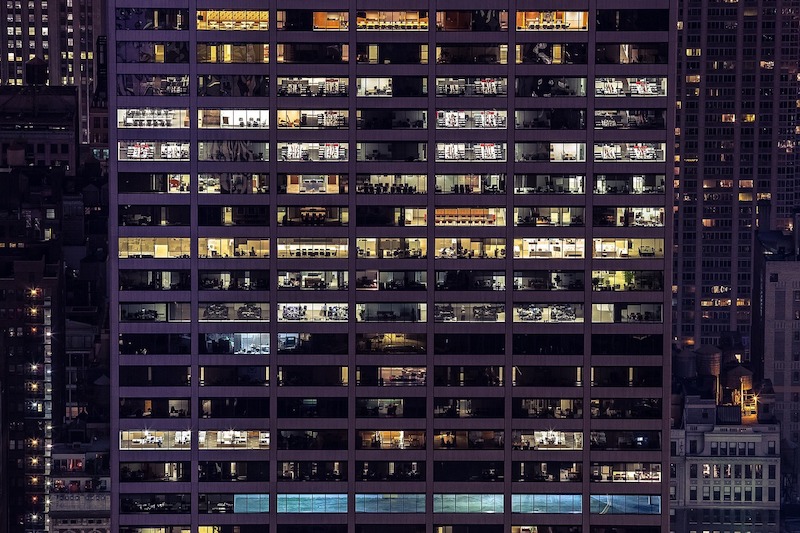

A rising tide of new office projects may be skewing the national average rental rate upward and obscuring increased leasing challenges for second-generation properties in many markets, Transwestern’s latest U.S. office market report suggests.

Monthly asking rent averaged $26.97 per square foot in the third quarter, representing a 3.4% increase from a year earlier and a five-year gain of 19.7%. Much of that national increase reflects above-market rents at new or renovated projects, where landlords have incurred elevated material and labor costs to complete amenity-rich offerings.

The national vacancy rate has plateaued near 9.8%, equal to the rate one year ago. A dozen of the 49 markets Transwestern tracks showed negative net absorption or an increase in the volume of vacant space for the 12 months ended September. Nationwide, annualized absorption through the third quarter was 57.3 million square feet, or roughly one-third less than the 85.2 million square feet absorbed in 2018.

Office construction is at a cyclical high. Building starts in the 12 months through the third quarter were up 12.1% over the year-ago period, with more than 166 million square feet of projects underway. The sector delivered 18.5 million square feet of new space in the recent quarter, less than the second quarter’s 21.7 million square feet but up 1.3% from a year earlier, while the national economy and average monthly job growth have slowed.

“Developers have responded vigorously to tenant preferences for new construction,” said Jimmy Hinton, Senior Managing Director of Investment & Analytics at Transwestern. “In many markets, new construction is outpacing already moderating tenant demand, creating extra pressure on older-vintage properties. Landlords are increasingly challenged in reconciling capital improvement needs with cycle timing and prospects for suitable investment returns.”

While high-end rents at new properties can increase a market’s average lease rate, new construction drives rent downward when landlords feel pressure to compete for tenants by lowering rates. In Houston, for example, average third quarter asking rent had declined 0.7% from a year earlier.

Stuart Showers, Vice President of Research in Houston, predicts other markets will experience a similar shift in the coming months, and could represent a late-cycle playbook for landlords in other markets, should macro conditions deteriorate.

“The volume of new office construction pushing through Houston has resulted in downward pressure on rental rates, a situation that will manifest throughout second-generation product in a number of the nation’s markets that have high construction activity,” Showers said.

Download the full third quarter 2019 U.S. office market report at: www.twurls.com/us-office-3q19

Related Stories

Market Data | Mar 24, 2021

Architecture billings climb into positive territory after a year of monthly declines

AIA’s ABI score for February was 53.3 compared to 44.9 in January.

Market Data | Mar 22, 2021

Construction employment slips in 225 metros from January 2020 to January 2021

Rampant cancellations augur further declines ahead.

Market Data | Mar 18, 2021

Commercial Construction Contractors’ Outlook lifts on rising revenue expectations

Concerns about finding skilled workers, material costs, and steel tariffs linger.

Market Data | Mar 16, 2021

Construction employment in January lags pre-pandemic mark in 42 states

Canceled projects, supply-chain woes threaten future jobs.

Market Data | Mar 15, 2021

Rising materials prices and supply chain disruptions are hurting many construction firms

The same firms are already struggling to cope with pandemic impacts.

Market Data | Mar 11, 2021

Soaring materials costs, supply-chain problems, and project cancellations continue to impact construction industry

Costs and delayed deliveries of materials, parts, and supplies are vexing many contractors.

Market Data | Mar 8, 2021

Construction employment declines by 61,000 in February

Association officials urge congress and Biden administration to focus on new infrastructure funding.

Market Data | Mar 2, 2021

Construction spending rises in January as private nonresidential sector stages rare gain

Private nonresidential market shrinks 10% since January 2020 with declines in all 11 segments.

Market Data | Feb 24, 2021

2021 won’t be a growth year for construction spending, says latest JLL forecast

Predicts second-half improvement toward normalization next year.

Market Data | Feb 23, 2021

Architectural billings continue to contract in 2021

AIA’s Architecture Billings Index (ABI) score for January was 44.9 compared to 42.3 in December.