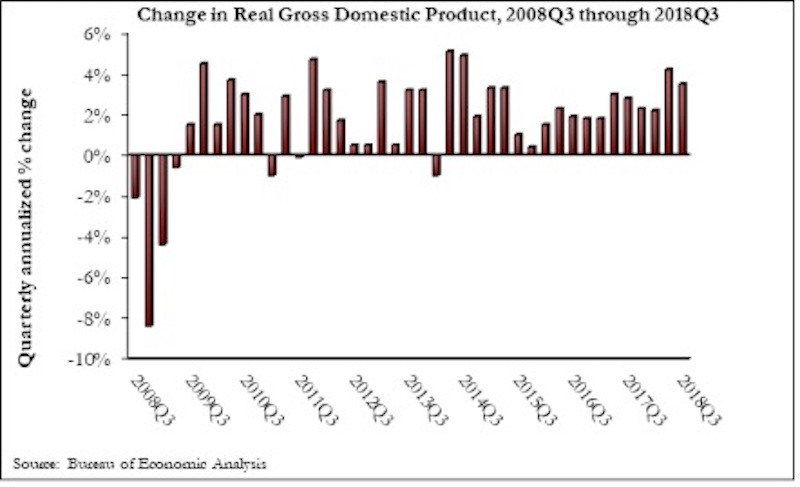

The U.S. economy expanded at a 3.5% annualized rate during the third quarter of 2018, according to an Associated Builders and Contractors analysis of U.S. Bureau of Economic Analysis data released today. This represents the first time there have been two consecutive quarters of 3%-plus growth since the beginning of 2015.

Despite the broader economic growth, fixed investment inched 0.3% lower in the third quarter. Nonresidential fixed investment increased at just a 0.8% annualized rate, a stark reversal from the 11.5% and 8.7% growth observed in the first and second quarters, respectively. Investment in structures plummeted 7.9% after increasing by 13.9% and 14.5% in the previous two quarters.

“While the GDP increased, business investment, including investment in structures, was generally disappointing,” said ABC Chief Economist Anirban Basu. “Today’s GDP release is consistent with other data indicating a recent softening in capital expenditures, which caught many observers by surprise. Coming into the year, the expectation among many was that corporate tax cuts would translate into a lengthy period of rising business investment.

“As always, there are multiple explanations for the observed slowing in capital expenditures,” said Basu. “The first is simply that this represents an inevitable moderation in fixed business investment after the stunning growth in investment registered during the year’s initial two quarters. A second explanation, however, is not nearly as benign. This explanation focuses on both the growing constraints that businesses face due to a lack of trained workers available to work on new equipment, as well as the impact of rising input costs. Corporate earnings are no longer as consistently surprising to the upside, an indication of the impact of rising business costs. It may be that the dislocation created by ongoing trade skirmishes is also inducing certain firms to invest less in equipment and structures.

“If the first explanation is correct, one would expect a bounce back in capital expenditures,” said Basu. “The logic is that the U.S. business community has taken a bit of a breather to digest all of the capital investments undertaken during the first half of 2018. However, the second would indicate economic growth and the pace of hiring to soften in 2019. That obviously would not be a welcome dynamic for America’s construction sector.”

Related Stories

Market Data | Sep 3, 2020

6 must reads for the AEC industry today: September 3, 2020

New affordable housing comes to the Bronx and California releases guide for state water policy.

Market Data | Sep 2, 2020

Coronavirus has caused significant construction project delays and cancellations

Yet demand for skilled labor is high, new survey finds.

Market Data | Sep 2, 2020

5 must reads for the AEC industry today: September 2, 2020

Precast concrete tower honors United AIrlines Flight 93 victims and public and private nonresidential construction spending slumps.

Market Data | Sep 2, 2020

Public and private nonresidential construction spending slumps in July

Industry employment declines from July 2019 in two-thirds of metros.

Market Data | Aug 31, 2020

5 must reads for the AEC industry today: August 31, 2020

The world's first LEED Platinum integrated campus and reopening campus performance arts centers.

Market Data | Aug 21, 2020

5 must reads for the AEC industry today: August 21, 2020

Student housing in the COVID-19 era and wariness of elevators may stymie office reopening.

Market Data | Aug 20, 2020

6 must reads for the AEC industry today: August 20, 2020

Japan takes on the public restroom and a look at the evolution of retail.

Market Data | Aug 19, 2020

6 must reads for the AEC industry today: August 19, 2020

July architectural billings remained stalled and Florida becomes third state to adopt concrete repair code.

Market Data | Aug 18, 2020

July architectural billings remained stalled

Clients showed reluctance to sign contracts for new design projects during July.

Market Data | Aug 18, 2020

Nonresidential construction industry won’t start growing again until next year’s third quarter

But labor and materials costs are already coming down, according to latest JLL report.