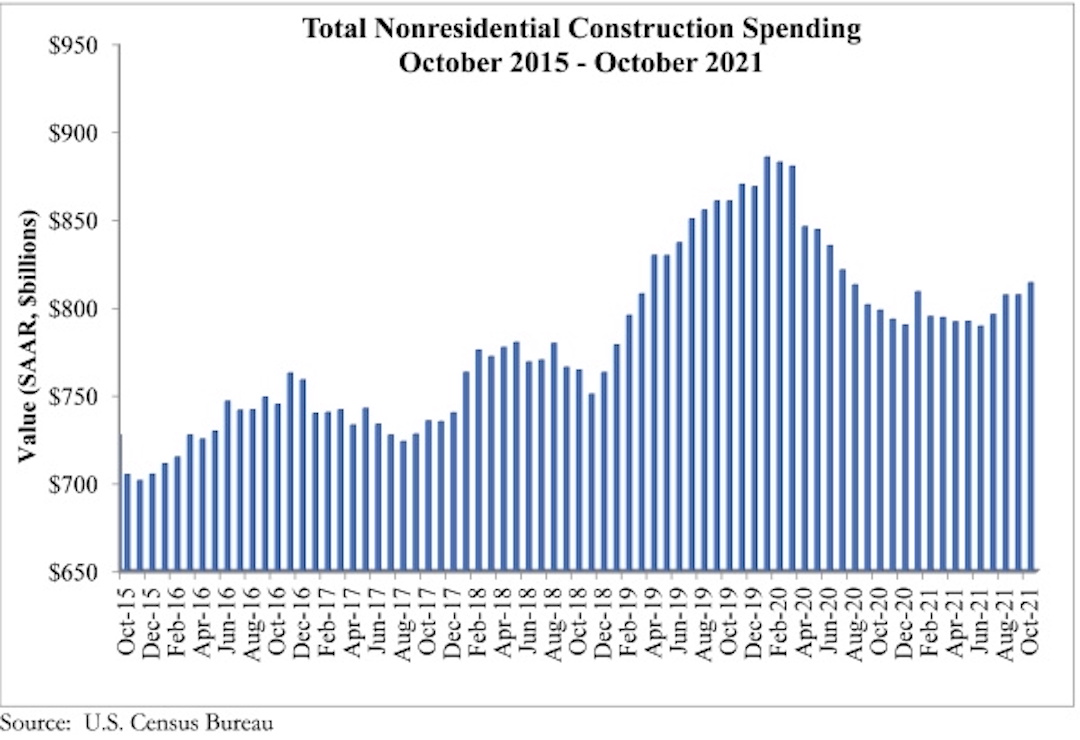

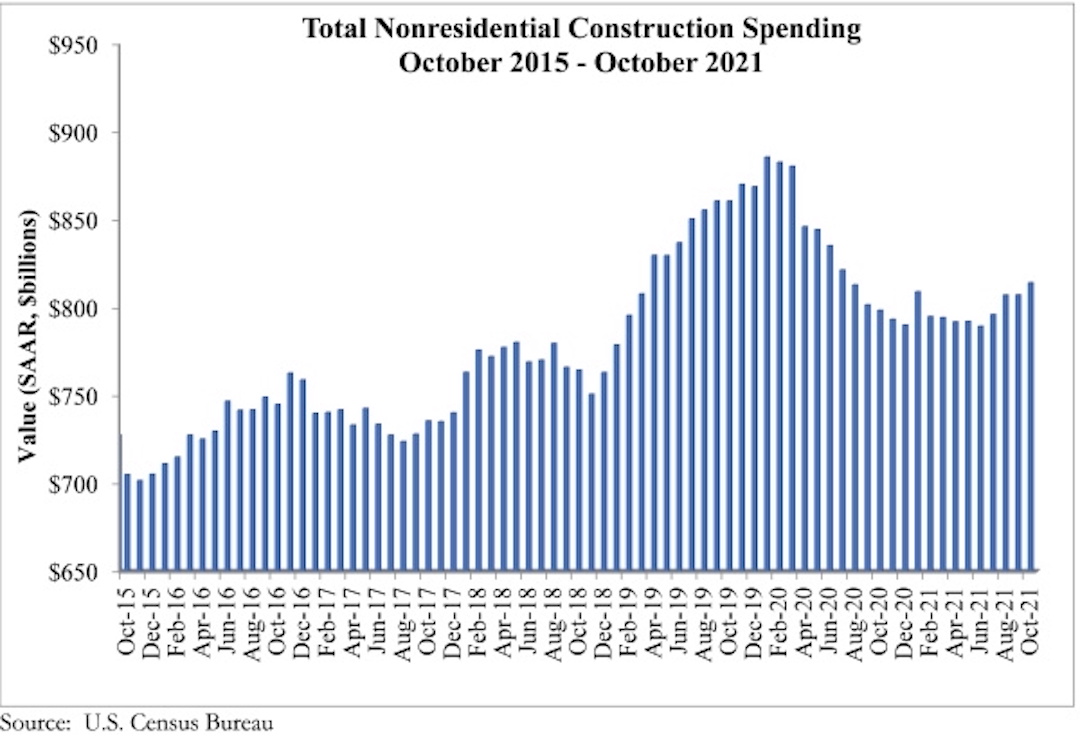

National nonresidential construction spending was up 0.9% in October, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $814.2 billion for the month.

Spending was up on a monthly basis in 13 of the 16 nonresidential subcategories, with spending in the commercial subcategory virtually unchanged for the month. Private nonresidential spending was up slightly by 0.2%, while public nonresidential construction spending increased 1.8% in October.

“On the surface, there is much to be encouraged by in October’s construction spending data,” said ABC Chief Economist Anirban Basu. “Nonresidential spending is now at its highest level since July 2020 and has rebounded 3.1% since bottoming out in June 2021. Nonresidential spending expanded meaningfully for the month and those gains were spread across most subsectors. Data characterizing the two prior months were upwardly revised by a combined $27 billion, or 1.7%.

“But construction data do not adjust for inflation, and these spending gains are largely attributable to increases in the cost of delivering construction services,” said Basu. “Challenges that have suppressed nonresidential construction spending growth remain firmly in place. While lofty levels of investment in real estate would normally be associated with significant private construction volumes, many project owners have been induced to postpone projects because of elevated material and labor costs as well as widespread shortages.

“Still, leading indicators remain positive,” said Basu. “ABC members collectively expect revenues and employment levels to climb during the months ahead, according to ABC’s Construction Confidence Index. Design work is plentiful, which means that many investors are at least considering moving forward with projects. In certain geographies, especially in the southern United States, office and other segments are improving, which should translate into more abundant construction starts once global supply chains and materials prices normalize. In this regard, the emergence of the omicron variant adds another layer of uncertainty and may prevent certain materials and equipment prices from declining in the very near term.

“The bottom line is that 2022 should be an excellent year for nonresidential construction,” said Basu. “Performance will be led by public construction, especially in the context of a recently passed and large infrastructure package. Among the segments that are set to zoom ahead are roads and bridges, school construction, water systems, airports, seaports and rail. Traditional office and lodging construction will likely remain weak in much of the nation, however.”

Related Stories

Market Data | May 11, 2020

6 must reads for the AEC industry today: May 11, 2020

Nashville residential tower will rise 416 feet and the construction industry loses 975,000 jobs.

Market Data | May 8, 2020

Construction industry loses 975,000 jobs in April as new association survey shows deteriorating demand for construction projects

Association partner Procore also releases near real-time construction data measuring impacts of coronavirus as association calls for new measures.

Market Data | May 8, 2020

7 must reads for the AEC industry today: May 8, 2020

The death of the office and Colorado's first multifamily project to receive WELL Precertification.

Market Data | May 7, 2020

5 must reads for the AEC industry today: May 7, 2020

5 memory care communities with a strong sense of mission and making jobsites safer in the COVID-19 world.

Market Data | May 6, 2020

6 must reads for the AEC industry today: May 6, 2020

5 questions engineers will ask after COVID-19 and coronavirus threatens push for denser housing.

Market Data | May 5, 2020

5 must reads for the AEC industry today: May 5, 2020

A new temporary hospital pops up in N.J., and apartment firms' reactivation plans begin to take shape.

Market Data | May 4, 2020

6 must reads for the AEC industry today: May 4, 2020

How working from home is influencing design and is this the end of the open office?

Market Data | May 4, 2020

The Los Angeles market continue to lead the U.S. hotel construction pipeline at the close of the first quarter of 2020

Nationally, under construction project counts hit a new all-time high with 1,819 projects with 243,100 rooms.

Market Data | May 1, 2020

Nonresidential construction spending declines in March as pandemic halts projects

Group warns loan threats are hurting relief program.

Market Data | May 1, 2020

6 must reads for the AEC industry today: May 1, 2020

DLR Group completes LA Memorial Coliseum renovation and over 50% of department stores in malls predicted to close by 2021.