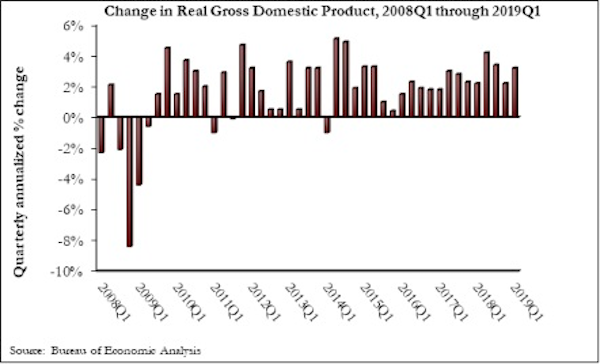

The U.S. economy expanded at an annualized 3.2% rate during the first quarter of 2019, according to an Associated Builders and Contractors assessment of data released today by the U.S. Bureau of Economic Analysis. The pace of growth exceeded expectations, as many economists predicted growth would be closer to 2.5%.

Growth was fueled by myriad factors, including personal consumption expenditures, private inventory investment, surprisingly rapid growth in exports, state and local government spending and intellectual property. However, residential investment declined.

“Today’s headline number was a blockbuster,” said ABC Chief Economist Anirban Basu. “Despite a slowing global economy, growing labor shortages, soft residential construction and generally lackluster first quarter growth, the overall U.S. economy got off to a fast start in 2019. What’s more, that rapid growth continues to be associated with only moderate inflation.

“That said, nonresidential building investment declined for a third consecutive quarter during the first quarter of 2019, though the pace of decline was not as noteworthy as it was during the third and fourth quarters of last year,” said Basu. “There are many conceivable factors, including weather-induced interruptions in construction activity, concern about overbuilding in office, lodging and other commercial segments, as well as the inability of contractors to fully address demand for construction services due to a dearth of available skilled workers.

“With the year off to a strong start, there appears to be enough momentum to carry the U.S. economy through 2019,” said Basu. “Any fears of a near-term recession have likely been quashed. However, the surprising strength of the U.S. economy may result in a reassessment of policymaking by the Federal Reserve, even though recent statements made by Fed officials have suggested that there wouldn’t be a further rate increase in 2019. If the Federal Reserve decides to pivot and raise rates again later this year, that would represent a negative in terms of demand for construction services due to a corresponding increase in the cost of capital to finance projects.”

Related Stories

Market Data | Jun 11, 2020

5 must reads for the AEC industry today: June 11, 2020

Istanbul opens largest base-isolated hospital in the world and AIA issues tools for reducing risk of COVID-19 transmission in buildings.

Market Data | Jun 10, 2020

6 must reads for the AEC industry today: June 10, 2020

Singapore's newest residential district and CannonDesign unveils COVID Shield.

Market Data | Jun 9, 2020

ABC’s Construction Backlog Indicator inches higher in May; Contractor confidence continues to rebound

Nonresidential construction backlog is down 0.8 months compared to May 2019 and declined year over year in every industry.

Market Data | Jun 9, 2020

6 must reads for the AEC industry today: June 9, 2020

OSHA safety inspections fall 84% and the office isn't dead.

Market Data | Jun 8, 2020

Construction jobs rise by 464,000 jobs but remain 596,000 below recent peak

Gains in may reflect temporary support from paycheck protection program loans and easing of construction restrictions, but hobbled economy and tight state and local budgets risk future job losses.

Market Data | Jun 5, 2020

7 must reads for the AEC industry today: June 5, 2020

The world's first carbon-fiber reinforced concrete building and what will college be like in the fall?

Market Data | Jun 4, 2020

7 must reads for the AEC industry today: June 4, 2020

Construction unemployment declines in 326 of 358 metro areas and is the show over for AMC Theatres?

Market Data | Jun 3, 2020

Construction employment declines in 326 out of 358 metro areas in April

Association says new transportation proposal could help restore jobs.

Market Data | Jun 3, 2020

6 must reads for the AEC industry today: June 3, 2020

5 ways to improve cleanliness of public restrooms and office owners are in no hurry for tenants to return.

Market Data | Jun 2, 2020

Architects, health experts release strategies, tools for safely reopening buildings

AIA issues three new and enhanced tools for reducing risk of COVID-19 transmission in buildings.