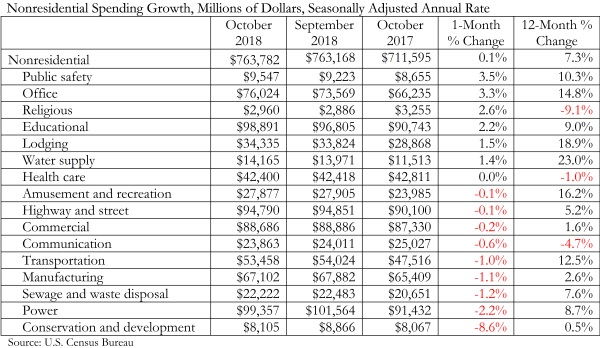

National nonresidential spending increased 0.1% in October, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data released today. Total nonresidential spending for the month stood at $763.8 billion on a seasonally adjusted annualized rate, which represents a 7.3% increase over the same time last year.

Thirteen out of 16 subsectors are associated with year-over-year increases, with the exceptions being religious (-9.1%), communication (-4.7%), and health care (-1%). Water supply (+23%), lodging (+18.9%) and amusement and recreation (+16.2%) have generated the largest increases among nonresidential construction segments over the past 12 months.

“It is remarkable that the construction spending cycle remains firmly in place despite worker shortages, tariffs, rising materials prices, financial market volatility, more restrictive monetary policy, evidence of a slowing global economy and an abundance of political controversies,” said ABC Chief Economic Anirban Basu. “With backlog still elevated, nonresidential construction spending will enter 2019 with plentiful momentum.

“It is true that not all construction spending segments have participated in the industry’s recovery. However, the number of segments experiencing negative spending growth is small and the expectation is that a turnaround in spending is likely in at least one of these categories,” said Basu. “The religious category (-9.1% year-over-year) represents less than 1% of total nonresidential construction spending. Demographic forces and a strong economy should translate into growing demand for healthcare services, which will eventually trigger more construction in the health care category (-1%), including in the form of outpatient medical centers.

“While there will always be reasons to fret about the economic outlook, 2018 will go down as a fine year for the U.S. economy and for the nation’s nonresidential construction sector,” said Basu. “That said, while demand for construction services remained strong throughout the year, many contractors indicate that profit margins are under pressure. Given the ongoing dearth of available, skilled construction workers, that is likely to continue into 2019. However, materials price dynamics could be far different given a slowing global economy and expectations for a strong U.S. dollar next year.”

*Correction: This press release originally classified data centers as a component of the communications category. Data centers are instead a component of the office category.

Related Stories

Market Data | Nov 2, 2020

More contractors report canceled projects than starts, survey finds

Construction employment declined in most metros in latest 12 months.

Multifamily Housing | Oct 30, 2020

The Weekly show: Multifamily security tips, the state of construction industry research, and AGC's market update

BD+C editors speak with experts from AGC, Charles Pankow Foundation, and Silva Consultants on the October 29 episode of "The Weekly." The episode is available for viewing on demand.

Hotel Facilities | Oct 27, 2020

Hotel construction pipeline dips 7% in Q3 2020

Hospitality developers continue to closely monitor the impact the coronavirus will have on travel demand, according to Lodging Econometrics.

Market Data | Oct 22, 2020

Multifamily’s long-term outlook rebounds to pre-covid levels in Q3

Slump was a short one for multifamily market as 3rd quarter proposal activity soars.

Market Data | Oct 21, 2020

Architectural billings slowdown moderated in September

AIA’s ABI score for September was 47.0 compared to 40.0 in August.

Market Data | Oct 21, 2020

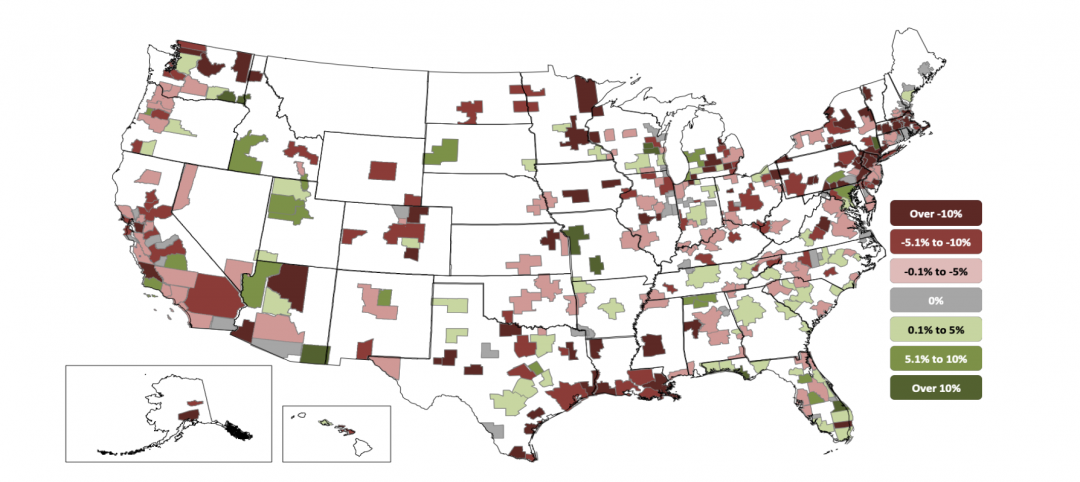

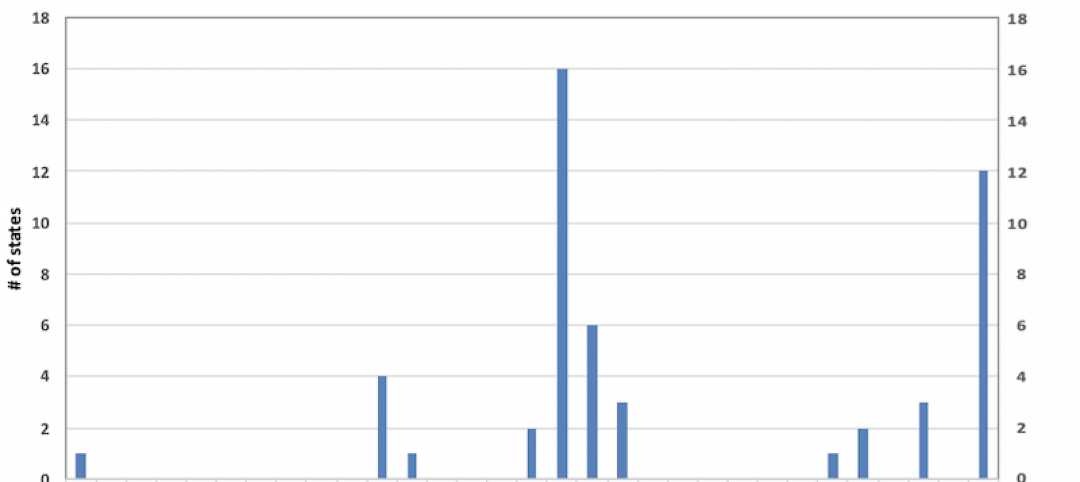

Only eight states top February peak construction employment despite gains in 32 states last month

California and Vermont post worst losses since February as Virginia and South Dakota add the most.

Market Data | Oct 20, 2020

AIA releases updated contracts for multi-family residential and prototype residential projects

New resources provide insights into mitigating and managing risk on complex residential design and construction projects.

Market Data | Oct 20, 2020

Construction officials call on Trump and Biden to establish a nationwide vaccine distribution plan to avoid confusion and delays

Officials say nationwide plan should set clear distribution priorities.

Market Data | Oct 19, 2020

5 must reads for the AEC industry today: October 19, 2020

Lower cost metros outperform pricey gateway markets and E-commerce fuels industrial's unstoppable engine.

Market Data | Oct 19, 2020

Lower-cost metros continue to outperform pricey gateway markets, Yardi Matrix reports

But year-over-year multifamily trendline remained negative at -0.3%, unchanged from July.