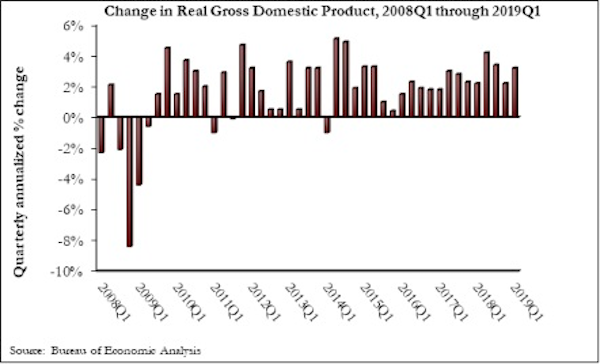

The U.S. economy expanded at an annualized 3.2% rate during the first quarter of 2019, according to an Associated Builders and Contractors assessment of data released today by the U.S. Bureau of Economic Analysis. The pace of growth exceeded expectations, as many economists predicted growth would be closer to 2.5%.

Growth was fueled by myriad factors, including personal consumption expenditures, private inventory investment, surprisingly rapid growth in exports, state and local government spending and intellectual property. However, residential investment declined.

“Today’s headline number was a blockbuster,” said ABC Chief Economist Anirban Basu. “Despite a slowing global economy, growing labor shortages, soft residential construction and generally lackluster first quarter growth, the overall U.S. economy got off to a fast start in 2019. What’s more, that rapid growth continues to be associated with only moderate inflation.

“That said, nonresidential building investment declined for a third consecutive quarter during the first quarter of 2019, though the pace of decline was not as noteworthy as it was during the third and fourth quarters of last year,” said Basu. “There are many conceivable factors, including weather-induced interruptions in construction activity, concern about overbuilding in office, lodging and other commercial segments, as well as the inability of contractors to fully address demand for construction services due to a dearth of available skilled workers.

“With the year off to a strong start, there appears to be enough momentum to carry the U.S. economy through 2019,” said Basu. “Any fears of a near-term recession have likely been quashed. However, the surprising strength of the U.S. economy may result in a reassessment of policymaking by the Federal Reserve, even though recent statements made by Fed officials have suggested that there wouldn’t be a further rate increase in 2019. If the Federal Reserve decides to pivot and raise rates again later this year, that would represent a negative in terms of demand for construction services due to a corresponding increase in the cost of capital to finance projects.”

Related Stories

Market Data | Sep 16, 2020

6 must reads for the AEC industry today: September 16, 2020

REI sells unused HQ building and Adjaye Associates will design The Africa Institute.

Market Data | Sep 15, 2020

7 must reads for the AEC industry today: September 15, 2020

Energy efficiency considerations for operating buildings during a pandemic and is there really a glass box paradox?

Market Data | Sep 14, 2020

6 must reads for the AEC industry today: September 14, 2020

63% of New York's restaurants could be gone by 2021 and new weapons in the apartment amenities arms race.

Market Data | Sep 11, 2020

5 must reads for the AEC industry today: September 11, 2020

Des Moines University begins construction on new campus and the role of urgent care in easing the oncology journey.

Market Data | Sep 10, 2020

6 must reads for the AEC industry today: September 10, 2020

Taipei's new Performance Hall and Burger King's touchless restaurant designs.

Market Data | Sep 9, 2020

6 must reads for the AEC industry today: September 9, 2020

What will the 'new normal' look like and the AIA hands out its Twenty-five Year Award.

Market Data | Sep 8, 2020

‘New normal’: IAQ, touchless, and higher energy bills?

Not since 9/11 has a single event so severely rocked the foundation of the commercial building industry.

Market Data | Sep 8, 2020

7 must reads for the AEC industry today: September 8, 2020

Google proposes 40-acre redevelopment plan and office buildings should be an essential part of their communities.

Market Data | Sep 4, 2020

6 must reads for the AEC industry today: September 4, 2020

10 Design to redevelop Nanjing AIrport and TUrner Construction takes a stand against racism.

Market Data | Sep 4, 2020

Construction sector adds 16,000 workers in August but nonresidential jobs shrink

Association survey finds contractor pessimism is increasing.