In 2009, we met with Senior Facility Managers of four U.S. national laboratories to discuss a major limitation in the way they summarized their capital needs. As with most large organizations, they expressed capital needs in terms of deferred maintenance projects—things that needed to be fixed as determined by condition assessment (inspection or prescribed schedule). To put these needs in perspective, they computed a facility condition index (FCI), which is the ratio of deferred maintenance (D.M) costs to the replacement value of a building or portfolio.

Several years later, following the acquisition of Whitestone Research by CBRE Inc., it quickly became clear that major healthcare organizations around the world oftentimes employ a similar FCI based approach to their capital planning and prioritization decisions.

FACILITY CONDITION INDEX BREAKDOWN

According to a well-known scale developed initially for educational facilities in 1991, a facility is considered in poor condition if its FCI exceeds 90%. The shortcomings of the FCI approach are well-known, as results are not easily compared with alternative condition assessment approaches, and it does not contemplate methodologies for determining replacement values. These choices can become highly political for an organization that uses, as many do, the FCI as a key policy metric.

The basic concern of the laboratory facility managers was that the FCI did not represent the true condition of the facility in terms of safety, security, mission relevance, and other criteria that actually guide their decisions. FCI is also not a forecast or leading indicator that demonstrates consequences of alternative actions. These concerns led to a series of small projects that would eventually define a new approach to summarizing facility condition and prioritizing capital expenditures.

The new method, Risk Scanning, meets three requirements identified in our original meeting. The process must not rely on expensive inspections, must incorporate multiple (customizable) criteria, and the outcomes must be expressed as a simple monetary value.

This approach has universal applicability for laboratories and for large, corporate occupiers. In addition, we have found this approach to be particularly relevant for healthcare organizations today, given the extraordinary economic and regulatory pressures that have become a reality for the industry.

RISK SCANNING

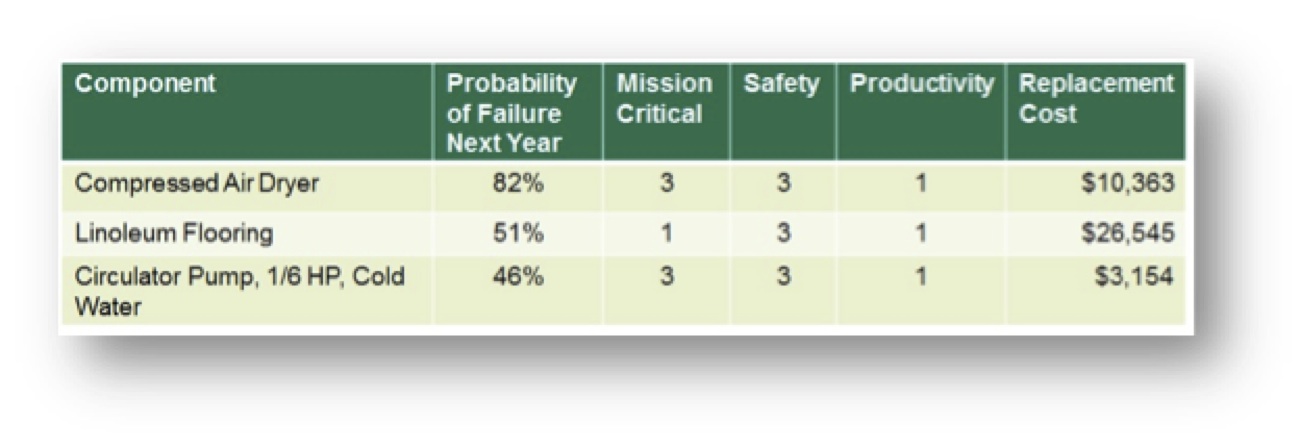

Risk Scanning assumes that buildings or other assets can be reduced to an inventory of components (roof, HVAC equipment, plumbing fixtures, etc.). Each component has a “survivor” curve that relates its age to the likelihood of its failure in the future, little different than an actuarial calculation for an insurance policy. And each component, should it fail, could have consequences for the building operation. Below, Figure 1 illustrates how this data could be used as a simple sort by probability of failure, consequence of failure, or replacement cost.

A more useful view of this data combines knowledge of the probability of failure and the potential consequences as the Risk Facility Managers implicitly consider when scheduling repairs. For example, a new light bulb in a closet would be low risk (low likelihood of failure, low impact on safety, security, mission, etc.), while a roof or electrical panel, far beyond their expected service life would be a high risk. Individual component risk ratings can be aggregated into risk maps by building, consequence type, or aggregated at the portfolio level.

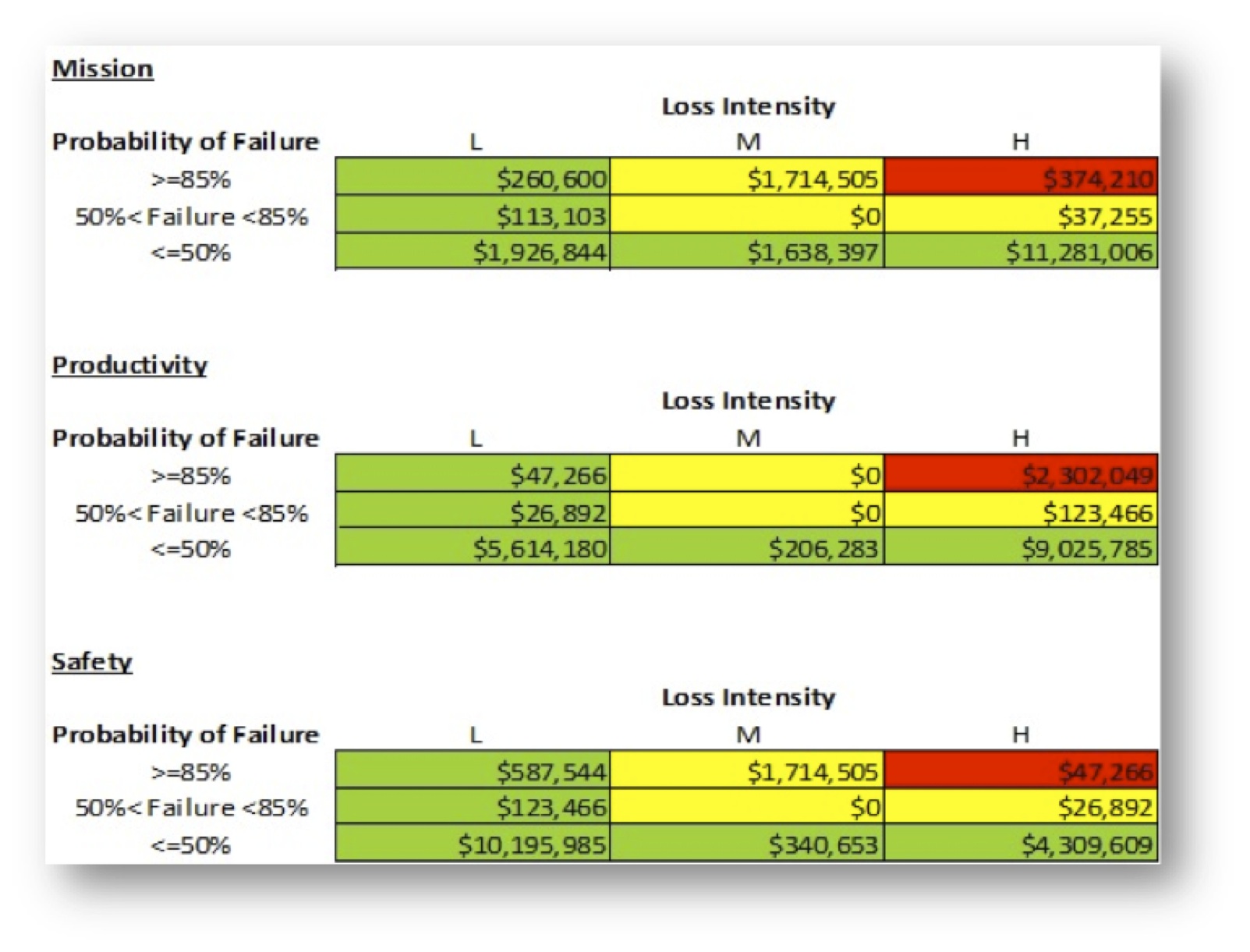

Another example is a risk scan of a data center built in 1980, as shown in Figure 2. Risk is summarized by three consequences or threats of failure – mission, productivity and safety. The “Loss Intensity” is the measure (low, medium, high) of the impact of failure. Each cell in the tables is the sum of the replacement value of each component. For instance, in the first table there are high risk (red) components with replacement values totaling $374,210.

Figure 2: Dashboard showing risk by consequence

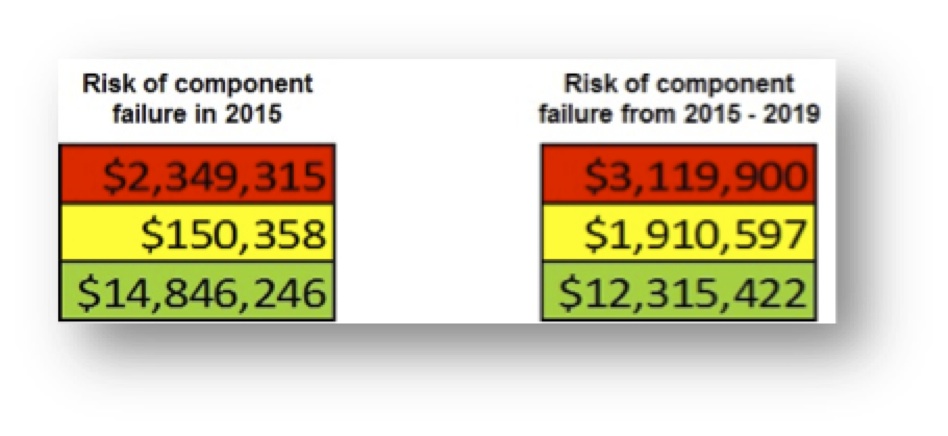

One way to represent overall risk is to sum across the individual tables in Figure 2, by risk category (red = high, yellow = moderate, green = low) to produce a single risk column, as shown in Figure 3. This shows that the costs to replace components rated high risk in 2015 for any reason (mission, productivity, or safety) were $2,349,315. Note that some components are high risk for multiple reasons.

The calculation of the column can be modified for different purposes. The ratings from the dashboard could be weighted to reflect management priorities. The likelihood of failure, and consequent migration of risk ratings, could be estimated for a range of years, as shown for the period 2015-2019.

COMPARING THE FCI WITH RISK SCANNING

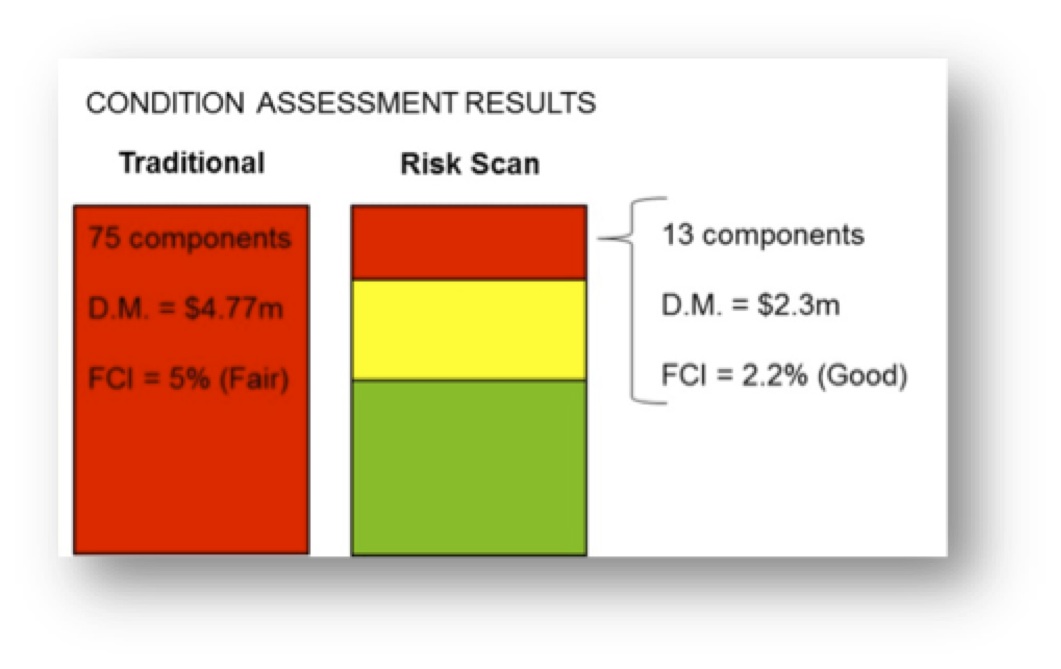

The data center example provides a useful comparison of the output from a simple condition assessment with the additional data provided by Risk Scanning.

A conventional facility condition assessment using a life cycle cost model indicated that 75 components had exceeded their service life. The costs of replacing these would be $4,771,159. Considering this amount to be deferred maintenance (D.M.), the FCI would be 5% (given $100 million replacement value). This would be summarized as a building in “fair” condition.

A Risk Scan of the component inventory indicates that 13 components are at high risk, and the costs of replacing these would be $2,349,315. This is less than half the costs of replacements by a simple service life-assessment. An FCI based on high risk components would be 2.2%, indicating a building in “good” condition.

In this case, with the additional information provided by Risk Scanning, the facility would be considered in better condition than with the simple condition assessment. Moreover, the risk scan would provide a rating for all components—including those not yet considered as deferred maintenance—as a basis for anticipating future needs and prioritization.

CONCLUSION

The Risk Scanning approach uses well-known risk analytics applied to pre-existing facility data to provide a richer view of facility condition more consistent with actual management decision making. In practice, limited funding is directed to those repairs and replacements that address corporate priorities, such as safety, security, and mission achievement. For healthcare systems, this approach can provide critical insight for decision-making about capital deployment where actionable criteria are not established or where data is limited.

About the Authors

Peter Lufkin is Senior Managing Director and Luca Romani is Senior Analyst with CBRE Whitestone.

Related Stories

Mass Timber | Jul 11, 2023

5 solutions to acoustic issues in mass timber buildings

For all its advantages, mass timber also has a less-heralded quality: its acoustic challenges. Exposed wood ceilings and floors have led to issues with excessive noise. Mass timber experts offer practical solutions to the top five acoustic issues in mass timber buildings.

Multifamily Housing | Jul 11, 2023

Converting downtown office into multifamily residential: Let’s stop and think about this

Is the office-to-residential conversion really what’s best for our downtowns from a cultural, urban, economic perspective? Or is this silver bullet really a poison pill?

Adaptive Reuse | Jul 10, 2023

California updates building code for adaptive reuse of office, retail structures for housing

The California Building Standards Commission recently voted to make it easier to convert commercial properties to residential use. The commission adopted provisions of the International Existing Building Code (IEBC) that allow developers more flexibility for adaptive reuse of retail and office structures.

Laboratories | Jul 10, 2023

U.S. Department of Agriculture opens nation’s first biosafety level 4 containment facility for animal disease research

Replacing a seven-decade-old animal disease center, the National Bio and Agro-Defense Facility includes the nation’s first facility with biosafety containment capable of housing large livestock.

Adaptive Reuse | Jul 6, 2023

The responsibility of adapting historic university buildings

Shepley Bulfinch's David Whitehill, AIA, believes the adaptive reuse of historic university buildings is not a matter of sentimentality but of practicality, progress, and preservation.

Market Data | Jul 5, 2023

Nonresidential construction spending decreased in May, its first drop in nearly a year

National nonresidential construction spending decreased 0.2% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.06 trillion.

Architects | Jul 5, 2023

Niles Bolton Associates promotes Jeffrey Smith, AIA, to President and C. Cannon Reynolds, AIA, to Managing Director

Niles Bolton Associates (NBA), a leading architecture, planning and design firm, announces leadership changes as a part of its ongoing commitment to future growth. Current Executive Vice President, Jeffrey Smith, AIA, has been named President and C. Cannon Reynolds, AIA, has been named Managing Director effective June 30, 2023.

Mixed-Use | Jun 29, 2023

Massive work-live-play development opens in LA's new Cumulus District

VOX at Cumulus, a 14-acre work-live-play development in Los Angeles, offers 910 housing units and 100,000 sf of retail space anchored by a Whole Foods outlet. VOX, one of the largest mixed-use communities to open in the Los Angeles area, features apartments and townhomes with more than one dozen floorplans.

Office Buildings | Jun 28, 2023

When office-to-residential conversion works

The cost and design challenges involved with office-to-residential conversions can be daunting; designers need to devise creative uses to fully utilize the space.

Architects | Jun 28, 2023

CSHQA hires first CEO in company's 134-year history

The Board of Directors of CSHQA announced the appointment of Ryan D. Martin, AIA NCARB as Chief Executive Officer.