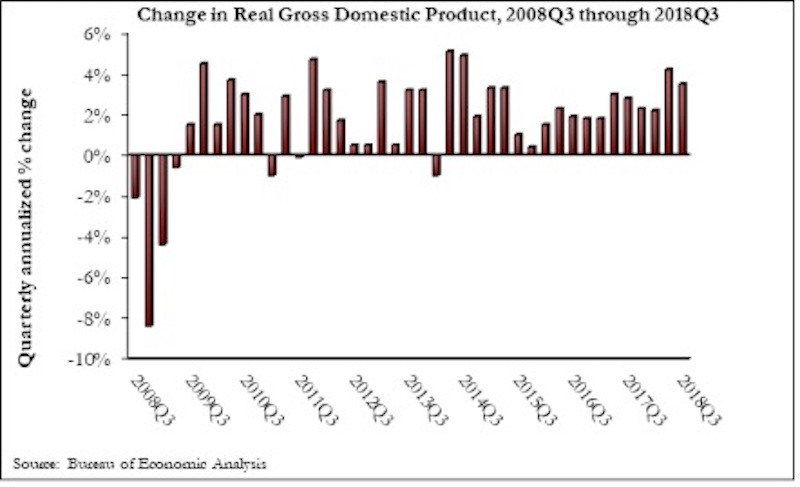

The U.S. economy expanded at a 3.5% annualized rate during the third quarter of 2018, according to an Associated Builders and Contractors analysis of U.S. Bureau of Economic Analysis data released today. This represents the first time there have been two consecutive quarters of 3%-plus growth since the beginning of 2015.

Despite the broader economic growth, fixed investment inched 0.3% lower in the third quarter. Nonresidential fixed investment increased at just a 0.8% annualized rate, a stark reversal from the 11.5% and 8.7% growth observed in the first and second quarters, respectively. Investment in structures plummeted 7.9% after increasing by 13.9% and 14.5% in the previous two quarters.

“While the GDP increased, business investment, including investment in structures, was generally disappointing,” said ABC Chief Economist Anirban Basu. “Today’s GDP release is consistent with other data indicating a recent softening in capital expenditures, which caught many observers by surprise. Coming into the year, the expectation among many was that corporate tax cuts would translate into a lengthy period of rising business investment.

“As always, there are multiple explanations for the observed slowing in capital expenditures,” said Basu. “The first is simply that this represents an inevitable moderation in fixed business investment after the stunning growth in investment registered during the year’s initial two quarters. A second explanation, however, is not nearly as benign. This explanation focuses on both the growing constraints that businesses face due to a lack of trained workers available to work on new equipment, as well as the impact of rising input costs. Corporate earnings are no longer as consistently surprising to the upside, an indication of the impact of rising business costs. It may be that the dislocation created by ongoing trade skirmishes is also inducing certain firms to invest less in equipment and structures.

“If the first explanation is correct, one would expect a bounce back in capital expenditures,” said Basu. “The logic is that the U.S. business community has taken a bit of a breather to digest all of the capital investments undertaken during the first half of 2018. However, the second would indicate economic growth and the pace of hiring to soften in 2019. That obviously would not be a welcome dynamic for America’s construction sector.”

Related Stories

Market Data | Jun 2, 2020

5 must reads for the AEC industry today: June 2, 2020

New Luxembourg office complex breaks ground and nonresidential construction spending falls.

Market Data | Jun 1, 2020

Nonresidential construction spending falls in April

Of the 16 subcategories, 13 were down on a monthly basis.

Market Data | Jun 1, 2020

7 must reads for the AEC industry today: June 1, 2020

Energy storage as an amenity and an entry-point for wellness screening everywhere.

Market Data | May 29, 2020

House-passed bill making needed improvements to paycheck protection program will allow construction firms to save more jobs

Construction official urges senate and White House to quickly pass and sign into law the Paycheck Protection Program Flexibility Act.

Market Data | May 29, 2020

7 must reads for the AEC industry today: May 29, 2020

Using lighting IoT data to inform a safer office reentry strategy and Ghafari joins forces with Eview 360.

Market Data | May 27, 2020

5 must reads for the AEC industry today: May 28, 2020

Biophilic design on the High Line and the office market could be a COVID-19 casualty.

Market Data | May 27, 2020

6 must reads for the AEC industry today: May 27, 2020

AIA's COTE Top Ten Awards and OSHA now requires employers to track COVID-19 cases.

Market Data | May 26, 2020

6 must reads for the AEC industry today: May 26, 2020

Apple's new Austin hotel and is CLT really a green solution?

Market Data | May 21, 2020

7 must reads for the AEC industry today: May 21, 2020

'Creepy' tech invades post-pandemic offices, and meet the new darling of commercial real estate.

Market Data | May 20, 2020

6 must reads for the AEC industry today: May 20, 2020

A wave 'inside' a South Korean building and architecture billings continues historic contraction.