PwC's latest quarterly analysis reported that the worldwide engineering and construction industries closed 218 merger and acquisition deals in 2014 worth more than $172 billion. The numbers are more than three times greater than 2013's total of $55 billion. Last year was the busiest year for M&A activity since 2007.

There were four mega deals in the fourth quarter of 2014, including one valued at $35 billion. Overall, there were 21 mega deals last year, totaling $127 billion. The greatest number of deals took place in Asia and Oceania.

“Some of the significant year-over-year growth in M&A activity can be attributed to companies seeking to better position themselves for mega projects that not only require a longer commitment of time and capital, but also deeper pools of highly skilled talent,” said H. Kent Goetjen, U.S. engineering and construction leader at PwC. “The lack of available talent, which is being fueled in the U.S. by the retirement of the baby boomer generation, is driving up the price of acquisitions and will continue to do so for the foreseeable future.”

PwC analysts are monitoring several other trends that are expected to affect the values and locations of deals in the engineering and construction sector, including:

• The integration of design and consultancy firms with construction companies is well under way as the E&C industry continues to move toward full service integration. Firms are generally looking to leverage higher-value added services, such as design, while balancing out their regional exposure.

• A major driver of consolidation is talent needs, as companies compete for specialized technical expertise in high-demand segments. As an alternative to acquiring expertise, some companies are embarking upon joint ventures, but these are complicated and add significant operational risk to any project. Companies are positioning themselves to bid on larger, increasingly complex projects with new partners and non-traditional sources of funding.

• A flurry of smaller, local deals took place, particularly within Asia. Cross-border activity dropped to 22% of the total in the quarter, with most local activity occurring in Asia.

• Cement oversupply and tepid demand continue to plague the industry. Top players, in an attempt to maintain their market share and margin, continue to acquire smaller companies post-merger announcement of Holcim and Lafarge.

• The consolidation in Asia was not limited to the construction materials segment, and not all driven by overcapacity, as all segments of E&C experienced a pick-up in local consolidation. The uncertain economic outlook in China raises many concerns for inbound activity in Asia but does not seem to be hindering deal activity in the region.

Related Stories

Building Owners | Aug 23, 2023

Charles Pankow Foundation releases free project delivery selection tool for building owners, developers, and project teams

Building owners and project teams can use the new Building Owner Assessment Tool (BOAT) to better understand how an owner's decision-making profile impacts outcomes for different project delivery methods.

Transportation & Parking Facilities | Aug 23, 2023

California parking garage features wind-activated moving mural

A massive, colorful, moving mural creatively conceals a newly opened parking garage for a global technology company in Mountain View, Calif.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

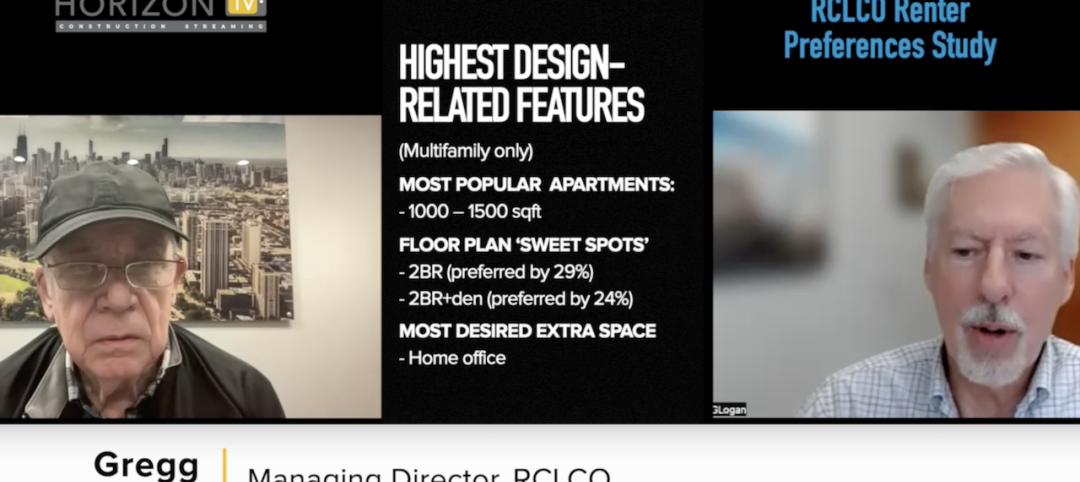

Apartments | Aug 22, 2023

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Shopping Centers | Aug 22, 2023

The mall of the future

There are three critical aspects of mall design that, through evolution, have proven to be instrumental in the staying power of a retail destination: parking, planning, and customer experience. This are crucial to the mall of the future.

Healthcare Facilities | Aug 21, 2023

Sutter Health’s new surgical care center finishes three months early, $3 million under budget

Sutter Health’s Samaritan Court Ambulatory Care and Surgery Center (Samaritan Court), a three-story, 69,000 sf medical office building, was recently completed three months early and $3 million under budget, according to general contractor Skanska.

Healthcare Facilities | Aug 18, 2023

Psychiatric hospital to feature biophilic elements, aim for net-zero energy

A new 521,000 sf, 350-bed behavioral health hospital in Lakewood, Wash., a Tacoma suburb, will serve forensic patients who enter care through the criminal court system, freeing other areas of campus to serve civil patients. The facility at Western State Hospital, to be designed by HOK, will promote a holistic approach to rehabilitation as part of the state’s vision for transforming behavioral health.

Vertical Transportation | Aug 17, 2023

Latest version of elevator safety code has more than 100 changes

A new version of ASME A17.1/CSA B44, a safety code for elevators, escalators, and related equipment developed by the American Society of Mechanical Engineers, will be released next month.

Adaptive Reuse | Aug 16, 2023

One of New York’s largest office-to-residential conversions kicks off soon

One of New York City’s largest office-to-residential conversions will soon be underway in lower Manhattan. 55 Broad Street, which served as the headquarters for Goldman Sachs from 1967 until 1983, will be reborn as a residence with 571 market rate apartments. The 30-story building will offer a wealth of amenities including a private club, wellness and fitness activities.

Sustainability | Aug 15, 2023

Carbon management platform offers free carbon emissions assessment for NYC buildings

nZero, developer of a real-time carbon accounting and management platform, is offering free carbon emissions assessments for buildings in New York City. The offer is intended to help building owners prepare for the city’s upcoming Local Law 97 reporting requirements and compliance. This law will soon assess monetary fines for buildings with emissions that are in non-compliance.