Last year was another bumper year for New York City’s real estate market. Multifamily sales hit $12.6 billion, or 39% more that in 2013, according to a year-end report by Ariel Property Advisors, an investment property sales firm.

There were a total of 761 transactions last year, 8% more than in 2013. The borough of Brooklyn accounted for 222 of those transactions valued at $2.35 billion, or 88% higher than the Brooklyn transactions in 2013. In that borough, deals exceeding $20 million accounted for 47% of its transactions. For New York City as a whole, $20 million-plus deals accounted for more than half of all transactions.

Ariel estimates that 1,413 properties were sold last year, 13% more than in 2013. The properties sold had 47,885 total units, or 20% more than the buildings sold in 2013.

In Manhattan, whose real estate prices have been going through the roof in recent years, transactions may have declined by 12% to 139, but dollar volume jumped by 15% to $5.138 billion, with the Upper East Side being the liveliest neighborhood. The Real Deal, a website that reports on New York real estate news and trends, notes that one of the biggest deals last year was the Chetrit Group and Stellar Management’s purchase of two Upper East Side rental buildings at 1660 2nd Avenue and 160 East 88th Street for a combined $485 million.

In a recent interview with the New York Real Estate Journal, Ariel’s founder and president, Shimon Shkury, notes that the average price per square foot in Manhattan rose by 25% to $866, “as investors were willing to pay ever-higher premiums to own core Manhattan.”

For 2015, Shkury remains bullish about New York’s real estate prospects, with some caveats. “We’ve identified a few headwinds, including rising construction costs, the unknowns of the mayor’s housing policy, the sustainability of the luxury market, rents leveling off, interest rates, global uncertainty, and the strengthening dollar.” On the positive side, Shkury believes multifamily sales in New York will benefit from lower oil prices, increased job creation, improved consumer spending, and tight inventory.

Related Stories

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

Industrial Facilities | Nov 14, 2023

Some AEC firms are plugging into EV charging market

Decentralized electrical distribution is broadening recharger installation to several building types.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

MFPRO+ News | Nov 1, 2023

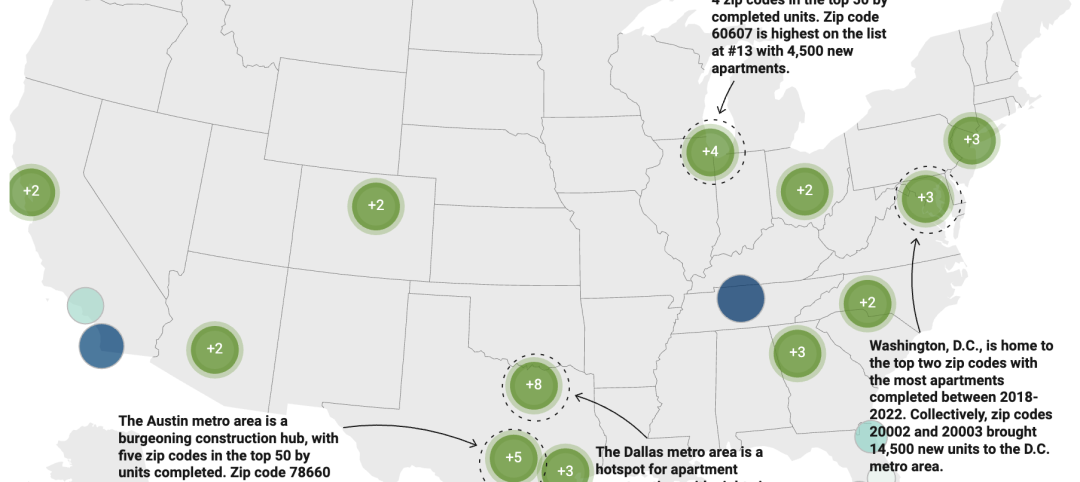

Washington, D.C., Queens, N.Y., lead nation in number of new apartments by zip code

A study of new apartment construction by zip code showed Washington D.C., and the Queens borough of New York City are the hottest multifamily markets since 2018, according to RentCafe.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.

Mass Timber | Oct 27, 2023

Five winners selected for $2 million Mass Timber Competition

Five winners were selected to share a $2 million prize in the 2023 Mass Timber Competition: Building to Net-Zero Carbon. The competition was co-sponsored by the Softwood Lumber Board and USDA Forest Service (USDA) with the intent “to demonstrate mass timber’s applications in architectural design and highlight its significant role in reducing the carbon footprint of the built environment.”