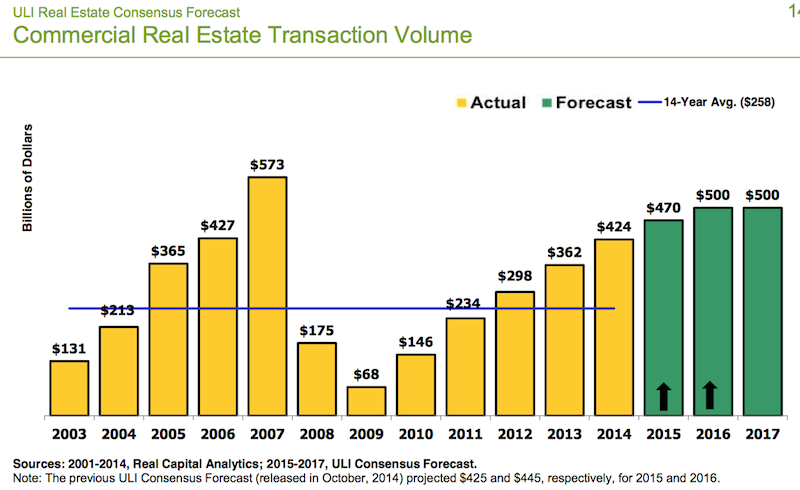

Driven by sparser availability of warehouses, offices, and retail, the real estate industry is positioned for solid growth this year and next, before tapering off at a still-respectable $500 billion in annual transactions in 2017.

Those predictions highlight Urban Land Institute’s (ULI) latest three-year Real Estate Consensus Forecast, based on the median of forecasts from 46 economists and analysts at 33 leading real estate organizations, who were surveyed from February 27 through March 23.

The expert consensus projects an 18% increase, to $470 billion, in commercial real estate transactions for 2015, followed by a 6.4%, to $500 billion, in 2016.

ULI’s forecast is more optimistic for the years 2015 and 2016 than previous forecasts for all indicators except single-family home starts.

The experts’ optimism stems, in part, from their predictions for healthy GDP growth, which they expect to rise by 3% this year and next, and by 2.8% in 2017. If realized, those would be the highest annual growth rates in nine years.

In addition, the U.S. economy has been experiencing its highest rate of job growth in 15 years. “For real estate, it’s really about jobs,” says William Maher, a director with LaSalle Investment Management, who analyzed the results of the survey for ULI.

The Consensus Forecast provides oultooks for specific construction segments:

• Institutional real estate assets are expected to provide total returns across all sectors of 11% in 2015, moderating to 10% in 2016 and 9% in 2017. By property type, returns should be strongest for industrial and office, followed by retail and apartments, in all three years.

• Vacancy rates are expected to decrease modestly for office and retail over all three forecast years. Industrial availability rates and hotel occupancy rate are forecasted to improve modestly in 2015 and 2016 and level off in 2017. Apartment vacancy rates are expected to begin rising slightly to 4.7% in 2015, 5% in 2016, and 5.3% in 2017. The 2017 forecast is just below the 20-year average vacancy rate.

• CRBE estimated that the availability rate for the industrial/warehouse sector declined to 10.3% at the end of 2014, coming in just below the 20-year average for the first time since 2007. ULI Consensus Forecast predicts availability rates will continue to decline in 2015 and 2016, with year-end vacancy rates at 9.8% and 9.6%, respectively, and remain steady in 2017 at 9.6%. Consequently, warehouse rental rate growth should continue, by 4% in 2015, 3.8% in 2016, and 3.1% in 2017, all above the 20-year average growth rate.

• The same pattern can be found in office vacancy rates, which declined for the fourth straight year, to 13.9% in 2014. That pattern is expected to continue through 2017, sparking further appreciation in office rental rates, which according the Consensus Forecast will increase by 4% in 2015 and 4.1% in 2016. Rental rate growth is expected to moderate slightly in 2017 to 3.5%.

• The Consensus foresees improvements in retail availability. And with rents increasing in 2014 for the first time in six years, the Consensus Forecast expects rental rates to sustain this growth, increasing by 2% in 2015, 3% in 2016, and 2.9% 2017.

ULI will release its next Consensus Forecast in October.

Related Stories

| Sep 23, 2011

Under 40 Leadership Summit

Building Design+Construction’s Under 40 Leadership Summit takes place October 26-28, 2011 Hotel at the Monteleone in New Orleans. Discounted hotel rate deadline: October 2, 2011.

| May 17, 2011

Redesigning, redefining the grocery shopping experience

The traditional 40,000- to 60,000-sf grocery store is disappearing and much of the change is happening in the city. Urban infill sites and mixed-use projects offer grocers a rare opportunity to repackage themselves into smaller, more efficient, and more convenient retail outlets. And the AEC community will have a hand in developing how these facilities will look and operate.

| Apr 12, 2011

Retail complex enjoys prime Abu Dhabi location

The Galleria at Sowwah Square in Abu Dhabi will be built in a prime location within Sowwah Island that also includes a five-star Four Seasons Hotel, the healthcare facility Cleveland Clinic Abu Dhabi, and nearly two million sf of Class A office space.

| Mar 30, 2011

Big-box giants downsize, open smaller, urban stores

As U.S. chain retailers absorb the lessons of the Great Recession, many big-box chains have started to shrink average store footprints to reflect the growing importance of multi-channel shopping, adapt to urban settings, and recognize the need to optimize portfolios. Wal-Mart, Target, Best Buy, and the Gap, among others, all have small concepts in the works or are adapting existing ones. These smaller store formats should allow the retailers to maximize profitability and open more stores in closer proximity to each other.

| Mar 22, 2011

Mayor Bloomberg unveils plans for New York City’s largest new affordable housing complex since the ’70s

Plans for Hunter’s Point South, the largest new affordable housing complex to be built in New York City since the 1970s, include new residences for 5,000 families, with more than 900 in this first phase. A development team consisting of Phipps Houses, Related Companies, and Monadnock Construction has been selected to build the residential portion of the first phase of the Queens waterfront complex, which includes two mixed-use buildings comprising more than 900 housing units and roughly 20,000 square feet of new retail space.

| Feb 23, 2011

Unprecedented green building dispute could cost developer $122.3 Million

A massive 4.5 million-sf expansion of the Carousel Center shopping complex in Syracuse, N.Y., a project called Destiny USA, allegedly failed to incorporate green building components that developers had promised the federal government—including LEED certification. As a result, the project could lose its tax-exempt status, which reportedly saved developer The Pyramid Cos. $120 million, and the firm could be penalized $2.3 million by the IRS.