employment and backlog.