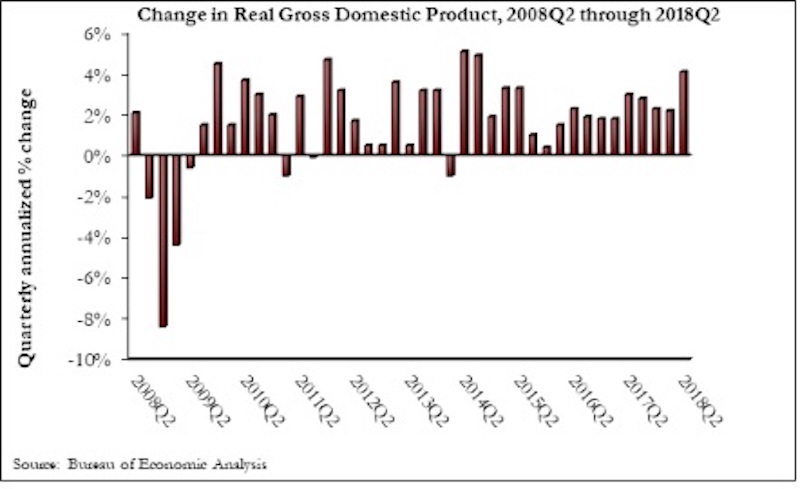

The U.S. economy expanded at an annualized 4.1% rate during the second quarter of 2018—the fastest rate of quarterly growth since the second quarter of 2014, according to an Associated Builders and Contractors analysis of U.S. Bureau of Economic Analysis data released today.

Nonresidential fixed investment represented an especially important element of second quarter strength in the advance estimate. While overall fixed investment expanded at a 5.4% annualized pace, nonresidential fixed investment grew 7.3%. The nonresidential sub-component exhibiting the most upward force was structures, which grew at a 13.3% annualized pace and by 13.9% during the year’s initial quarter.

Today’s data release helps explain why nonresidential contractors continue to report hefty backlog and scramble for human capital. By contrast, the residential segment, which continues to be impacted by rising mortgage rates and the lowest level of housing affordability in a decade, contracted at a 1.1% annualized rate and has now shrunk during three of the previous four quarters.

“It is quite remarkable that an economy now in its 10th year of economic expansion is actually gaining steam,” said ABC Chief Economist Anirban Basu. “A host of forces are at work, including elevated levels of confidence among business owners, developers and others who drive investment in America. Meanwhile, the consumer, supported by the strongest labor market in about two decades, continues to reliably contribute to economic growth. The result is an economy that is now on its way to a potential 3% growth year.

“As always, there are reasons to temper optimism,” said Basu. “Some of second quarter growth was driven by aggressive purchases of American output (e.g. soybeans) in advance of the imposition of retaliatory tariffs. That helped bulk up exports, but that pattern may not continue during the third quarter. The rapidly expanding economy is also serving to exacerbate inflationary pressures, which in turn are likely to drive borrowing costs higher. In other words, today’s strong economic growth may translate into weaker economic growth at some point in the future, and there is plenty of precedent for such a dynamic.

“Contractors can rest assured that the economy will retain its momentum through the balance of the year,” said Basu. “While financial markets may remain volatile and the global news cycle will undoubtedly continue to swirl, leading indicators, including those related to the level of observable activity among engineers, architects and other design professionals, suggest that another wave of building construction is on the way. The tax cuts passed late last year are just now beginning to have an impact. The hope is that tax reform will trigger a structural shift in the U.S. economy by helping to expand productivity and the economy’s long-term growth potential.The other possibility is that the tax reform’s primary effects will be to lift short-term growth, expand federal budget deficits, and ultimately give way to a countervailing reform at some point in the future.”

Related Stories

Market Data | May 20, 2020

Architecture billings continue historic contraction

AIA’s Architecture Billings Index (ABI) score of 29.5 for April reflects a decrease in design services provided by U.S. architecture firms.

Market Data | May 19, 2020

5 must reads for the AEC industry today: May 19, 2020

Clemson's new mass timber building and empty hotels as an answer for the affordable housing shortage.

Market Data | May 18, 2020

5 must reads for the AEC industry today: May 18, 2020

California's grid can support all-electric buildings and you'll miss your office when it's gone.

Market Data | May 15, 2020

6 must reads for the AEC industry today: May 15, 2020

Nonresidential construction employment sees record loss and Twitter will keep all of its office space.

Market Data | May 15, 2020

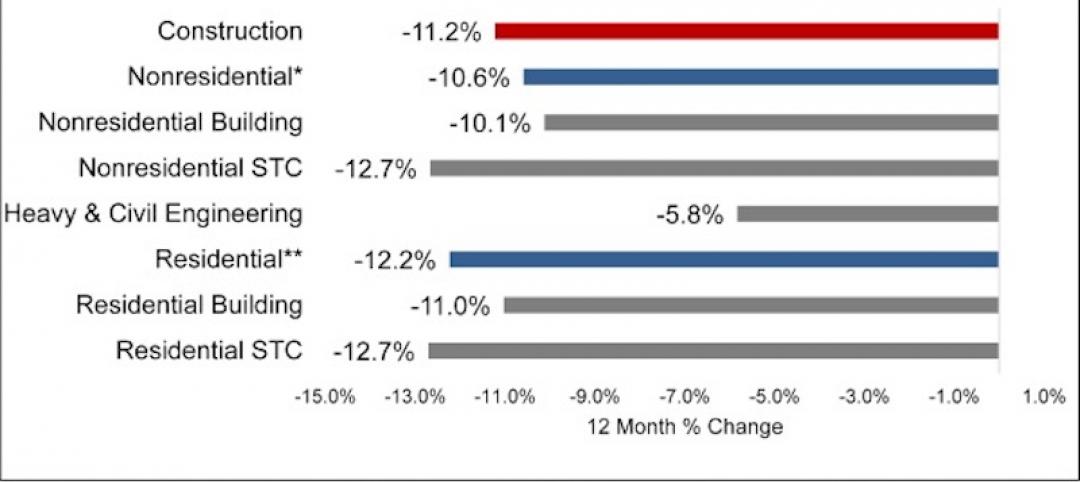

Nonresidential construction employment sees record loss in April

The construction unemployment rate was 16.6% in April, up 11.9 percentage points from the same time last year.

Market Data | May 14, 2020

5 must reads for the AEC industry today: May 14, 2020

The good news about rent might not be so good and some hotel developers consider whether to abandon projects.

Market Data | May 13, 2020

House democrats' coronavirus measure provides some relief for contractors, but lacks other steps needed to help construction

Construction official says new highway funding, employee retention credits and pension relief will help, but lack of safe harbor measure, Eextension of unemployment bonus will undermine recovery.

Market Data | May 13, 2020

5 must reads for the AEC industry today: May 13, 2020

How to design resilient libraries in a post-covid world and vacation real-estate markets are 'toast.'

Market Data | May 12, 2020

ABC’s Construction Backlog Indicator falls in April; Contractor Confidence rebounds from historic lows

Nonresidential construction backlog is down 0.4 months compared to the March 2020 ABC survey and 1.7 months from April 2019.

Market Data | May 12, 2020

6 must reads for the AEC industry today: May 12, 2020

A 13-point plan to reduce coronavirus deaths in nursing homes and Bjarke Ingels discusses building on Mars.