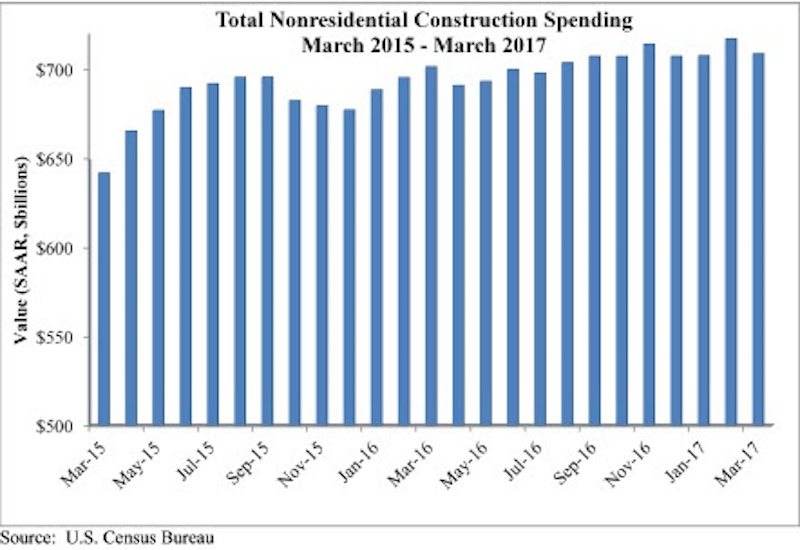

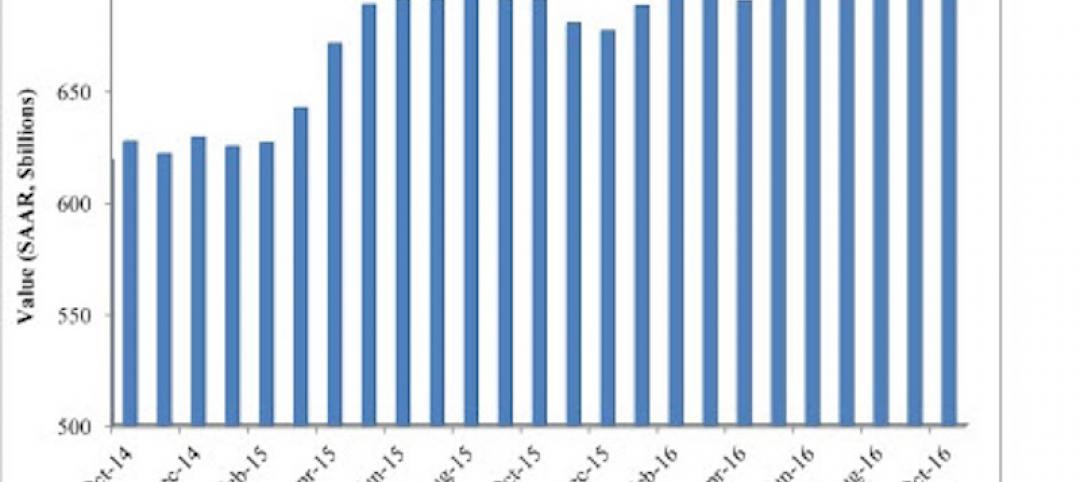

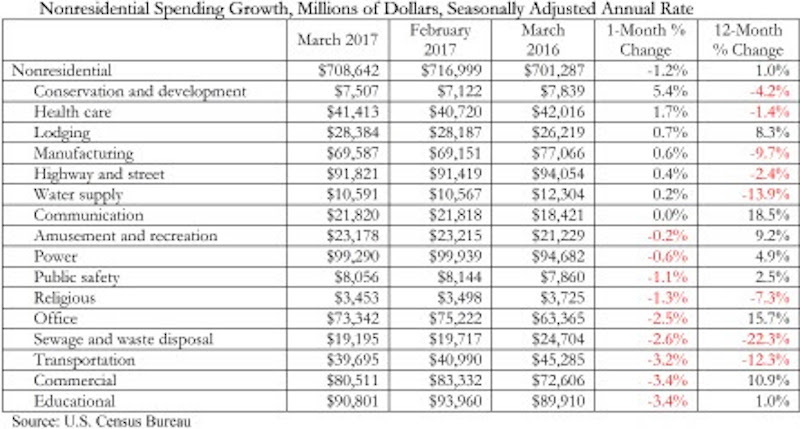

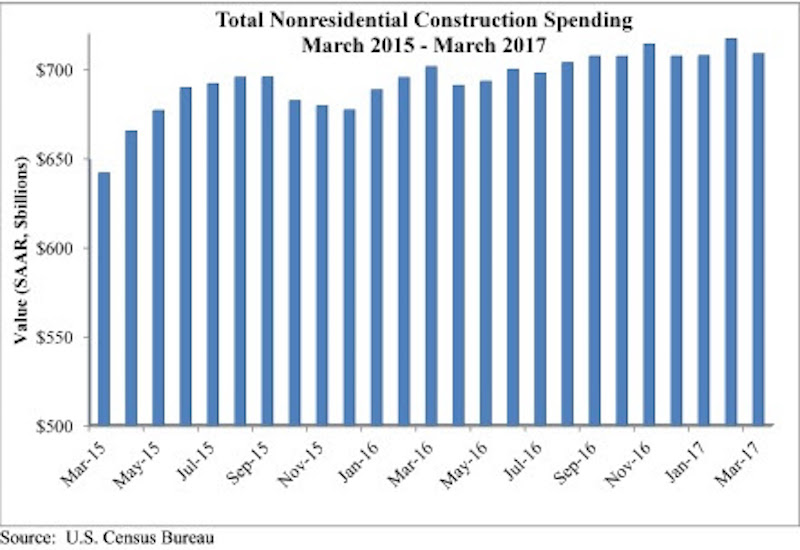

Nonresidential construction spending fell 1.2 percent in March, according to analysis of U.S. Census Bureau data recently released by Associated Builders and Contractors (ABC). Spending in the segment totaled $708.6 billion on a seasonally adjusted, annualized basis, however the decline is less dramatic than it may be perceived to be given that February’s initial estimate of $701.6 billion was upwardly revised to $717 billion, making it the highest level or spending recorded in the data series.

In March, private nonresidential construction spending fell 1.3 percent for the month, but remains up 6.4 percent on a year-ago basis. Public nonresidential spending decreased by 0.9 percent and is down 6.5 percent year over year. Were it not for the manufacturing subsector, where spending has contracted 9.7 percent from the same time last year, overall spending would have increased from February and set a new record high for construction spending.

“There are at least two tales to tell, and neither one of them is particularly uplifting,” said ABC Chief Economist Anirban Basu. “One narrative relates to public spending, which remains soft. Even categories in which one might have expected spending growth have not experienced an increase over past year. For instance, one might have anticipated stepped-up spending in the water supply category given the events in Flint, Mich. But spending in that category is down by roughly 14 percent over the past year. Similarly, one might have predicted spending increases in the highway and street category since the Fixing America’s Surface Transportation Act was passed in December 2015. However, spending in that category is down 2.4 percent on a year-over-year basis.

“Private construction spending has lost momentum as well, perhaps because developers and their financiers are becoming increasingly unnerved by the possibility of mini-bubbles in certain commercial real estate segments,” said Basu. “Many investors may also have adopted a wait-and-see attitude regarding policies coming out of Washington, D.C., including those related to proposed tax reform and infrastructure spending initiatives. Perhaps as a result, office and commercial-related construction spending declined in March. Still, other data suggest lingering momentum in various privately-financed segments, and data from the most recent GDP report indicate that investors continue to invest aggressively in structures. It is for this reason that today’s construction spending release is at least somewhat surprising with respect to private investment in structures. An upward revision to today’s data may be forthcoming.

“Looking ahead, all eyes are on Washington, D.C,” said Basu. “A pro-business agenda remains in the works, but little of it has been implemented thus far. Financial markets continue to express confidence regarding the ultimate execution of significant portions of this agenda, but if it remains bogged down politically, market confidence will wane and private construction spending will continue to be erratic.”

Related Stories

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.

Market Data | Jan 12, 2017

73% of construction firms plan to expand their payrolls in 2017

However, many firms remain worried about the availability of qualified workers.

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.

Market Data | Jan 5, 2017

Nonresidential spending thrives in strong November spending report

Many construction firms have reported that they remain busy but have become concerned that work could dry up in certain markets in 2017 or 2018, says Anirban Basu, ABC Chief Economist.

Market Data | Dec 21, 2016

Architecture Billings Index up slightly in November

New design contracts also return to positive levels, signifying future growth in construction activity.

Market Data | Dec 21, 2016

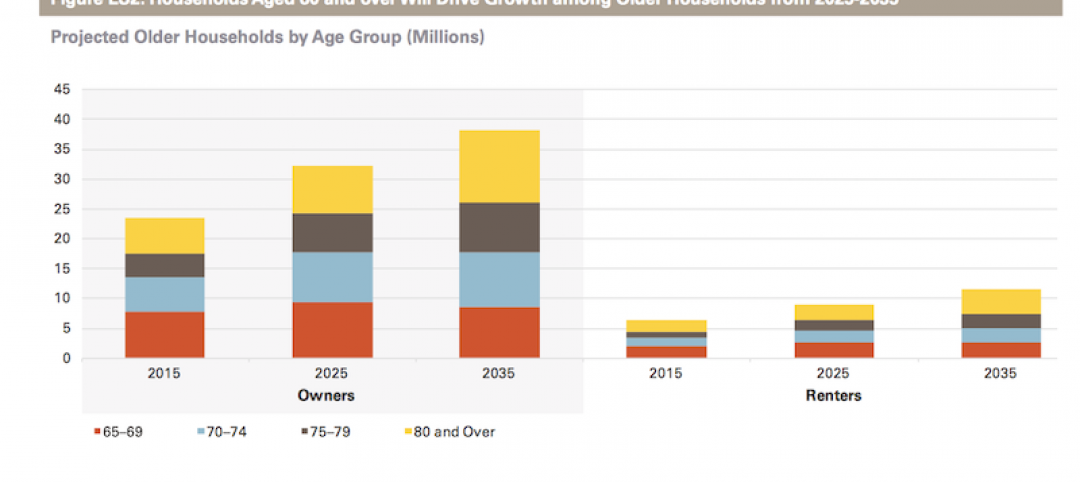

Will housing adjust to an aging population?

New Joint Center report projects 66% increase in senior heads of households by 2035.

Market Data | Dec 13, 2016

ABC predicts modest growth for 2017 nonresidential construction sector; warns of vulnerability for contractor

“The U.S. economy continues to expand amid a weak global economy and, despite risks to the construction industry, nonresidential spending should expand 3.5 percent in 2017,” says ABC Chief Economist Anirban Basu.

Market Data | Dec 2, 2016

Nonresidential construction spending gains momentum

Nonresidential spending is now 2.6 percent higher than at the same time one year ago.