Financing solutions provider Billd recently surveyed nearly 900 commercial construction professionals across the U.S. for its 2023 National Subcontractor Market Report. Its key finding: rising input prices for materials and labor cost subcontractors $97 billion in unplanned expenses last year.

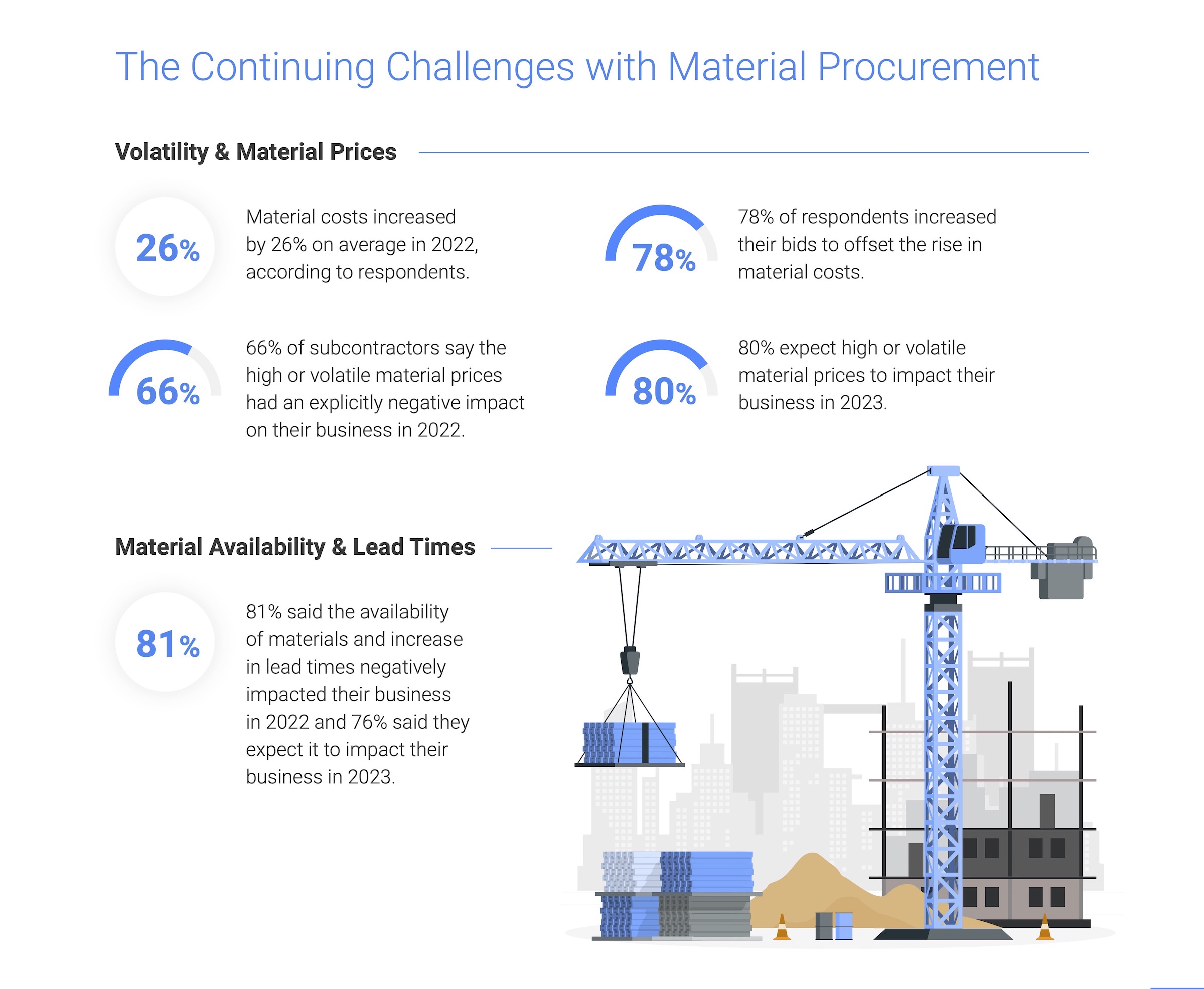

Rising material costs and price volatility are not new issues for subcontractors, with 81% of those surveyed reporting a negative effect on their businesses in 2022; 80% expect that trend to continue. It is no surprise given material costs jumped a staggering 26%, according to respondents. Similarly, competition for labor due to the longtime labor shortage was validated by a 15% average increase in labor cost. Together, those increases amounted to $97 billion in additional expenses for the subcontractor. While some subcontractors increased their bids to offset these rapidly rising costs, one third of respondents were unable to raise those bids commensurate with their expenses. This resulted in 57% of businesses reporting a decrease in profitability, despite 61% reporting revenue growth.

"Subcontractors are the foundation of the construction industry, providing all material and labor to complete a project," said Chris Doyle, CEO of Billd. "They purchase that material and pay for that labor upfront, not being paid for their work for 74 days, a result of the dysfunctional payment cycle. If you add unplanned expenses due to rising costs in material and labor, it puts an unrealistic burden on subcontractors to provide that foundation."

The report examines how macroeconomic conditions from this and prior years impacted subcontractors in 2022, as well as their outlook for 2023. It also creates hope by providing perspective on new financing options subcontractors can leverage as mainstays – like supplier terms – become less reliable. 72% of respondents report having supplier terms of 30 days or less. Compared to a 74-day average wait time for payment, it is no surprise that 51% deem the length of their terms insufficient.

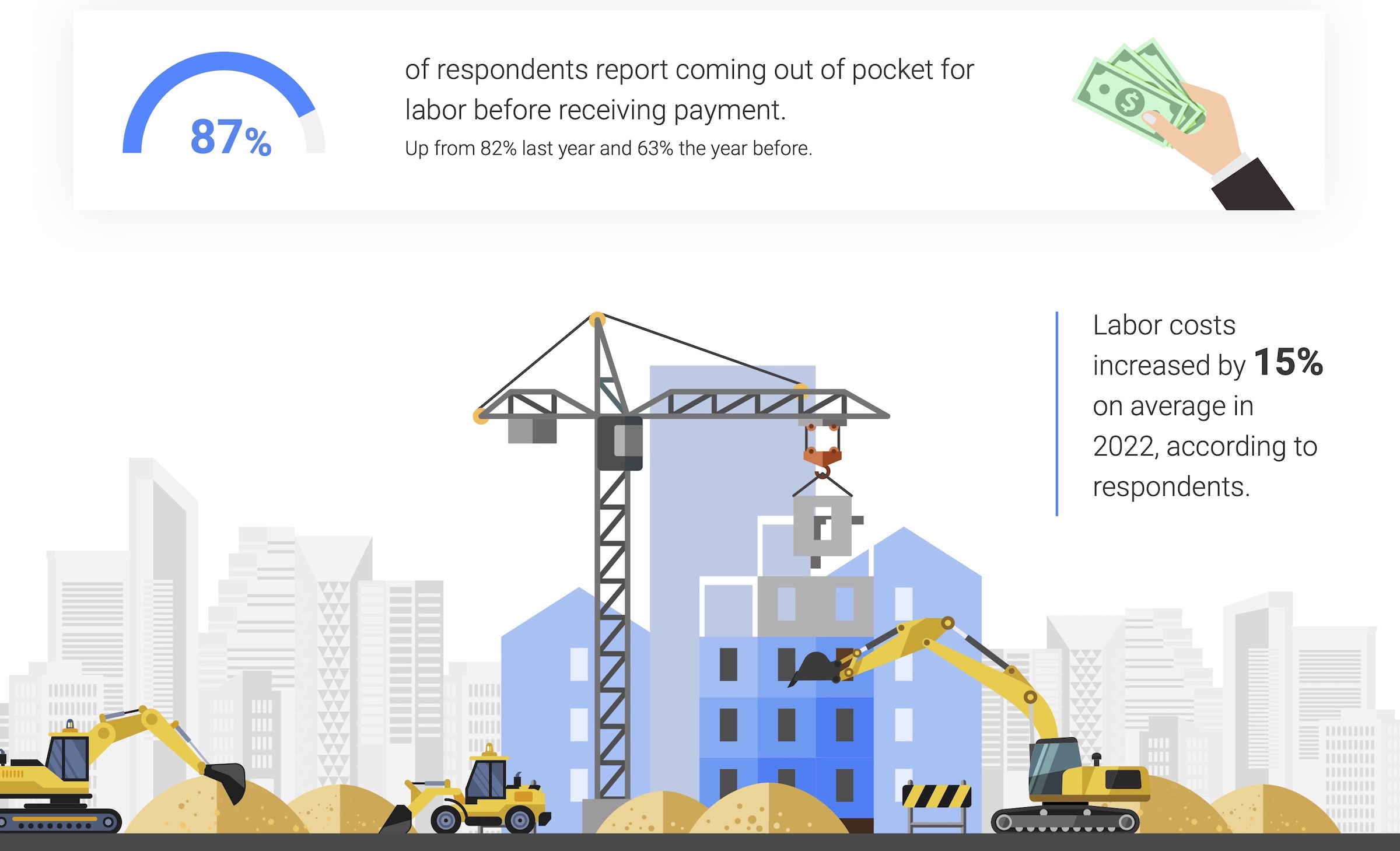

Supplier terms also have an unforeseen cost; most suppliers (also surveyed) state that they offer discounts for upfront payment. Despite those disadvantages, 87% of respondents still rely on supplier terms as their predominant means of buying materials. When it comes to funding their increasing labor costs, traditional financing options are even less accessible, leaving 87% of respondents coming out of pocket for labor before getting paid themselves. Luckily, the report highlights financial relief for labor as well as materials.

Related Stories

Building Team | Nov 7, 2022

U.S. commercial buildings decreased energy use intensity from 2012 to 2018

The recently released 2018 Commercial Buildings Energy Consumption Survey (CBECS) by the U.S. Energy Information Administration found that the total floorspace in commercial buildings has increased but energy consumption has not, compared with the last survey analyzing the landscape in 2012.

Sports and Recreational Facilities | Nov 7, 2022

Gilbane, Turner, Populous tapped to design and build new Buffalo Bills stadium

The joint venture of Gilbane Building Company and Turner Construction Company, in association with 34 Group, has been selected to provide construction management of the planned new NFL stadium for the Buffalo Bills in Orchard Park, N.Y. The project team also includes the project management firm, Legends Project Development, and Populous as the designer.

| Nov 7, 2022

Mixed-use tower in China features world’s highest outdoor pool

Guangxi China Resources Tower, a new 403-meter-tall (1,322 feet) skyscraper in Nanning, China features the world’s highest outdoor pool—at 323 meters (1,060 feet) above grade.

Building Team | Nov 3, 2022

More than half of U.S. contractors say finding skilled workers is big barrier to their growth

More than half of U.S. contractors (55%) say finding enough skilled workers is one of the biggest barriers to growing their business, according to a DEWALT Powering the Future Survey.

Building Materials | Nov 2, 2022

Design for Freedom: Ending slavery and child labor in the global building materials sector

Sharon Prince, Founder and CEO of Grace Farms and Design for Freedom, discusses DFF's report on slavery and enforced child labor in building products and materials.

Codes and Standards | Nov 2, 2022

New York City construction official wants to boost design-build

The new associate commissioner of alternative delivery in New York City’s Department of Design and Construction aims to encourage more design-build project delivery in the city.

University Buildings | Nov 2, 2022

New Univ. of Calif. Riverside business school building will support hybrid learning

A design-build partnership of Moore Ruble Yudell and McCarthy Building Companies will collaborate on a new business school building at the University of California at Riverside.

40 Under 40 | Nov 1, 2022

40 Under 40 class of 2022 winners: Meet the contractors

Meet the eight all-star construction professionals to be named 40 Under 40 class of 2022 winners by the editors of Building Design+Construction

Building Team | Nov 1, 2022

Nonresidential construction spending increases slightly in September, says ABC

National nonresidential construction spending was up by 0.5% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

K-12 Schools | Nov 1, 2022

Safety is the abiding design priority for K-12 schools

With some exceptions, architecture, engineering, and construction firms say renovations and adaptive reuse make up the bulk of their work in the K-12 schools sector.