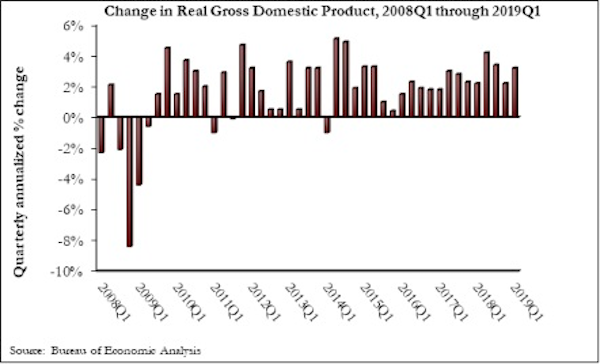

The U.S. economy expanded at an annualized 3.2% rate during the first quarter of 2019, according to an Associated Builders and Contractors assessment of data released today by the U.S. Bureau of Economic Analysis. The pace of growth exceeded expectations, as many economists predicted growth would be closer to 2.5%.

Growth was fueled by myriad factors, including personal consumption expenditures, private inventory investment, surprisingly rapid growth in exports, state and local government spending and intellectual property. However, residential investment declined.

“Today’s headline number was a blockbuster,” said ABC Chief Economist Anirban Basu. “Despite a slowing global economy, growing labor shortages, soft residential construction and generally lackluster first quarter growth, the overall U.S. economy got off to a fast start in 2019. What’s more, that rapid growth continues to be associated with only moderate inflation.

“That said, nonresidential building investment declined for a third consecutive quarter during the first quarter of 2019, though the pace of decline was not as noteworthy as it was during the third and fourth quarters of last year,” said Basu. “There are many conceivable factors, including weather-induced interruptions in construction activity, concern about overbuilding in office, lodging and other commercial segments, as well as the inability of contractors to fully address demand for construction services due to a dearth of available skilled workers.

“With the year off to a strong start, there appears to be enough momentum to carry the U.S. economy through 2019,” said Basu. “Any fears of a near-term recession have likely been quashed. However, the surprising strength of the U.S. economy may result in a reassessment of policymaking by the Federal Reserve, even though recent statements made by Fed officials have suggested that there wouldn’t be a further rate increase in 2019. If the Federal Reserve decides to pivot and raise rates again later this year, that would represent a negative in terms of demand for construction services due to a corresponding increase in the cost of capital to finance projects.”

Related Stories

Healthcare Facilities | Feb 18, 2021

The Weekly show, Feb 18, 2021: What patients want from healthcare facilities, and Post-COVID retail trends

This week on The Weekly show, BD+C editors speak with AEC industry leaders from JLL and Landini Associates about what patients want from healthcare facilities, based on JLL's recent survey of 4,015 patients, and making online sales work for a retail sector recovery.

Market Data | Feb 17, 2021

Soaring prices and delivery delays for lumber and steel squeeze finances for construction firms already hit by pandemic

Association officials call for removing tariffs on key materials to provide immediate relief for hard-hit contractors and exploring ways to expand long-term capacity for steel, lumber and other materials,

Market Data | Feb 9, 2021

Construction Backlog and contractor optimism rise to start 2021, according to ABC member survey

Despite the monthly uptick, backlog is 0.9 months lower than in January 2020.

Market Data | Feb 9, 2021

USGBC top 10 states for LEED in 2020

The Top 10 States for LEED green building is based on gross square feet of certified space per person using 2010 U.S. Census data and includes commercial and institutional projects certified in 2020.

Market Data | Feb 8, 2021

Construction employment stalls in January with unemployment rate of 9.4%

New measures threaten to undermine recovery.

Market Data | Feb 4, 2021

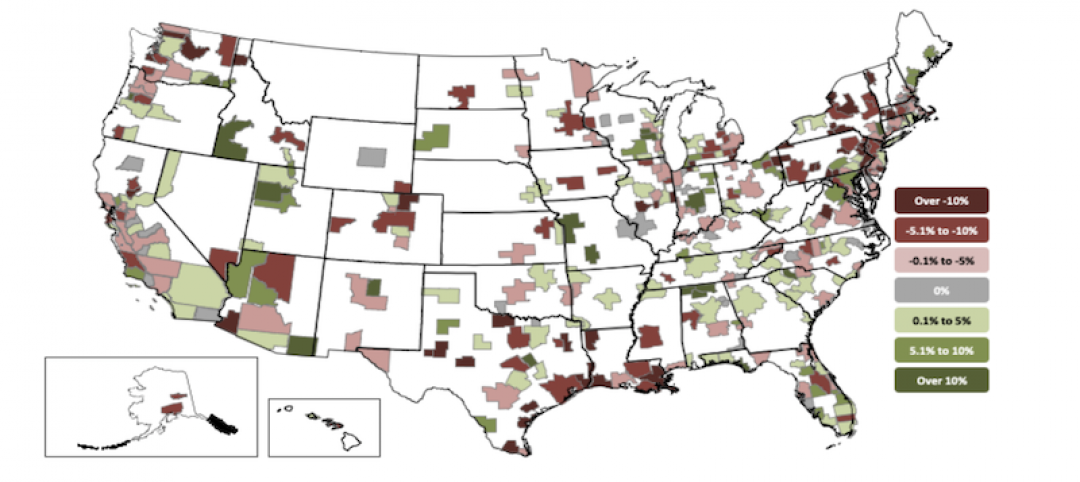

Construction employment declined in 2020 in majority of metro areas

Houston-The Woodlands-Sugar Land and Brockton-Bridgewater-Easton, Mass. have worst 2020 losses, while Indianapolis-Carmel-Anderson, Ind. and Walla Walla, Wash. register largest gains in industry jobs.

Market Data | Feb 3, 2021

Construction spending diverges in December with slump in private nonresidential sector, mixed public work, and boom in homebuilding

Demand for nonresidential construction and public works will decline amid ongoing pandemic concerns.

Market Data | Feb 1, 2021

The New York City market is back on top and leads the U.S. hotel construction pipeline

New York City has the greatest number of projects under construction with 108 projects/19,439 rooms.

Market Data | Jan 29, 2021

Multifamily housing construction outlook soars in late 2020

Exceeds pre-COVID levels, reaching highest mark since 1st quarter 2018.

Market Data | Jan 29, 2021

The U.S. hotel construction pipeline stands at 5,216 projects/650,222 rooms at year-end 2020

At the end of Q4 ‘20, projects currently under construction stand at 1,487 projects/199,700 rooms.