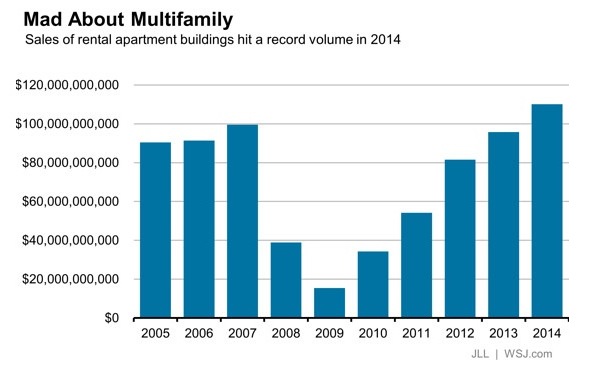

Investors bet big time on demand for rental properties over homeownership in 2014, when sales of apartment buildings hit a record $110.1 billion, or nearly 15% higher than the previous year, according to Jones Lang LaSalle (JLL), a professional services and investment management firm.

Nearly half of those transactions were for buildings in six metros: New York, Los Angeles, Atlanta, Houston, Dallas, and Washington D.C. And the allure of owning rental properties in America’s largest cities continues into 2015, the Wall Street Journal reported.

Blackstone Group, the world’s largest private equity holder of real estate, in late January agreed to pay $1.7 billion for 36 properties with an estimated 11,000 apartment units, half of which are in Washington D.C. and Boston. The seller was Praedium Group, which JLL and Evercore Partners advised. The deal increases to 43,000 the number of apartment units managed by LivCor, Blackstone’s multifamily real estate unit, according to Crain’s Chicago Business.

The multifamily sector “has become the preferred asset class of institutional investors” since the last economic downturn, says Jubeen Vaghefi, managing director of JLL’s capital markets division. That opinion is consistent with what Vaghefi wrote in JLL’s Fall 2014 Multifamily Outlook: “The ability for multifamily starts to occur 3.5 times faster than the overall market is due to the combination of higher oversupply of single-family homes throughout the United States, a marked preference for multi-unit buildings, and residential development in core submarkets, which continue to post high occupancy rates.”

The question now is how long investors will ride this gravy train, especially if increasing supply adversely impacts rent appreciation.

The Census Bureau’s latest data for housing starts, which it released on January 21, 2015, estimates that 456,000 units were under construction in buildings with five or more units at the end of December 2014, or 26% more than in December 2013. The possibility that this market may be overheating, though, is reflected in annualized multifamily starts, which inched up by only 0.3% in December to 339,000 units. Annualized multifamily permits issued stood at 338,000 units in December, down 12.4% from December 2013

On a less ambiguous note, rents increased by 3.6% nationwide in 2014, according to Reis, the real-estate research firm. Apartment vacancy rates, at 4.2%, were near their lowest levels in 2001. And the days of excess demand that has kept rents under control “are likely over,” Ryan Severino, Reis’ senior economist, stated.

JLL contends that with vacancies stabilizing and with the market average of inventory under construction at 4.4% and growing, “the pace of multifamily tightening is softening, with projected rent growth between 2% and 3% over the next 18 months.”

Related Stories

Projects | Mar 22, 2022

Austin multifamily project to feature 60 micro-housing apartments

A new 34,364 sf multifamily project, Sixth and Chicon, in Austin, Texas, will feature 60 micro-housing apartments designed for “the urban minimalist.”

Projects | Mar 18, 2022

Former department store transformed into 1 million sf mixed-use complex

Sibley Square, a giant mixed-use complex project that transformed a nearly derelict former department store was recently completed in Rochester, N.Y.

Multifamily Housing | Mar 15, 2022

Multifamily rents climbed 15.4 percent in one year

Multifamily asking rents picked up another $10 in February to reach a national average $1,628, and year-over-year growth recorded a 15.4 percent bump, according to the new Yardi Matrix Multifamily National Report.

Multifamily Housing | Mar 15, 2022

A 42-story tower envelops residents in Vancouver’s natural beauty

The city of Vancouver is world-renowned for the stunning nature that surrounds it: water, beaches, mountains. A 42-story tower, Fifteen Fifteen, will envelop residents in that natural beauty.

Multifamily Housing | Mar 15, 2022

Hermosa Village earns 2021 NAHB Best in American Living Award

Cadence McShane Construction Company received first place in this year's NAHB Best in American Living Award for its Hermosa Village project.

Projects | Mar 11, 2022

Suffolk completes construction of luxury condominium 2000 Ocean

The 38-story glass-encased tower along the beach on 1.3 acres is owned by KAR Properties and designed by TEN Arquitectos.

Projects | Mar 9, 2022

New 243-unit luxury apartment community opens in St. Paul, Minn.

Waterford Bay, a four-story, 243-unit luxury multifamily development recently opened in St. Paul, Minn.

Mass Timber | Mar 8, 2022

Heavy timber office and boutique residential building breaks ground in Austin

T3 Eastside, a heavy timber office and boutique residential building, recently broke ground in Austin, Texas.

Multifamily Housing | Mar 4, 2022

221,000 renters identify what they want in multifamily housing, post-Covid-19

Fresh data from the 2022 NMHC/Grace Hill Renter Preferences Survey shows how remote work is impacting renters' wants and needs in apartment developments.

Projects | Mar 2, 2022

Manufacturing plant gets second life as a mixed-use development

Wire Park, a mixed-use development being built near Athens, Ga., will feature 130 residential units plus 225,000 square feet of commercial, office, and retail space. About an hour east of downtown Atlanta, the 66-acre development also will boast expansive public greenspace.