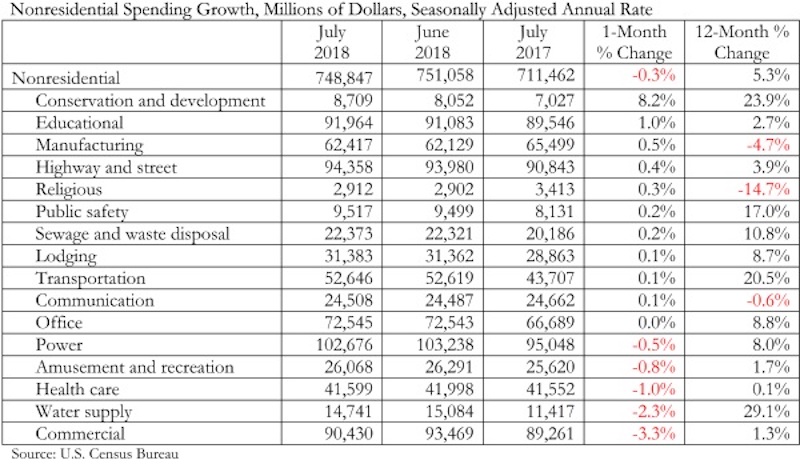

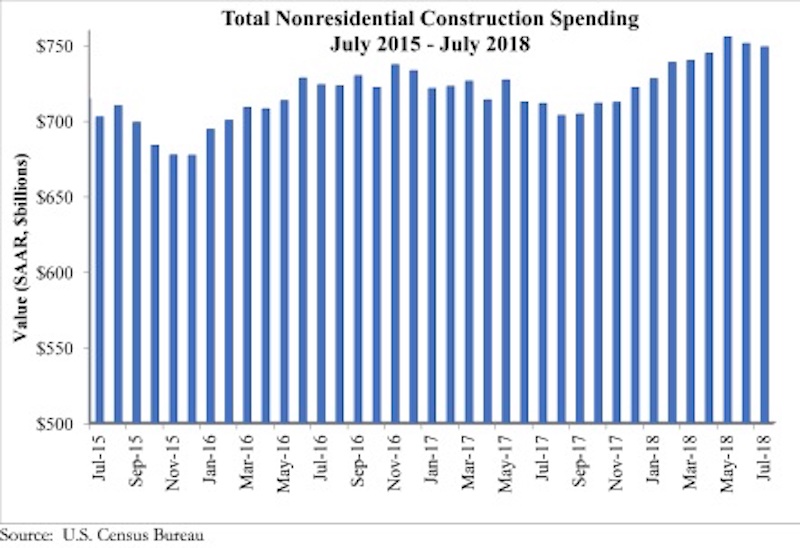

National nonresidential construction spending declined 0.3% in July, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data recently released. Total nonresidential spending stood at $748.8 billion on a seasonally adjusted, annualized rate in July, an increase of 5.3% from the same time last year. Private nonresidential spending fell 1% in July, while public nonresidential spending expanded 0.7%.

“Construction spending dynamics have reversed almost completely during the past 12 to 18 months,” said ABC Chief Economist Anirban Basu. “Earlier in the cycle, private construction expanded briskly, driven in part by abundantly available financing at very low interest rates. While private construction volumes continue to be elevated, they are no longer expanding at quite the same rate. For instance, construction spending on lodging and office space barely budged for the month, while commercial construction, such as fulfillment and shopping centers, fell 3.3%.

“By contrast, nonresidential construction segments associated with large public components, including conservation and development, education, highway and street, public safety, and sewage and waste disposal all experienced an uptick in spending in July,” said Basu. “Many states are now running budget surpluses for the first time in years, in part due to surging capital gains tax collections. One result is that more public projects are moving forward. As evidence, construction spending in the water supply category is up 29% on a year-over-year basis, conservation and development (e.g. flood control) by 24%, transportation by nearly 21%, public safety-related spending by 17% and sewage and waste disposal by 11%.

“The implication is that the economy’s strong performance is increasingly translating into infrastructure spending, even in the absence of a federal infrastructure package,” said Basu. “Given recent economic and financial market performance, there is every reason to believe that state and local government finances, though still fragile in many instances, will continue to improve. That strongly suggests public construction spending will continue to progress during the months ahead. In constrast, private construction spending growth is more likely to remain constrained for a number of reasons, including recent increases in private borrowing costs and concerns that segments in certain communities are now overbuilt or approaching overbuilt status.”

Related Stories

Market Data | Nov 30, 2016

Marcum Commercial Construction Index reports industry outlook has shifted; more change expected

Overall nonresidential construction spending in September totaled $690.5 billion, down a slight 0.7 percent from a year earlier.

Industry Research | Nov 30, 2016

Multifamily millennials: Here is what millennial renters want in 2017

It’s all about technology and convenience when it comes to the things millennial renters value most in a multifamily facility.

Market Data | Nov 29, 2016

It’s not just traditional infrastructure that requires investment

A national survey finds strong support for essential community buildings.

Industry Research | Nov 28, 2016

Building America: The Merit Shop Scorecard

ABC releases state rankings on policies affecting construction industry.

Multifamily Housing | Nov 28, 2016

Axiometrics predicts apartment deliveries will peak by mid 2017

New York is projected to lead the nation next year, thanks to construction delays in 2016

Market Data | Nov 22, 2016

Construction activity will slow next year: JLL

Risk, labor, and technology are impacting what gets built.

Market Data | Nov 17, 2016

Architecture Billings Index rebounds after two down months

Decline in new design contracts suggests volatility in design activity to persist.

Market Data | Nov 11, 2016

Brand marketing: Why the B2B world needs to embrace consumers

The relevance of brand recognition has always been debatable in the B2B universe. With notable exceptions like BASF, few manufacturers or industry groups see value in generating top-of-mind awareness for their products and services with consumers.

Industry Research | Nov 8, 2016

Austin, Texas wins ‘Top City’ in the Emerging Trends in Real Estate outlook

Austin was followed on the list by Dallas/Fort Worth, Texas and Portland, Ore.

Market Data | Nov 2, 2016

Nonresidential construction spending down in September, but August data upwardly revised

The government revised the August nonresidential construction spending estimate from $686.6 billion to $696.6 billion.