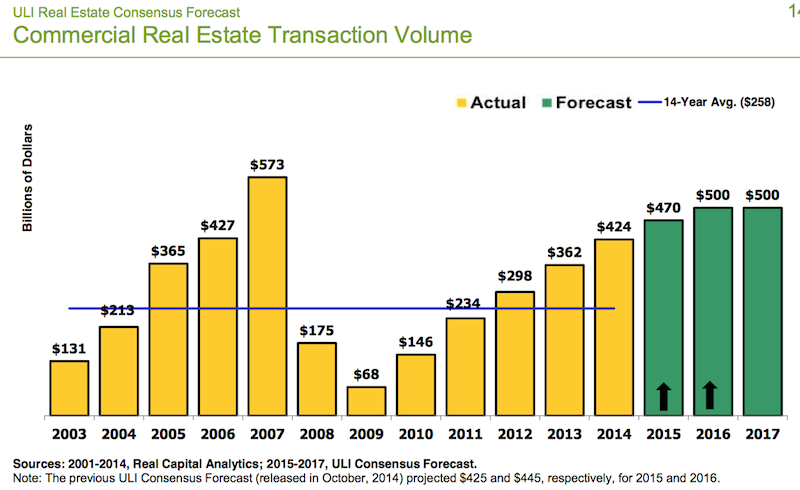

Driven by sparser availability of warehouses, offices, and retail, the real estate industry is positioned for solid growth this year and next, before tapering off at a still-respectable $500 billion in annual transactions in 2017.

Those predictions highlight Urban Land Institute’s (ULI) latest three-year Real Estate Consensus Forecast, based on the median of forecasts from 46 economists and analysts at 33 leading real estate organizations, who were surveyed from February 27 through March 23.

The expert consensus projects an 18% increase, to $470 billion, in commercial real estate transactions for 2015, followed by a 6.4%, to $500 billion, in 2016.

ULI’s forecast is more optimistic for the years 2015 and 2016 than previous forecasts for all indicators except single-family home starts.

The experts’ optimism stems, in part, from their predictions for healthy GDP growth, which they expect to rise by 3% this year and next, and by 2.8% in 2017. If realized, those would be the highest annual growth rates in nine years.

In addition, the U.S. economy has been experiencing its highest rate of job growth in 15 years. “For real estate, it’s really about jobs,” says William Maher, a director with LaSalle Investment Management, who analyzed the results of the survey for ULI.

The Consensus Forecast provides oultooks for specific construction segments:

• Institutional real estate assets are expected to provide total returns across all sectors of 11% in 2015, moderating to 10% in 2016 and 9% in 2017. By property type, returns should be strongest for industrial and office, followed by retail and apartments, in all three years.

• Vacancy rates are expected to decrease modestly for office and retail over all three forecast years. Industrial availability rates and hotel occupancy rate are forecasted to improve modestly in 2015 and 2016 and level off in 2017. Apartment vacancy rates are expected to begin rising slightly to 4.7% in 2015, 5% in 2016, and 5.3% in 2017. The 2017 forecast is just below the 20-year average vacancy rate.

• CRBE estimated that the availability rate for the industrial/warehouse sector declined to 10.3% at the end of 2014, coming in just below the 20-year average for the first time since 2007. ULI Consensus Forecast predicts availability rates will continue to decline in 2015 and 2016, with year-end vacancy rates at 9.8% and 9.6%, respectively, and remain steady in 2017 at 9.6%. Consequently, warehouse rental rate growth should continue, by 4% in 2015, 3.8% in 2016, and 3.1% in 2017, all above the 20-year average growth rate.

• The same pattern can be found in office vacancy rates, which declined for the fourth straight year, to 13.9% in 2014. That pattern is expected to continue through 2017, sparking further appreciation in office rental rates, which according the Consensus Forecast will increase by 4% in 2015 and 4.1% in 2016. Rental rate growth is expected to moderate slightly in 2017 to 3.5%.

• The Consensus foresees improvements in retail availability. And with rents increasing in 2014 for the first time in six years, the Consensus Forecast expects rental rates to sustain this growth, increasing by 2% in 2015, 3% in 2016, and 2.9% 2017.

ULI will release its next Consensus Forecast in October.

Related Stories

| Jan 4, 2011

Grubb & Ellis predicts commercial real estate recovery

Grubb & Ellis Company, a leading real estate services and investment firm, released its 2011 Real Estate Forecast, which foresees the start of a slow recovery in the leasing market for all property types in the coming year.

| Dec 17, 2010

Vietnam business center will combine office and residential space

The 300,000-sm VietinBank Business Center in Hanoi, Vietnam, designed by Foster + Partners, will have two commercial towers: the first, a 68-story, 362-meter office tower for the international headquarters of VietinBank; the second, a five-star hotel, spa, and serviced apartments. A seven-story podium with conference facilities, retail space, restaurants, and rooftop garden will connect the two towers. Eco-friendly features include using recycled heat from the center’s power plant to provide hot water, and installing water features and plants to improve indoor air quality. Turner Construction Co. is the general contractor.

| Dec 17, 2010

Toronto church converted for condos and shopping

Reserve Properties is transforming a 20th-century church into Bellefair Kew Beach Residences, a residential/retail complex in The Beach neighborhood of Toronto. Local architecture firm RAWdesign adapted the late Gothic-style church into a five-story condominium with 23 one- and two-bedroom units, including two-story penthouse suites. Six three-story townhouses also will be incorporated. The project will afford residents views of nearby Kew Gardens and Lake Ontario. One façade of the church was updated for retail shops.

| Nov 3, 2010

Chengdu retail center offers a blend of old and new China

The first phase of Pearl River New Town, an 80-acre project in Chengdu, in China’s Wenjiang District, is under way along the banks of the Jiang’an River. Chengdu was at one time a leading center for broadcloth production, and RTKL, which is overseeing the project’s master planning, architecture, branding, and landscape architecture, designed the project’s streets, pedestrian pathways, and bridges to resemble a woven fabric.

| Nov 1, 2010

Sustainable, mixed-income housing to revitalize community

The $41 million Arlington Grove mixed-use development in St. Louis is viewed as a major step in revitalizing the community. Developed by McCormack Baron Salazar with KAI Design & Build (architect, MEP, GC), the project will add 112 new and renovated mixed-income rental units (market rate, low-income, and public housing) totaling 162,000 sf, plus 5,000 sf of commercial/retail space.

| Nov 1, 2010

Vancouver’s former Olympic Village shoots for Gold

The first tenants of the Millennium Water development in Vancouver, B.C., were Olympic athletes competing in the 2010 Winter Games. Now the former Olympic Village, located on a 17-acre brownfield site, is being transformed into a residential neighborhood targeting LEED ND Gold. The buildings are expected to consume 30-70% less energy than comparable structures.

| Oct 12, 2010

The Watch Factory, Waltham, Mass.

27th Annual Reconstruction Awards — Gold Award. When the Boston Watch Company opened its factory in 1854 on the banks of the Charles River in Waltham, Mass., the area was far enough away from the dust, dirt, and grime of Boston to safely assemble delicate watch parts.

| Oct 6, 2010

From grocery store to culinary school

A former West Philadelphia supermarket is moving up the food chain, transitioning from grocery store to the Center for Culinary Enterprise, a business culinary training school.

| Sep 16, 2010

Gehry’s Santa Monica Place gets a wave of changes

Omniplan, in association with Jerde Partnership, created an updated design for Santa Monica Place, a shopping mall designed by Frank Gehry in 1980.

| Sep 13, 2010

3D Prototyping Goes Low-cost

Today’s less costly 3D color printers are attracting the attention of AEC firms looking to rapidly prototype designs and communicate design intent to clients.