PwC's latest quarterly analysis reported that the worldwide engineering and construction industries closed 218 merger and acquisition deals in 2014 worth more than $172 billion. The numbers are more than three times greater than 2013's total of $55 billion. Last year was the busiest year for M&A activity since 2007.

There were four mega deals in the fourth quarter of 2014, including one valued at $35 billion. Overall, there were 21 mega deals last year, totaling $127 billion. The greatest number of deals took place in Asia and Oceania.

“Some of the significant year-over-year growth in M&A activity can be attributed to companies seeking to better position themselves for mega projects that not only require a longer commitment of time and capital, but also deeper pools of highly skilled talent,” said H. Kent Goetjen, U.S. engineering and construction leader at PwC. “The lack of available talent, which is being fueled in the U.S. by the retirement of the baby boomer generation, is driving up the price of acquisitions and will continue to do so for the foreseeable future.”

PwC analysts are monitoring several other trends that are expected to affect the values and locations of deals in the engineering and construction sector, including:

• The integration of design and consultancy firms with construction companies is well under way as the E&C industry continues to move toward full service integration. Firms are generally looking to leverage higher-value added services, such as design, while balancing out their regional exposure.

• A major driver of consolidation is talent needs, as companies compete for specialized technical expertise in high-demand segments. As an alternative to acquiring expertise, some companies are embarking upon joint ventures, but these are complicated and add significant operational risk to any project. Companies are positioning themselves to bid on larger, increasingly complex projects with new partners and non-traditional sources of funding.

• A flurry of smaller, local deals took place, particularly within Asia. Cross-border activity dropped to 22% of the total in the quarter, with most local activity occurring in Asia.

• Cement oversupply and tepid demand continue to plague the industry. Top players, in an attempt to maintain their market share and margin, continue to acquire smaller companies post-merger announcement of Holcim and Lafarge.

• The consolidation in Asia was not limited to the construction materials segment, and not all driven by overcapacity, as all segments of E&C experienced a pick-up in local consolidation. The uncertain economic outlook in China raises many concerns for inbound activity in Asia but does not seem to be hindering deal activity in the region.

Related Stories

Industrial Facilities | Aug 3, 2023

The state of battery manufacturing in the era of EV

One of the most significant changes seen in today’s battery plant is the full manufacturing process—from raw materials to the fully operational battery.

Government Buildings | Aug 2, 2023

A historic courthouse in Charlotte is updated and expanded by Robert A.M. Stern Architects

Robert A.M. Stern Architects’ design retains the original building’s look and presence.

Hotel Facilities | Aug 2, 2023

Top 5 markets for hotel construction

According to the United States Construction Pipeline Trend Report by Lodging Econometrics (LE) for Q2 2023, the five markets with the largest hotel construction pipelines are Dallas with a record-high 184 projects/21,501 rooms, Atlanta with 141 projects/17,993 rooms, Phoenix with 119 projects/16,107 rooms, Nashville with 116 projects/15,346 rooms, and Los Angeles with 112 projects/17,797 rooms.

Architects | Aug 1, 2023

Ware Malcomb announces hire of Jason Golub as Regional Director

In this role, Golub is responsible for the overall leadership and continued growth of the office.

Market Data | Aug 1, 2023

Nonresidential construction spending increases slightly in June

National nonresidential construction spending increased 0.1% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Spending is up 18% over the past 12 months. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion in June.

Healthcare Facilities | Aug 1, 2023

Top 10 healthcare design projects for 2023

The HKS-designed Allegheny Health Network Wexford (Pa.) Hospital and Flad Architects' Sarasota Memorial Hospital - Venice (Fla.) highlight 10 projects to win 2023 Healthcare Design Awards from the American Institute of Architects Academy of Architecture for Health.

Digital Twin | Jul 31, 2023

Creating the foundation for a Digital Twin

Aligning the BIM model with the owner’s asset management system is the crucial first step in creating a Digital Twin. By following these guidelines, organizations can harness the power of Digital Twins to optimize facility management, maintenance planning, and decision-making throughout the building’s lifecycle.

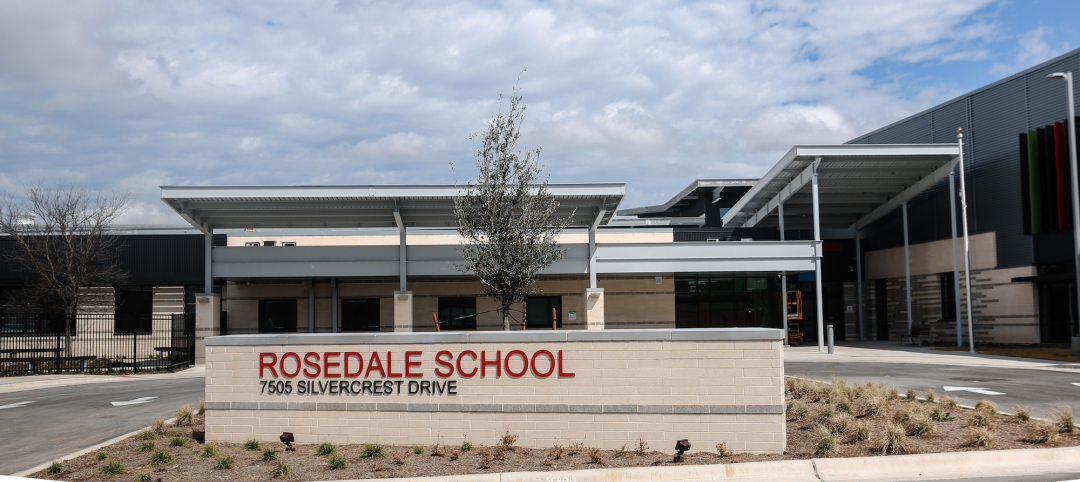

K-12 Schools | Jul 31, 2023

Austin’s new Rosedale School serves students with special needs aged 3 to 22

In Austin, the Rosedale School has opened for students with special needs aged 3 to 22. The new facility features sensory rooms, fully accessible playgrounds and gardens, community meeting spaces, and an on-site clinic. The school serves 100 learners with special needs from across Austin Independent School District (ISD).

MFPRO+ New Projects | Jul 27, 2023

OMA, Beyer Blinder Belle design a pair of sculptural residential towers in Brooklyn

Eagle + West, composed of two sculptural residential towers with complementary shapes, have added 745 rental units to a post-industrial waterfront in Brooklyn, N.Y. Rising from a mixed-use podium on an expansive site, the towers include luxury penthouses on the top floors, numerous market rate rental units, and 30% of units designated for affordable housing.

Affordable Housing | Jul 27, 2023

Houston to soon have 50 new residential units for youth leaving foster care

Houston will soon have 50 new residential units for youth leaving the foster care system and entering adulthood. The Houston Alumni and Youth (HAY) Center has broken ground on its 59,000-sf campus, with completion expected by July 2024. The HAY Center is a nonprofit program of Harris County Resources for Children and Adults and for foster youth ages 14-25 transitioning to adulthood in the Houston community.