Financing solutions provider Billd recently surveyed nearly 900 commercial construction professionals across the U.S. for its 2023 National Subcontractor Market Report. Its key finding: rising input prices for materials and labor cost subcontractors $97 billion in unplanned expenses last year.

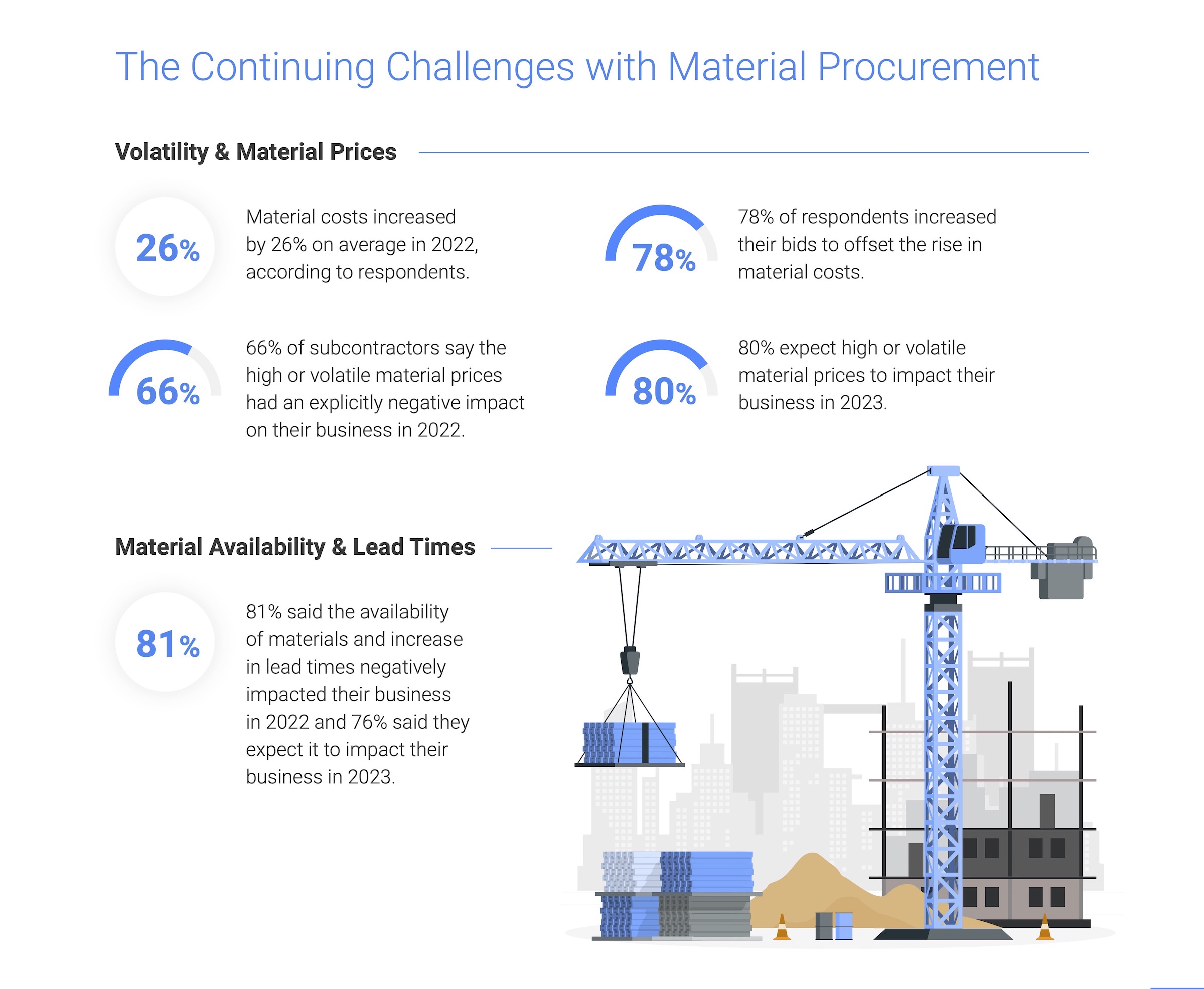

Rising material costs and price volatility are not new issues for subcontractors, with 81% of those surveyed reporting a negative effect on their businesses in 2022; 80% expect that trend to continue. It is no surprise given material costs jumped a staggering 26%, according to respondents. Similarly, competition for labor due to the longtime labor shortage was validated by a 15% average increase in labor cost. Together, those increases amounted to $97 billion in additional expenses for the subcontractor. While some subcontractors increased their bids to offset these rapidly rising costs, one third of respondents were unable to raise those bids commensurate with their expenses. This resulted in 57% of businesses reporting a decrease in profitability, despite 61% reporting revenue growth.

"Subcontractors are the foundation of the construction industry, providing all material and labor to complete a project," said Chris Doyle, CEO of Billd. "They purchase that material and pay for that labor upfront, not being paid for their work for 74 days, a result of the dysfunctional payment cycle. If you add unplanned expenses due to rising costs in material and labor, it puts an unrealistic burden on subcontractors to provide that foundation."

The report examines how macroeconomic conditions from this and prior years impacted subcontractors in 2022, as well as their outlook for 2023. It also creates hope by providing perspective on new financing options subcontractors can leverage as mainstays – like supplier terms – become less reliable. 72% of respondents report having supplier terms of 30 days or less. Compared to a 74-day average wait time for payment, it is no surprise that 51% deem the length of their terms insufficient.

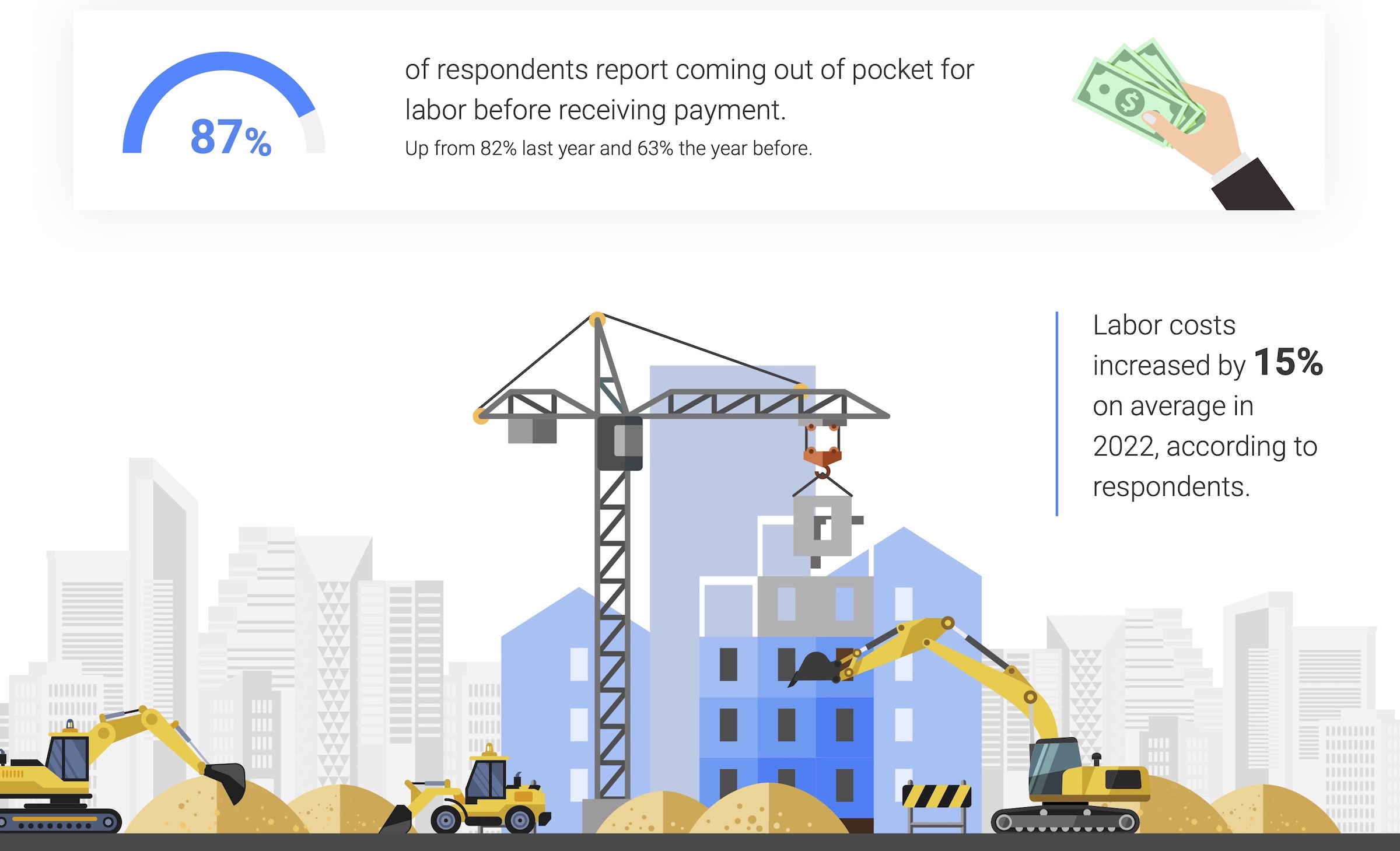

Supplier terms also have an unforeseen cost; most suppliers (also surveyed) state that they offer discounts for upfront payment. Despite those disadvantages, 87% of respondents still rely on supplier terms as their predominant means of buying materials. When it comes to funding their increasing labor costs, traditional financing options are even less accessible, leaving 87% of respondents coming out of pocket for labor before getting paid themselves. Luckily, the report highlights financial relief for labor as well as materials.

Related Stories

| Feb 23, 2011

London 2012: What Olympic Park looks like today

London 2012 released a series of aerial images that show progress at Olympic Park, including a completed roof on the stadium (where seats are already installed), tile work at the aquatic centre, and structural work complete on more than a quarter of residential projects at Olympic Village.

| Feb 23, 2011

Call for Entries: 2011 Building Team Awards, Deadline: March 25, 2011

The 14th Annual Building Team Awards recognizes newly built projects that exhibit architectural and construction excellence—and best exemplify the collaboration of the Building Team, including the owner, architect, engineer, and contractor.

| Feb 23, 2011

Green building on the chopping block in House spending measure

Bryan Howard, Legislative Director of the U.S. Green Building Council, blogs about proposed GOP budget cuts that could impact green building in the commercial sector.

| Feb 22, 2011

LEED Volume Program celebrates its 500th certified Pilot Project

More than 500 building projects have certified through the LEED Volume Program since the pilot launched in 2006, according to the U.S. Green Building Council. The LEED Volume Program streamlines the certification process for high-volume property owners and managers, from commercial real estate firms, national retailers and hospitality providers, to local, state and federal governments.

| Feb 15, 2011

New 2030 Challenge to include carbon footprint of building materials and products

Architecture 2030 has just broadened the scope of its 2030 Challenge, issuing an additional challenge regarding the climate impact of building products. The 2030 Challenge for Products aims to reduce the embodied carbon (meaning the carbon emissions equivalent) of building products 50% by 2030.

| Feb 15, 2011

New Urbanist Andrés Duany: We need a LEED Brown rating

Andrés Duany advocates a "LEED Brown" rating that would give contractors credit for using traditional but low cost measures that are not easy to quantify or certify. He described these steps as "the original green," and "what we did when we didn't have money." Ostensibly, LEED Brown would be in addition to the current Silver, Gold and Platinum ratings.

| Feb 14, 2011

Sustainable Roofing: A Whole-Building Approach

According to sustainability experts, the first step toward designing an energy-efficient roofing system is to see roof materials and systems as an integral component of the enclosure and the building as a whole. Earn 1.0 AIA/CES learning units by studying this article and successfully completing the online exam.

| Feb 11, 2011

Four Products That Stand Up to Hurricanes

What do a panelized wall system, a newly developed roof hatch, spray polyurethane foam, and a custom-made curtain wall have in common? They’ve been extensively researched and tested for their ability to take abuse from the likes of Hurricane Katrina.