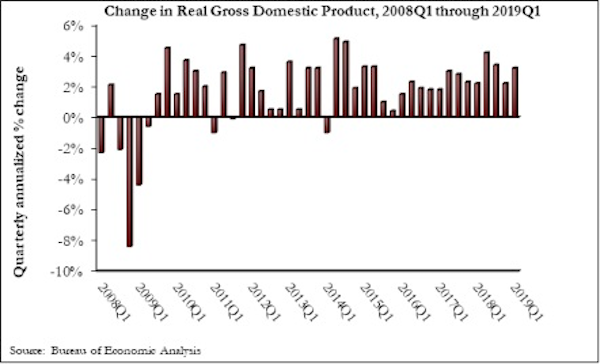

The U.S. economy expanded at an annualized 3.2% rate during the first quarter of 2019, according to an Associated Builders and Contractors assessment of data released today by the U.S. Bureau of Economic Analysis. The pace of growth exceeded expectations, as many economists predicted growth would be closer to 2.5%.

Growth was fueled by myriad factors, including personal consumption expenditures, private inventory investment, surprisingly rapid growth in exports, state and local government spending and intellectual property. However, residential investment declined.

“Today’s headline number was a blockbuster,” said ABC Chief Economist Anirban Basu. “Despite a slowing global economy, growing labor shortages, soft residential construction and generally lackluster first quarter growth, the overall U.S. economy got off to a fast start in 2019. What’s more, that rapid growth continues to be associated with only moderate inflation.

“That said, nonresidential building investment declined for a third consecutive quarter during the first quarter of 2019, though the pace of decline was not as noteworthy as it was during the third and fourth quarters of last year,” said Basu. “There are many conceivable factors, including weather-induced interruptions in construction activity, concern about overbuilding in office, lodging and other commercial segments, as well as the inability of contractors to fully address demand for construction services due to a dearth of available skilled workers.

“With the year off to a strong start, there appears to be enough momentum to carry the U.S. economy through 2019,” said Basu. “Any fears of a near-term recession have likely been quashed. However, the surprising strength of the U.S. economy may result in a reassessment of policymaking by the Federal Reserve, even though recent statements made by Fed officials have suggested that there wouldn’t be a further rate increase in 2019. If the Federal Reserve decides to pivot and raise rates again later this year, that would represent a negative in terms of demand for construction services due to a corresponding increase in the cost of capital to finance projects.”

Related Stories

Market Data | Aug 18, 2020

6 must reads for the AEC industry today: August 18, 2020

The world's first AI-driven facade system and LA's Greek Theatre restoriation completes.

Market Data | Aug 17, 2020

5 must reads for the AEC industry today: August 17, 2020

5 strategies for creating safer hotel experiences and how to manage multifamily assets when residents no longer leave.

Market Data | Aug 14, 2020

6 must reads for the AEC industry today: August 14, 2020

The largest single sloped solar array in the country and renewing the healing role of public parks.

Market Data | Aug 13, 2020

5 must reads for the AEC industry today: August 13, 2020

Apple Central World opens in Bangkok and 7-Eleven to buy Speedway.

Market Data | Aug 12, 2020

6 must reads for the AEC industry today: August 12, 2020

UC Davis's new dining commons and the pandemic is revolutionizing healthcare benefits.

Market Data | Aug 11, 2020

6 must reads for the AEC industry today: August 11, 2020

Elevators can be a 100% touch-free experience and the construction industry adds 20,000 employees in July.

Market Data | Aug 10, 2020

Dodge Momentum Index increases in July

This month’s increase in the Dodge Momentum Index was the first in all of 2020.

Market Data | Aug 10, 2020

Construction industry adds 20,000 employees in July but nonresidential employment dips

Association warns skid will worsen without new relief.

Market Data | Aug 10, 2020

5 must reads for the AEC industry today: August 10, 2020

Private student housing owners reap the benefits as campus housing de-densifies and race for COVID vaccine boosts real estate in life sciences hubs.

Market Data | Aug 7, 2020

6 must reads for the AEC industry today: August 7, 2020

BD+C's 2020 Color Trends Report and HMC releases COVID-19 Campus Reboot Guide for Prek-12 schools.