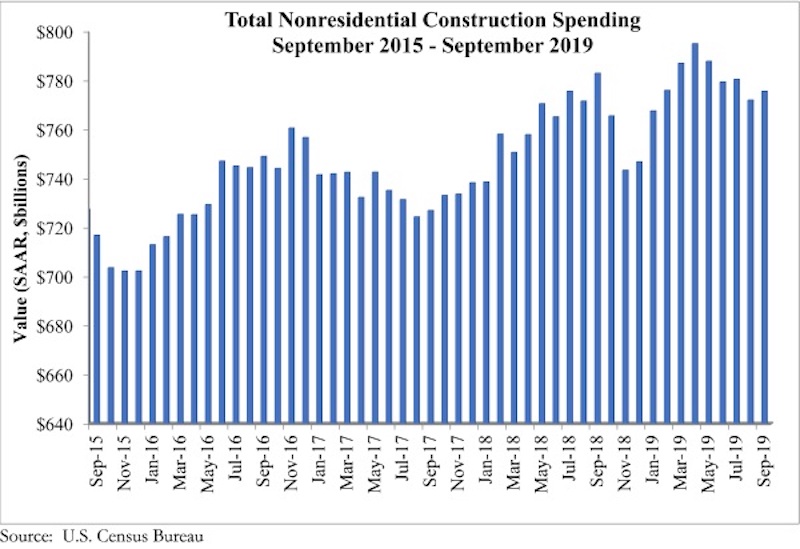

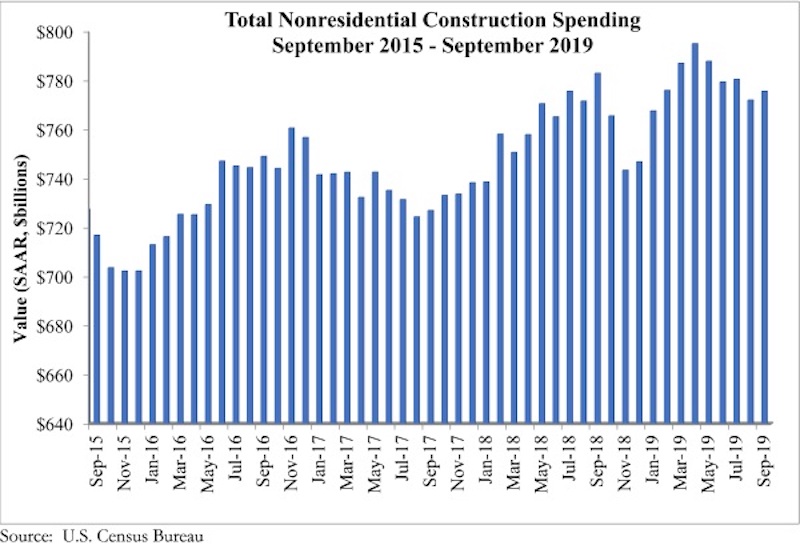

National nonresidential construction spending rose 0.5% in September but is down 0.9% on a year-ago basis, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, spending totaled $775.6 billion, 2.4% lower than the cyclical peak in April 2019.

Private nonresidential spending fell 0.3% on a monthly basis and is down 5.7% compared to the same time last year, while public nonresidential construction spending expanded 1.5% for the month and is up 6.6% for the year. This comports neatly with today’s employment report and GDP data released earlier this week, which revealed ongoing growth in outlays for infrastructure but declining investment in structures.

“Construction spending contracted in a number of private segments, including in the commercial and lodging categories,” said ABC Chief Economist Anirban Basu. "While it would be easy to attribute this to a slowing economy and/or growing concerns regarding the saturation of available space in certain private segments, there are also large-scale economic transformations playing a role. Commercial construction spending is down nearly 19%, as traditional retailers continue to contend with the growing presence and capabilities of e-commerce giants, while those in the lodging segment—which dipped in September and is essentially flat year-over-year—are increasingly competing with online platforms such as Airbnb.

“Meanwhile, public construction remains one of the strongest elements of the U.S. economy,” said Basu. “Spending in the water supply category surged nearly 6% in September and is up 20% on a year-over-year basis. Overall, public nonresidential construction is up nearly 7% over the past 12 months as state and local government finances enjoy their best health in more than a decade. While there were some declines on a monthly basis in certain public segments in September, year-over-year spending is up more than 6% in the highway/street category, by nearly 6% in the transportation segment and by nearly 9% in the public safety category.

“Leading indicators, including the Architecture Billings Index, continue to point toward sluggish growth or worse in private construction,” said Basu. “Public construction spending, by contrast, should remain a source of economic expansion during the months ahead, but the looming insolvency of the Highway Trust Fund must be addressed soon for momentum to persist. In September, nine of 16 nonresidential construction segments experienced a decline in spending, and there has been a negative trend in place since April. Accordingly, viewed from a high-level perspective, the outlook for nonresidential construction spending is becoming increasingly uncertain, though available data regarding backlog suggest that the industry will enter 2020 with residual momentum.”

Related Stories

Market Data | Jun 22, 2020

7 must reads for the AEC industry today: June 22, 2020

Construction employment rises from April to May in 45 states and the first building in the U.S. designed for post COVID-19 environment.

Market Data | Jun 22, 2020

Construction employment rises from April to May in 45 states, slips in 5

Rebound from April job losses reflects one-shot help from paycheck protection program loans and easing of stay-at-home orders, but cancellations and state and local deficits imply further cuts ahead.

Market Data | Jun 19, 2020

7 must reads for the AEC industry today: June 19, 2020

Brown University's first housing building in three decades and demand for family rentals expected to jump.

Market Data | Jun 18, 2020

New data shows construction activity returning to pre-coronavirus levels in many parts of the country

Association survey and data collected by Procore measure impacts of the pandemic, showing signs of a construction recovery, but labor shortages and project cancellations show industry needs federal help.

Market Data | Jun 18, 2020

AIA releases strategies and illustrations for reducing risk of COVID-19 in schools

For the 2020-21 school year, districts are facing the difficult task of determining if K-12 schools will reopen this fall.

Market Data | Jun 18, 2020

6 must reads for the AEC industry today: June 18, 2020

Northbrook's new cannabis dispensary and America's structural steel industry remains a success story.

Market Data | Jun 17, 2020

6 must reads for the AEC industry today: June 17, 2020

Santa Fe becomes the second city in the world to achieve LEED v4.1 and the megacity is dead.

Market Data | Jun 16, 2020

7 must reads for the AEC industry today: June 16, 2020

Tottenham Hotspur Stadium has its own brewery and workers want policy changes before they return to offices.

Market Data | Jun 15, 2020

International Code Council offers guidance on building re-occupancy for reopening economies

Companies and building managers can access free resources at the Code Council’s Coronavirus Response Center.

Market Data | Jun 12, 2020

6 must reads for the AEC industry today: June 12, 2020

How will museums change in the face of COVID-19 and the patriarch of The Boldt Company dies.