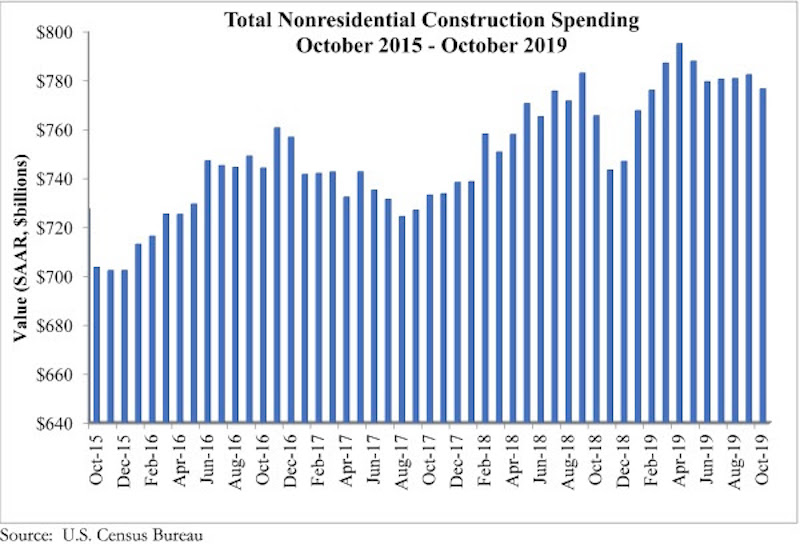

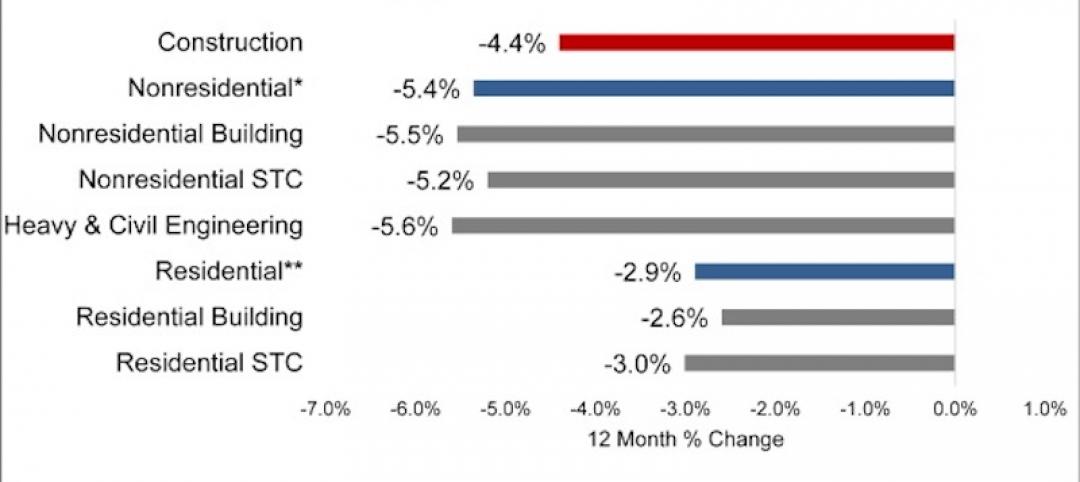

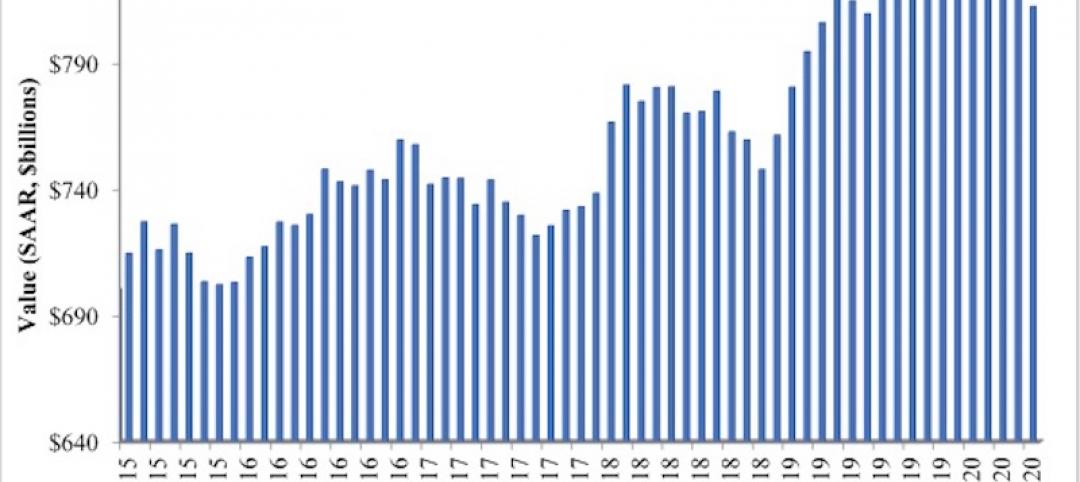

National nonresidential construction spending fell 0.7% in October but is up 1.4% compared to the same time last year, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, spending totaled $776.5 billion, 2.3% lower than the cyclical peak attained in April 2019.

Private nonresidential spending fell 1.2% on a monthly basis and is down 4.3% from October 2018. Public nonresidential construction spending also declined on a monthly basis, falling 0.1%. On an annual basis, however, public nonresidential spending is up 10.4%.

“At this point, economic indicators are providing mixed signals about the U.S. construction industry’s trajectory,” said ABC Chief Economist Anirban Basu. “Today’s release suggests that the industry’s spending cycle is winding toward a close and has been for about six months. Yet, according to the October employment data or ABC’s Construction Backlog Indicator, the story is very different. Those data tell the tale of an industry still wrestling with enormous levels of work and ongoing labor shortages.

“Moreover, though overall nonresidential construction spending is a bit lower than it was six months ago, there are still segments that are performing well,” said Basu. “A number of public construction segments experienced solid growth on monthly and annual bases, including public safety, conservation/development (e.g. flood control), educational and water supply. With state and local government budgets still generally healthy, spending on public works will conceivably remain elevated for the foreseeable future.

“The primary source of weakness has been private construction,” said Basu. “This is consistent with recent readings of ABC’s Construction Confidence Index and a number of other leading indicators. Among the segments softening the fastest are the manufacturing and commercial segments, which are both down on monthly and year-ago bases. Commercial construction is down more than 16% over the past year, which coincides with the fact that 2019 will set a record for store closings in the U.S. as e-commerce continues to gobble up market share. Lodging and office-related construction has also slowed of late, likely because developers have already exhausted many of the best investment opportunities.”

Related Stories

Market Data | Jul 7, 2020

Nonresidential construction has recovered 56% of jobs lost since March employment report

Nonresidential construction employment added 74,700 jobs on net in June.

Market Data | Jul 7, 2020

7 must reads for the AEC industry today: July 7, 2020

Construction industry adds 158,000 workers in June and mall owners open micro distribution hubs for e-commerce fulfillment.

Market Data | Jul 6, 2020

Nonresidential construction spending falls modestly in May

Private nonresidential spending declined 2.4% in May and public nonresidential construction spending increased 1.2%.

Market Data | Jul 6, 2020

Construction industry adds 158,000 workers in June but infrastructure jobs decline

Gains in June are concentrated in homebuilding as state and local governments postpone or cancel roads and other projects in face of looming budget deficits.

Market Data | Jul 6, 2020

5 must reads for the AEC industry today: July 6, 2020

Demand growth for mass timber components and office demand has increased as workers return.

Market Data | Jul 2, 2020

Fall in US construction spending in May shows weakness of country’s construction industry, says GlobalData

Dariana Tani, Economist at GlobalData, a leading data and analytics company, offers her view on the situation

Market Data | Jul 2, 2020

6 must reads for the AEC industry today: July 2, 2020

Construction spending declines 2.1% in May and how physical spaces may adapt to a post-COVID world.

Market Data | Jul 1, 2020

Construction spending declines 2.1% in May as drop in private work outweighs public pickup

Federal infrastructure measure can help offset private-sector demand that is likely to remain below pre-coronavirus levels amid economic uncertainty.

Market Data | Jul 1, 2020

7 must reads for the AEC industry today: July 1, 2020

Facebook to build $800 million data center and 329 metro areas added construction jobs in May.

Market Data | Jun 30, 2020

AIA releases strategies and illustrations for reducing risk of COVID-19 in senior living communities

Resources were developed as part of AIA’s “Reopening America: Strategies for Safer Buildings” initiative.