Financing solutions provider Billd recently surveyed nearly 900 commercial construction professionals across the U.S. for its 2023 National Subcontractor Market Report. Its key finding: rising input prices for materials and labor cost subcontractors $97 billion in unplanned expenses last year.

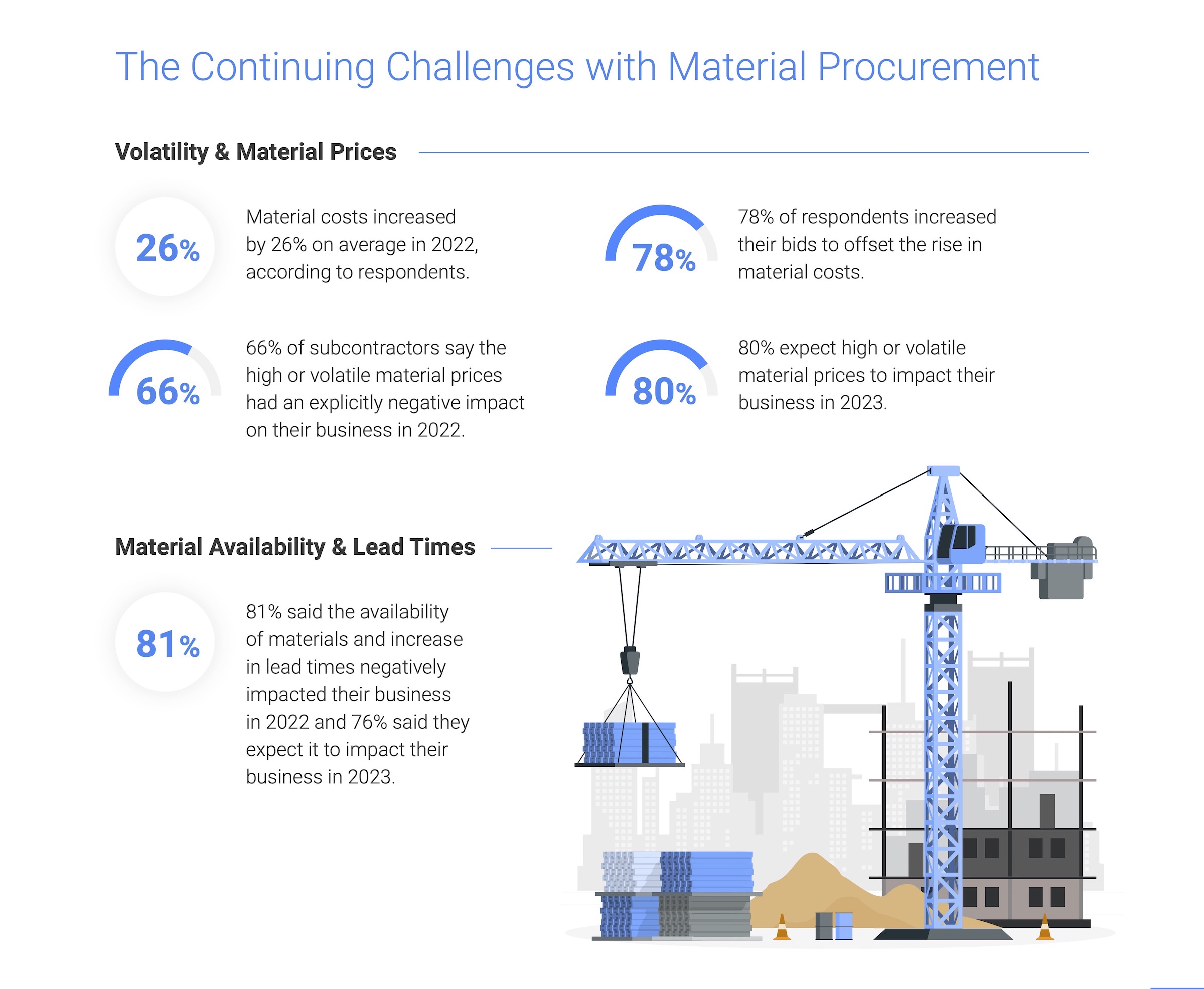

Rising material costs and price volatility are not new issues for subcontractors, with 81% of those surveyed reporting a negative effect on their businesses in 2022; 80% expect that trend to continue. It is no surprise given material costs jumped a staggering 26%, according to respondents. Similarly, competition for labor due to the longtime labor shortage was validated by a 15% average increase in labor cost. Together, those increases amounted to $97 billion in additional expenses for the subcontractor. While some subcontractors increased their bids to offset these rapidly rising costs, one third of respondents were unable to raise those bids commensurate with their expenses. This resulted in 57% of businesses reporting a decrease in profitability, despite 61% reporting revenue growth.

"Subcontractors are the foundation of the construction industry, providing all material and labor to complete a project," said Chris Doyle, CEO of Billd. "They purchase that material and pay for that labor upfront, not being paid for their work for 74 days, a result of the dysfunctional payment cycle. If you add unplanned expenses due to rising costs in material and labor, it puts an unrealistic burden on subcontractors to provide that foundation."

The report examines how macroeconomic conditions from this and prior years impacted subcontractors in 2022, as well as their outlook for 2023. It also creates hope by providing perspective on new financing options subcontractors can leverage as mainstays – like supplier terms – become less reliable. 72% of respondents report having supplier terms of 30 days or less. Compared to a 74-day average wait time for payment, it is no surprise that 51% deem the length of their terms insufficient.

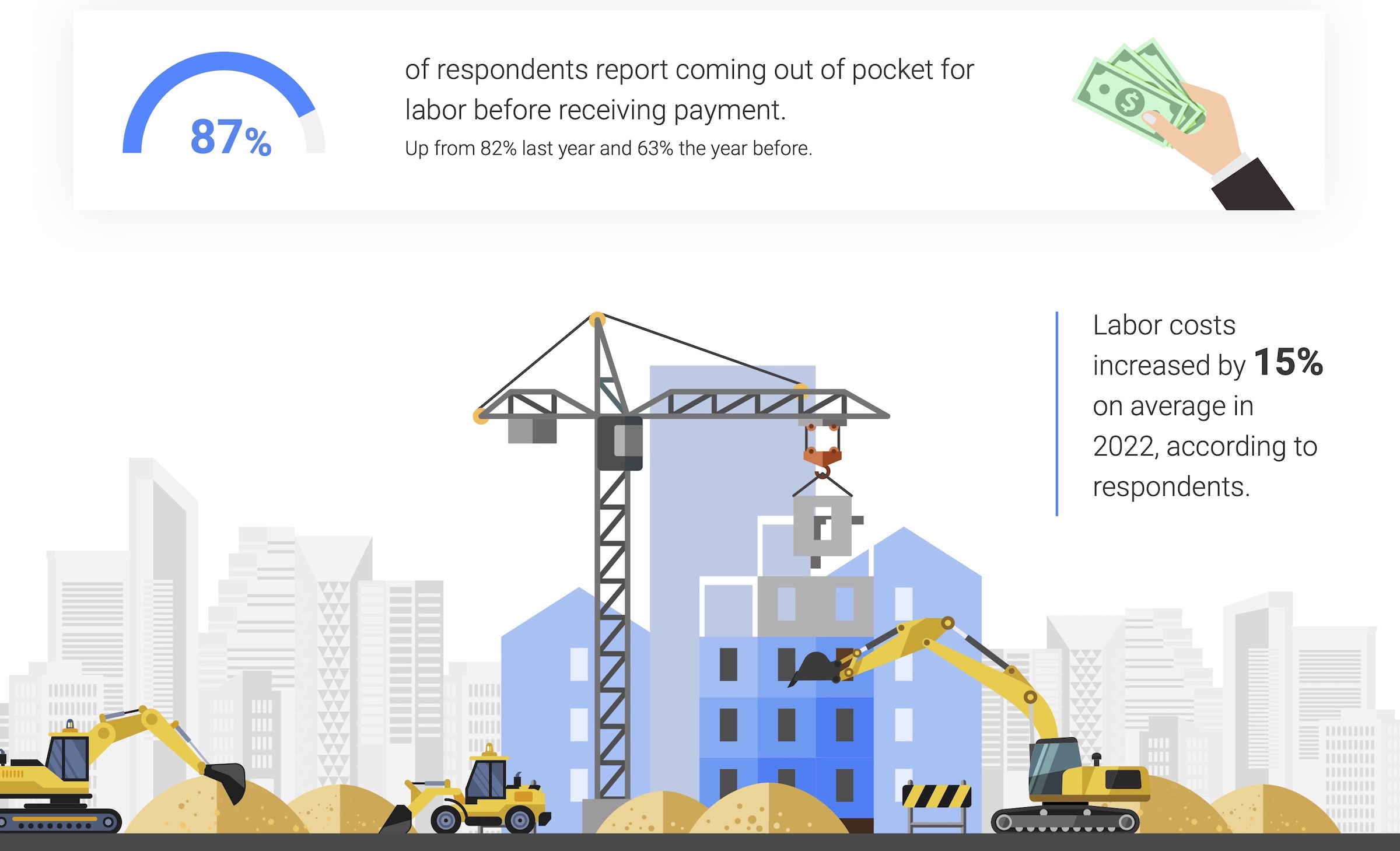

Supplier terms also have an unforeseen cost; most suppliers (also surveyed) state that they offer discounts for upfront payment. Despite those disadvantages, 87% of respondents still rely on supplier terms as their predominant means of buying materials. When it comes to funding their increasing labor costs, traditional financing options are even less accessible, leaving 87% of respondents coming out of pocket for labor before getting paid themselves. Luckily, the report highlights financial relief for labor as well as materials.

Related Stories

| Mar 11, 2011

Chicago office building will serve tenants and historic church

The Alter Group is partnering with White Oak Realty Partners to develop a 490,000-sf high-performance office building in Chicago’s West Loop. The tower will be located on land owned by Old St. Patrick’s Church (a neighborhood landmark that survived the Chicago Fire of 1871) that’s currently being used as a parking lot.

| Mar 11, 2011

Community sports center in Nashville features NCAA-grade training facility

A multisport community facility in Nashville featuring a training facility that will meet NCAA Division I standards is being constructed by St. Louis-based Clayco and Chicago-based Pinnacle.

| Mar 11, 2011

Slam dunk for the University of Nebraska’s basketball arena

The University of Nebraska men’s and women’s basketball programs will have a new home beginning in 2013. Designed by the DLR Group, the $344 million West Haymarket Civic Arena in Lincoln, Neb., will have 16,000 seats, suites, club amenities, loge, dedicated locker rooms, training rooms, and support space for game operations.

| Mar 10, 2011

How AEC Professionals Are Using Social Media

You like LinkedIn. You’re not too sure about blogs. For many AEC professionals, it’s still wait-and-see when it comes to social media.

| Mar 7, 2011

Sika Sarnafil announces 2010 roofing Contractor Project of the Year winners

Sika Sarnafil announced winners of its 2010 Contractor Project of the Year Competition. Twelve contractors were recognized for outstanding workmanship in completing a project using a Sika Sarnafil thermoplastic membrane for roofing or waterproofing applications. A winner and two finalists were chosen from each of four different categories: Low Slope, Steep Slope, Waterproofing and Sustainability.

| Mar 3, 2011

Webcor Builders and Shangri-La Construction form partnership

Webcor Builders and Shangri-La Construction announced today that the two general contractors have formed an exclusive partnership to pursue and provide general contracting and construction management services in select western states including California, Arizona, Nevada and Texas. The partnership, which will be named Webcor LA, will pursue construction projects across aviation, commercial real estate and tenant improvement, hospitality, institutional, healthcare, industrial, public works, and multi-family categories.

| Mar 2, 2011

Design professionals grow leery of green promises

Legal claims over sustainability promises vs. performance of certified green buildings are beginning to mount—and so are warnings to A/E/P and environmental consulting firms, according to a ZweigWhite report.

| Mar 2, 2011

How skyscrapers can save the city

Besides making cities more affordable and architecturally interesting, tall buildings are greener than sprawl, and they foster social capital and creativity. Yet some urban planners and preservationists seem to have a misplaced fear of heights that yields damaging restrictions on how tall a building can be. From New York to Paris to Mumbai, there’s a powerful case for building up, not out.

| Mar 1, 2011

How to make rentals more attractive as the American dream evolves, adapts

Roger K. Lewis, architect and professor emeritus of architecture at the University of Maryland, writes in the Washington Post about the rising market demand for rental housing and how Building Teams can make these properties a desirable choice for consumer, not just an economically prudent and necessary one.

| Feb 24, 2011

Lending revives stalled projects

An influx of fresh capital into U.S. commercial real estate is bringing some long-stalled development projects back to life and launching new construction of apartments, office buildings and shopping centers, according to a Wall Street Journal article.