Reed Construction Data has announced that the dollar value of construction starts in June, excluding residential activity, surged 34% versus May. The figures are in "current" dollars, meaning they are not adjusted for inflation.

The individual month of June, at $32.0 billion, was one of the strongest in Reed's entire database. To find a similarly high volume, one has to look back at June 2008, just before the Great Recession really took hold.

The one-third increase was an outsized gain, even after taking into account seasonality. Reed's long-term average May-to-June increase has been 4.5%. By comparison, May's month-to-month percentage change was +6.2% and April's -4.5%.

June starts this year compared with June of last year were +14.4%. The year-to-date level of total nonresidential construction starts, at $138 billion, was +2.4% when compared with the same January to June period of 2013.

Nonresidential construction accounts for a considerably larger share than of the total than residential work. The former's proportion of total put-in-place construction in the Census Bureau's May report was 62% versus the latter's 38%.

Reed's construction starts are leading indicators for the Census Bureau's capital investment or put-in-place series.

After a shockingly harsh winter, during which GDP contracted, the U.S. economy is back on an expansionary path with stock market indices near record highs and the unemployment rate close to the nation's 20-year average of 6.0%. Firms in the private sector are feeling more pressure to build new facilities.

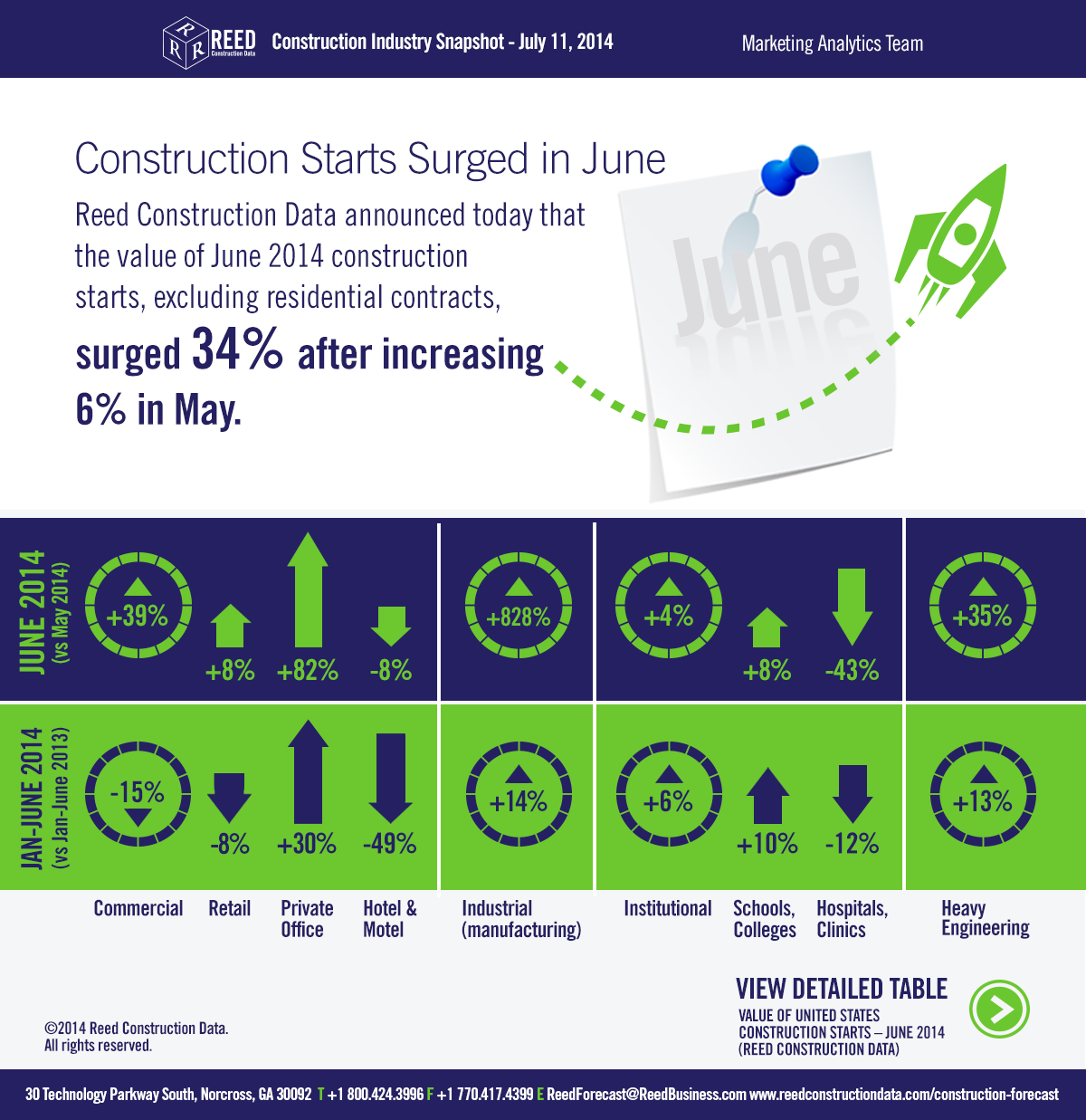

The month-to-month leaders among major nonresidential construction categories were commercial +39%, and heavy engineering +34.7%. Institutional work was also up +3.6%, but to a much lesser degree. Industrial starts recorded a large percentage gain, but it came on top of a smaller dollar volume than the other three.

Commercial starts this June were even more impressive, +48.5%, when compared with June of last year. Engineering starts this June versus the same month last year were +13.7%. Institutional starts were -8.1%.

Year to date, heavy engineering (+13%) is out front, followed by institutional (+5.9%). Commercial starts (-14.5%) are still down from last year. Industrial work is 13.5%.

In commercial construction's two largest sub-categories, retail starts were +8.3% month to month, but -8.1% year to date, while private office building starts were +81.6% month to month and +29.6 year to date.

In the institutional category of work, school and college starts were +7.5% month to month and +9.7% year over year. Hospital/clinic starts moved in the opposite direction, -43.2% month to month and -12.3% year to date.

With the exception of dam/marine work, all the sub-categories of heavy engineering construction were ahead both month to month and year to date, with water and sewage work especially strong versus May, +40.2.

Institutional and heavy engineering work have especially close ties to government finances. Washington's deficit is diminishing, although the debt load remains high. At the state and local levels, the ongoing improvement in the overall economy is providing budgetary payoffs.

The nonresidential construction sector will derive benefits from taxes that are increasing naturally. Stronger employment and higher incomes lift income tax revenues; advances in consumer spending yield more sales taxes; and rising home prices translate into improved property taxes.

The value of construction starts each month is summarized from Reed's database of all active construction projects in the U.S. Missing project values are estimated with the help of RSMeans' building cost models.

See Reed Construction Data's full Construction Industry Snapshot here.

Related Stories

| Aug 11, 2010

Gensler, HOK, HDR among the nation's leading reconstruction design firms, according to BD+C's Giants 300 report

A ranking of the Top 100 Reconstruction Design Firms based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Gensler, Arup, HOK among the largest office sector design firms

A ranking of the Top 100 Office Design firms based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Callison strengthens retail design presence with RYA acquisition

Callison LLC on June 1 acquired RYA Design Consultancy, a Dallas-based retail architecture and design firm with offices in New York City. The new “Callison RYA Studio” will merge staff and clients into Callison ’s existing retail practice at their Dallas and New York offices.

| Aug 11, 2010

Prism-shaped design unveiled for five-star hotel in Saudi Arabia

Goettsch Partners has been commissioned by Saudi Oger Ltd. to design a new five-star, 214-key business hotel in the King Abdullah Financial District in Riyadh, Saudi Arabia. As a design-build assignment, Saudi Oger is serving as the contractor, selected by developer Rayadah Investment Company. The project is sited on Parcel 1.08, one of the first 10 parcels currently under development in the massive new master-planned district.

| Aug 11, 2010

Construction Specifications Institute to end support of MasterFormat 95 on December 31, 2009

The Construction Specifications Institute (CSI) announced that the organization will cease to license and support MasterFormat 95 as of December 31, 2009. The CSI Board of Directors voted to stop licensing and supporting MasterFormat 95 during its June 16, 2009, meeting at the CSI Annual Convention in Indianapolis.

| Aug 11, 2010

Gensler among eight teams named finalists in 'classroom of the future' design competition

Eight teams were recognized today as finalists of the 2009 Open Architecture Challenge: Classroom. Finalists submitted designs ranging from an outdoor classroom for children in inner-city Chicago, learning spaces for the children of salt pan workers in India, safe spaces for youth in Bogota, Colombia and a bamboo classroom in the Himalayan mountains.

| Aug 11, 2010

F&S Partners merges with SmithGroup

F&S Partners, a Dallas architecture firm specializing in the design of educational, recreational, and religious projects, has merged with SmithGroup, a top 10 U.S. architecture/engineering firm. The 40-person office in Dallas will carry the name SmithGroup/F&S.