The medical office and industrial sectors will drive what is expected to be moderate growth in the commercial real estate market this year, predict the real estate advisory teams of Transwestern and Devencore located in 43 U.S. and Canadian metros.

The biggest potential impediments to that growth could be rising build-out costs and regulations on how medical tenants can use space.

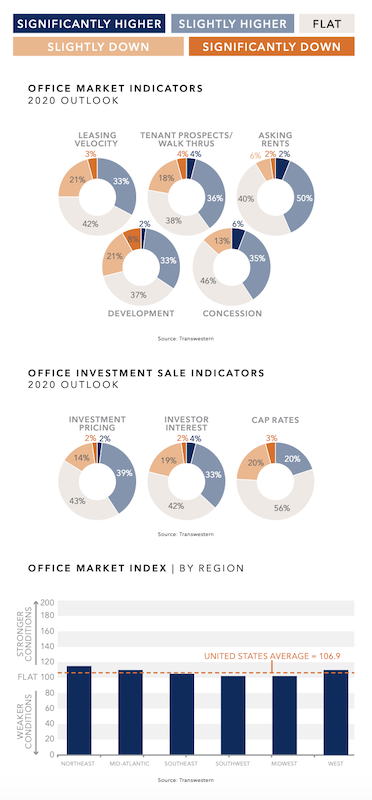

The survey (which can be downloaded from here) finds that conditions for the U.S. office market, while expected to improve, might still be down slightly from the previous year’s outlook. The Northeast, Mid-Atlantic, and West regions are expected to exhibit the strongest office demand. Two fifths of the survey’s respondents expect overall leasing velocity and tenant prospects to be flat this year, as tenants require more time to finalize their decisions.

Brokers and analysts are concerned about ebbing consumer confidence, given the upcoming elections and uncertain economy. Optimists, though, anticipate pockets of demand from tech and medical tenants. Brokers also expect tenant densification (measured by leased space per employee) to continue but at a decelerating pace from last year.

“Tenants are getting creative with space efficiency, with many opting to densify space in order to upgrade quality,” the survey observes.

Flat to slightly better conditions could prevail in most markets this year. Charts: Transwestern and Devencore

This trend might explain why respondents expect development pipelines to be only flat or slightly higher this year, with some markets showing signs of oversupply and rising construction costs. However, tenant leasing will remain intensely competitive, with concession packages staying at least even with 2019 or a bit higher, according to 81% of survey respondents.

About the same percentage think investment interest and pricing will be flat or rise slightly in 2020, and nearly three-fifths (56%) foresee flat capitalization.

The survey also looks at the markets for medical offices, industrial, and Canada’s office market. Its findings include the following:

•The medical office sector will “handsomely” outperform in 2020, with leasing activity, tenant walk throughs, asking rents and development all expected to be higher this year.

•Half of the respondents expect conditions for industrial to be healthy, albeit with slight deceleration in leasing velocity. And while brokers see some overbuilding occurring in markets like Houston and Dallas-Fort Worth, “generally, low supply, coupled with high demand from ecommerce, is forecasted to drive the market.”

•With the exception of Alberta, Canada’s major provinces—Ontario, British Columbia, and Quebec—should see leasing velocity and tenant prospects pick up this year. However, tenants are now taking anywhere from seven to 12 months to sign midsized deals.

Related Stories

Market Data | May 2, 2023

Nonresidential construction spending up 0.7% in March 2023 versus previous month

National nonresidential construction spending increased by 0.7% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $997.1 billion for the month.

Hotel Facilities | May 2, 2023

U.S. hotel construction up 9% in the first quarter of 2023, led by Marriott and Hilton

In the latest United States Construction Pipeline Trend Report from Lodging Econometrics (LE), analysts report that construction pipeline projects in the U.S. continue to increase, standing at 5,545 projects/658,207 rooms at the close of Q1 2023. Up 9% by both projects and rooms year-over-year (YOY); project totals at Q1 ‘23 are just 338 projects, or 5.7%, behind the all-time high of 5,883 projects recorded in Q2 2008.

Market Data | May 1, 2023

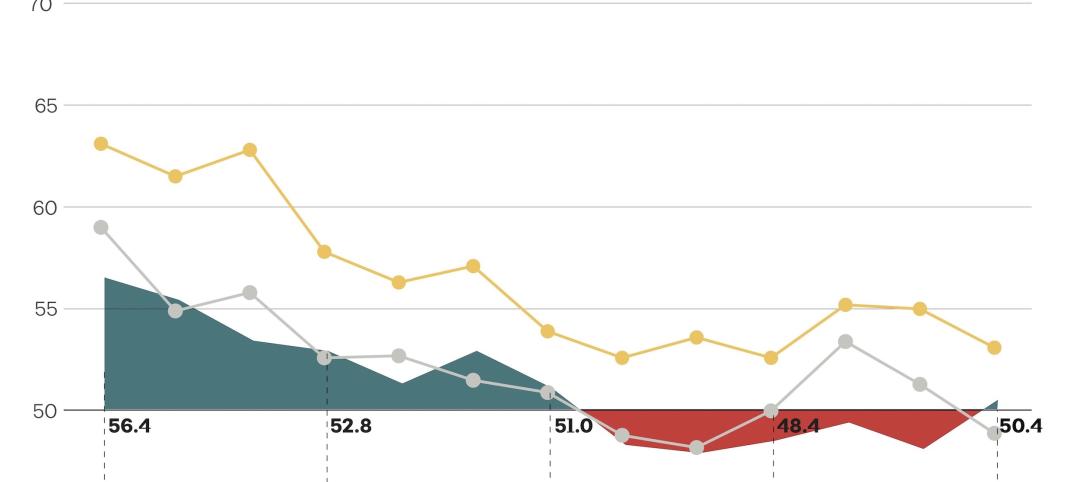

AEC firm proposal activity rebounds in the first quarter of 2023: PSMJ report

Proposal activity for architecture, engineering and construction (A/E/C) firms increased significantly in the 1st Quarter of 2023, according to PSMJ’s Quarterly Market Forecast (QMF) survey. The predictive measure of the industry’s health rebounded to a net plus/minus index (NPMI) of 32.8 in the first three months of the year.

Industry Research | Apr 25, 2023

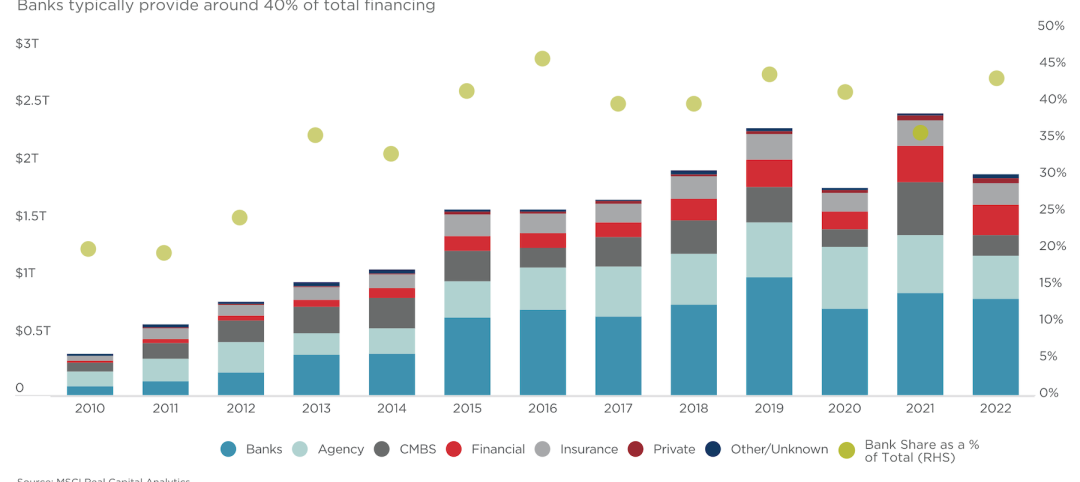

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Architects | Apr 21, 2023

Architecture billings improve slightly in March

Architecture firms reported a modest increase in March billings. This positive news was tempered by a slight decrease in new design contracts according to a new report released today from The American Institute of Architects (AIA). March was the first time since last September in which billings improved.

Contractors | Apr 19, 2023

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

Market Data | Apr 13, 2023

Construction input prices down year-over-year for first time since August 2020

Construction input prices increased 0.2% in March, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices rose 0.4% for the month.