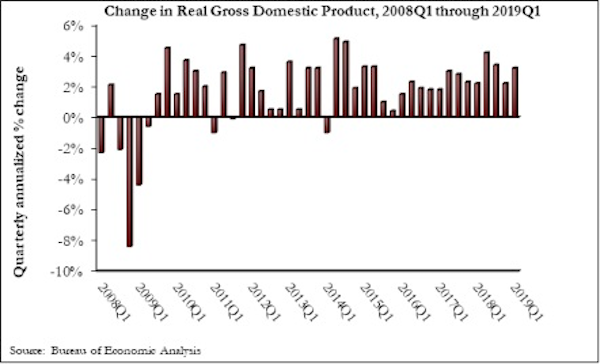

The U.S. economy expanded at an annualized 3.2% rate during the first quarter of 2019, according to an Associated Builders and Contractors assessment of data released today by the U.S. Bureau of Economic Analysis. The pace of growth exceeded expectations, as many economists predicted growth would be closer to 2.5%.

Growth was fueled by myriad factors, including personal consumption expenditures, private inventory investment, surprisingly rapid growth in exports, state and local government spending and intellectual property. However, residential investment declined.

“Today’s headline number was a blockbuster,” said ABC Chief Economist Anirban Basu. “Despite a slowing global economy, growing labor shortages, soft residential construction and generally lackluster first quarter growth, the overall U.S. economy got off to a fast start in 2019. What’s more, that rapid growth continues to be associated with only moderate inflation.

“That said, nonresidential building investment declined for a third consecutive quarter during the first quarter of 2019, though the pace of decline was not as noteworthy as it was during the third and fourth quarters of last year,” said Basu. “There are many conceivable factors, including weather-induced interruptions in construction activity, concern about overbuilding in office, lodging and other commercial segments, as well as the inability of contractors to fully address demand for construction services due to a dearth of available skilled workers.

“With the year off to a strong start, there appears to be enough momentum to carry the U.S. economy through 2019,” said Basu. “Any fears of a near-term recession have likely been quashed. However, the surprising strength of the U.S. economy may result in a reassessment of policymaking by the Federal Reserve, even though recent statements made by Fed officials have suggested that there wouldn’t be a further rate increase in 2019. If the Federal Reserve decides to pivot and raise rates again later this year, that would represent a negative in terms of demand for construction services due to a corresponding increase in the cost of capital to finance projects.”

Related Stories

Market Data | Dec 2, 2020

Nonresidential construction spending remains flat in October

Residential construction expands as many commercial projects languish.

Market Data | Nov 30, 2020

New FEMA study projects implementing I-Codes could save $600 billion by 2060

International Code Council and FLASH celebrate the most comprehensive study conducted around hazard-resilient building codes to-date.

Market Data | Nov 23, 2020

Construction employment is down in three-fourths of states since February

This news comes even after 36 states added construction jobs in October.

Market Data | Nov 18, 2020

Architecture billings remained stalled in October

The pace of decline during October remained at about the same level as in September.

Market Data | Nov 17, 2020

Architects face data, culture gaps in fighting climate change

New study outlines how building product manufacturers can best support architects in climate action.

Market Data | Nov 10, 2020

Construction association ready to work with president-elect Biden to prepare significant new infrastructure and recovery measures

Incoming president and congress should focus on enacting measures to rebuild infrastructure and revive the economy.

Market Data | Nov 9, 2020

Construction sector adds 84,000 workers in October

A growing number of project cancellations risks undermining future industry job gains.

Market Data | Nov 4, 2020

Drop in nonresidential construction offsets most residential spending gains as growing number of contractors report cancelled projects

Association officials warn that demand for nonresidential construction will slide further without new federal relief measures.

Market Data | Nov 2, 2020

Nonresidential construction spending declines further in September

Among the sixteen nonresidential subcategories, thirteen were down on a monthly basis.

Market Data | Nov 2, 2020

A white paper assesses seniors’ access to livable communities

The Joint Center for Housing Studies and AARP’s Public Policy Institute connect livability with income, race, and housing costs.