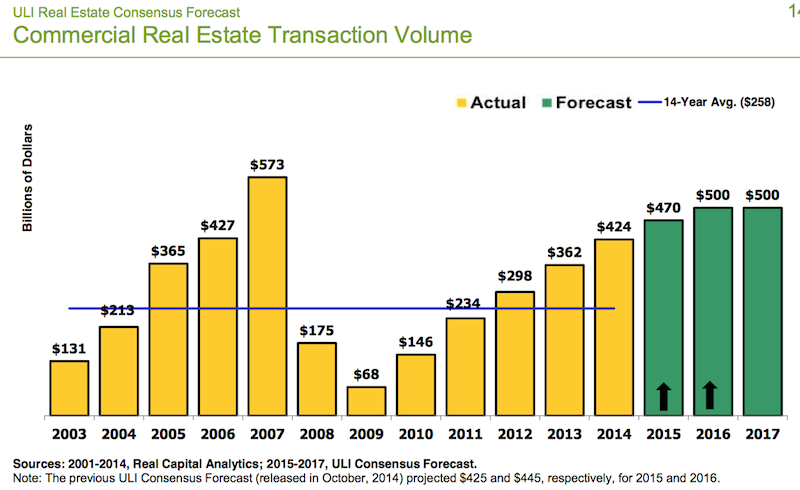

Driven by sparser availability of warehouses, offices, and retail, the real estate industry is positioned for solid growth this year and next, before tapering off at a still-respectable $500 billion in annual transactions in 2017.

Those predictions highlight Urban Land Institute’s (ULI) latest three-year Real Estate Consensus Forecast, based on the median of forecasts from 46 economists and analysts at 33 leading real estate organizations, who were surveyed from February 27 through March 23.

The expert consensus projects an 18% increase, to $470 billion, in commercial real estate transactions for 2015, followed by a 6.4%, to $500 billion, in 2016.

ULI’s forecast is more optimistic for the years 2015 and 2016 than previous forecasts for all indicators except single-family home starts.

The experts’ optimism stems, in part, from their predictions for healthy GDP growth, which they expect to rise by 3% this year and next, and by 2.8% in 2017. If realized, those would be the highest annual growth rates in nine years.

In addition, the U.S. economy has been experiencing its highest rate of job growth in 15 years. “For real estate, it’s really about jobs,” says William Maher, a director with LaSalle Investment Management, who analyzed the results of the survey for ULI.

The Consensus Forecast provides oultooks for specific construction segments:

• Institutional real estate assets are expected to provide total returns across all sectors of 11% in 2015, moderating to 10% in 2016 and 9% in 2017. By property type, returns should be strongest for industrial and office, followed by retail and apartments, in all three years.

• Vacancy rates are expected to decrease modestly for office and retail over all three forecast years. Industrial availability rates and hotel occupancy rate are forecasted to improve modestly in 2015 and 2016 and level off in 2017. Apartment vacancy rates are expected to begin rising slightly to 4.7% in 2015, 5% in 2016, and 5.3% in 2017. The 2017 forecast is just below the 20-year average vacancy rate.

• CRBE estimated that the availability rate for the industrial/warehouse sector declined to 10.3% at the end of 2014, coming in just below the 20-year average for the first time since 2007. ULI Consensus Forecast predicts availability rates will continue to decline in 2015 and 2016, with year-end vacancy rates at 9.8% and 9.6%, respectively, and remain steady in 2017 at 9.6%. Consequently, warehouse rental rate growth should continue, by 4% in 2015, 3.8% in 2016, and 3.1% in 2017, all above the 20-year average growth rate.

• The same pattern can be found in office vacancy rates, which declined for the fourth straight year, to 13.9% in 2014. That pattern is expected to continue through 2017, sparking further appreciation in office rental rates, which according the Consensus Forecast will increase by 4% in 2015 and 4.1% in 2016. Rental rate growth is expected to moderate slightly in 2017 to 3.5%.

• The Consensus foresees improvements in retail availability. And with rents increasing in 2014 for the first time in six years, the Consensus Forecast expects rental rates to sustain this growth, increasing by 2% in 2015, 3% in 2016, and 2.9% 2017.

ULI will release its next Consensus Forecast in October.

Related Stories

| Aug 11, 2010

Callison, MulvannyG2 among nation's largest retail design firms, according to BD+C's Giants 300 report

A ranking of the Top 75 Retail Design Firms based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Former nightclub morphing into a shopping center

New York City's Limelight, the one-time notorious church-turned-nightclub, will be restored again, this time as a 25,000-sf retail marketplace. Limelight Marketplace founder Jack Menashe hopes to merge lavish atmospheric elements with cutting-edge fashion, beauty, and gourmet retailers like BookSmart, Caswell Massy, J.

| Aug 11, 2010

And the world's tallest building is…

At more than 2,600 feet high, the Burj Dubai (right) can still lay claim to the title of world's tallest building—although like all other super-tall buildings, its exact height will have to be recalculated now that the Council on Tall Buildings and Urban Habitat (CTBUH) announced a change to its height criteria.

| Aug 11, 2010

New pavilion planned for famous boulevard

Located in a prime spot along Santa Monica Boulevard in the Westwood neighborhood of Los Angeles, the Santa Monica Pavilion will have 9,000 sf of retail space, 35,500 sf of office space, and two below-grade parking levels when it opens in late 2010. The $10 million, three-story building extends a full length of the block to create a window wall of blue-gray translucent, fritted glass panels ove...

| Aug 11, 2010

Mixed-use Seattle high-rise earns LEED Gold

Seattle’s 2201 Westlake development became the city’s first mixed-use and high-rise residential project to earn LEED Gold. Located in Seattle’s South Lake Union neighborhood, the newly completed 450,000-sf complex includes 300,000 sf of Class A office space, 135 luxury condominiums (known as Enso), and 25,000 sf of retail space.

| Aug 11, 2010

Expanding retail complex is LEED pre-certified

The Promenade at Coconut Creek in Broward County, Fla., a live-work-play shopping and lifestyle center, is being expanded by 105,000 sf. When phase II of the 335,000-sf project is complete, the facility will house 75 retailers, restaurants, and related services, making it one of the largest mixed-use projects in northern Broward County.

| Aug 11, 2010

CityCenter projects get LEED Gold

MGM Mirage and Infinity World Development have received LEED Gold certification for the first three CityCenter projects: the ARIA Resort hotel tower, ARIA Resort convention center and theater, and the Vdara Hotel (above). The CityCenter developers anticipate Gold or Silver LEED certification for the project's remaining developments, which include a Mandarin Oriental hotel, a 500,000-sf retail a...

| Aug 11, 2010

RMJM unveils design details for $1B green development in Turkey

RMJM has unveiled the design for the $1 billion Varyap Meridian development it is master planning in Istanbul, Turkey's Atasehir district, a new residential and business district. Set on a highly visible site that features panoramic views stretching from the Bosporus Strait in the west to the Sea of Marmara to the south, the 372,000-square-meter development includes a 60-story tower, 1,500 resi...

| Aug 11, 2010

'Feebate' program to reward green buildings in Portland, Ore.

Officials in Portland, Ore., have proposed a green building incentive program that would be the first of its kind in the U.S. Under the program, new commercial buildings, 20,000 sf or larger, that meet Oregon's state building code would be assessed a fee by the city of up to $3.46/sf. The fee would be waived for buildings that achieve LEED Silver certification from the U.